Key takeaways:

- Businesses of all sizes need accounting expertise to ensure accurate and compliant financial reporting, tax filing, payroll, and more.

- The cost of accounting varies greatly depending on factors such as qualifications and experience, the type of service required, the complexity of the job, and the size of your business.

- Accountants charge for services using different pricing structures, including hourly rates, monthly retainers, and per-project fees. Understanding the pros and cons of each will help you make smarter decisions when choosing an accountant.

- Outsourced accounting is gaining popularity thanks to its flexibility and cost-effectiveness, but in-house accounting remains the standard approach for most businesses.

- There are several ways you can save on accounting costs, such as taking a DIY approach with modern accounting software, negotiating better rates, and taking advantage of loyalty discounts.

Everyone needs an accountant at some point in their lives. Whether you’re an individual taxpayer or a business owner, wading into the murky waters of bookkeeping, financial reporting, and tax preparation without professional support can be overwhelming — and sometimes risky.

When the time comes to work with an accountant, perhaps the number-one question you’ll have is, “How much will it cost?” In this article, we’ll aim to provide an answer. In addition, we’ll look at some key factors that influence accounting costs, different fee structures, and how outsourced accounting compares to in-house accounting.

What services do accountants offer?

Accountants offer a broad range of services designed to help individuals and businesses manage their finances more effectively. In this section, we’ll highlight some of the main ones.

Tax services

One of the most common reasons people hire accountants is to handle tax-related tasks. The most common one of all is yearly income tax preparation and filing. While up to three-quarters of taxpayers plan to handle this themselves, hiring an accountant guarantees accurate and timely filing, especially with more complex tax returns. In addition to tax preparation, accountants help clients reduce their tax liabilities with tax planning and advisory services.

Bookkeeping

Accountants often provide bookkeeping services. This involves recording and organizing a company’s financial transactions, including purchases, expenses, and sales revenue. Bookkeeping can be seen as a subset of accounting. It’s often the first step to more complex accounting processes, such as analyzing and reporting financial data.

Payroll management

Accountants can handle payroll processing and management. This is a crucial function as it ensures that people get paid accurately and on time. In addition to calculating wages, payroll management includes deducting withholding taxes, calculating employee benefits and bonuses, and creating accurate payroll reports.

Business accounting services

A whole host of tasks and services fall under the umbrella of business accounting services. Essentially, accountants help businesses record, track, and report on all manner of financial transactions. This ensures that businesses have an accurate picture of their finances while staying compliant with the latest accounting, tax, and employment laws. Here are some examples:

- Preparing financial balance sheets, income statements, and cash flow statements

- Managing accounts payable and receivable

- Creating accurate budgets and forecasts

- Monitoring, categorizing, and reporting business expenses

- Month-end and year-end closing

- Performing regular account reconciliations

- Maintaining the general ledger

Consulting and advisory services

Accountants provide businesses and individuals with expert advice on matters such as tax, compliance, and financial processes. These services are often paid on an hourly basis and provide clients with the knowledge and expertise they need to improve internal operations and decision-making.

Audit services

Some accountants conduct audits. This involves looking at a business’s financial statements and accounting processes to ensure that they are accurate and compliant with legal regulations and accounting standards.

While any qualified accountant can perform internal audits, only certified public accountants (CPAs) can conduct external audits. All publicly listed companies in the US must undergo an audit each year to remain compliant with the US Securities and Exchange Commission (SEC).

Specialized services

In addition to more routine accounting tasks, some accountants offer highly specialized services. For example, services such as forensic accounting, international taxation, and estate planning require specific expertise and experience.

Factors influencing accountant fees

There are all sorts of factors that can impact how much an accountant charges, and why some charge more than others. Understanding these factors can help you make the most cost-effective decision when choosing which accountant to work with.

Qualifications and experience

One of the biggest factors influencing price is an accountant’s qualifications and experience. A regular accountant with basic qualifications and a year or two of experience will be relatively inexpensive to work with. On the other end of the scale, a CPA with decades of experience in highly specialized accounting areas will cost significantly more.

The right choice for you will depend on your specific needs and budget. For basic services such as bookkeeping or tax preparation, a regular accountant often represents a more cost-effective choice. For more complex or high-value services, such as external audits or representation in front of the Internal Revenue Service (IRS), working with a CPA is essential.

Type of service

The type of service you need will also have a major impact on the overall cost. Routine services such as tax preparation or bookkeeping tend to be relatively inexpensive. Services that require deeper knowledge and expertise, such as audit or advisory services, tend to be more expensive. Then there are highly specialized services such as forensic accounting, which come at a premium.

Complexity of work

Accounting fees within a service type can vary depending on the complexity of the job. For example, a simple individual tax return will cost significantly less than a complex corporate tax return. The more complex your case is, the more expertise and time it will take — and the more you’ll pay.

Location

Geographic location plays a major role in determining accounting fees. Accountants in major cities or affluent areas charge more in line with the higher cost of living. Those in rural areas or regions where service costs are generally lower will charge less. Thanks to cloud software and remote work, however, it’s no longer necessary to engage an accountant in your local area — especially if your needs are relatively simple.

Frequency of services

The frequency of services also dictates how much you’ll pay. Over the course of a year, one-time or infrequent services such as tax preparation will cost less than ongoing services such as bookkeeping or payroll. That said, if you’re a regular client with a longstanding relationship with the accountant, you may be able to negotiate discounted rates for ongoing services.

Accountant fee structures

Accountants use a variety of different fee structures when charging for their services. Understanding how these structures work can help you make the right choices when it comes to working with an accountant. In this section, we’ll look at the most common fee structures.

Hourly rates

Hourly rates are a common fee structure in accounting. They tend to be used for one-off, sporadic, or time-limited services, such as consulting or tax planning. Hourly rates provide flexibility, meaning you only get charged for the time the accountant spent. For longer projects, however, hourly rates can cause budgeting issues and anxiety about spiraling costs.

Hourly rates vary depending on an accountant’s area of focus and qualifications. To give you a rough idea of what to expect, here are some average price ranges for accountant hourly rates:

- Bookkeepers: $30 to $100 per hour

- CPAs: $200 to $800 per hour (depending on the type of service)

- Tax preparers: $75 to $200

Monthly rates

For ongoing services, accountants often charge a monthly retainer fee. This secures the accountant’s services on a month-by-month basis, ensuring consistent and continuous support across key accounting functions such as bookkeeping, payroll, financial reporting, and other recurring tasks.

Monthly rates provide predictability — you know exactly what you’ll pay each month. This makes it easier to budget for accounting support. On the flip side, you’ll be charged extra for services that lie outside the retainer agreement. Depending on the service type and other key factors, monthly rates can vary from a few hundred dollars to thousands of dollars.

Project-based fees

Some accountants charge a fixed fee for one-time jobs or project-based services. This approach is often used for tasks with an easily definable scope, which enables accountants to offer prices upfront. Examples include tax preparation and filing, audits, or setting up new financial systems.

The exact price will depend on the scope of the work, the time it will take to complete, and the level of expertise involved. Tax preparation can cost anywhere from $200 to several thousands of dollars, depending on complexity and whether it’s for an individual or business. Audits can cost anywhere from $10,000 for small businesses to more than $10 million for large corporations.

A comparison of fee structures

You can compare these fee structures, their pros and cons, and how they are best used in the table below:

| Fee structure | Average costs | Pros | Cons | Used for |

| Hourly rates | $30 to $800 | Flexible pricing based on work done | Costs can be unpredictable | Consulting, advisory, tax planning |

| Monthly rates | $200 to $10,000+ | Predictable costs, easy to budget, reliable support | May not cover extra services, set prices may not reflect work done | Bookkeeping, payroll, financial reporting |

| Project-based | $200 to $10,000+ | Clear and upfront pricing, defined start and end | Scope creep may lead to additional charges | Tax preparation, audits, system setups |

Average accountant costs for different services

So, how much do accountants charge? As we’ve already discussed, accounting fees vary greatly depending on factors such as the complexity of the job, geographic location, and the experience and qualifications of the accountant. That said, below is a breakdown of the average cost of an accountant for different service types.

Tax services

The cost of preparing income tax returns depends on the complexity of the job. Individual tax returns tend to cost less, but you’ll pay more if you are self-employed and have multiple income sources and itemized deductions. You’ll also pay more for state tax filing. Corporate tax returns tend to cost more, and prices vary depending on the complexity and type of business structure.

With all that in mind, here are the average flat-fee price ranges for income tax return preparation:

- Individual tax preparation: $200 to $800

- Corporate tax preparation: $500 to $2,000

For tax planning and advisory, accountants tend to charge per hour. You can expect to pay anywhere from $150 to $500 per hour, with CPAs charging more than regular accountants. For representation in front of the IRS, you can expect to pay in the region of $250 to $500.

Bookkeeping

Bookkeeping costs tend to be cheaper overall than more complex accounting services. This is because modern accounting software automates most of the manual processes involved. Prices can vary based on factors such as the volume and complexity of transactions and the size of your business.

Accountants either charge hourly rates or monthly retainers for bookkeeping services. Here are some examples of what you’re likely to pay:

- Hourly rates: $30 to $100 per hour

- Monthly retainer: $300 to $2,500+

Payroll management

The cost of payroll management increases the more employees you have. So small businesses will pay significantly less than large ones. Accountants use payroll management software to ensure people get paid accurately and on time. This enables them to lower overall costs compared to more hands-on accounting services.

Payroll costs are typically calculated using a combination of a flat monthly rate and an additional per-employee fee. Here’s what you can expect to pay:

- Monthly rate: $40 to $100+

- Additional per-employee fee: $2 to $15

Example: you have a team of 50 staff and pay a monthly rate of $100, with an additional per-employee fee of $5. Your monthly bookkeeping cost will be $350.

For a deeper dive into payroll fees and average costs, check out our in-depth article: The average cost of payroll services in 2024: a comprehensive guide.

Business accounting services

Business accounting services cover a broad range of accounting tasks. In some cases, you may need an accountant to cover all of your day-to-day accounting needs. In other cases, you may need someone for a specific task. This makes it difficult to calculate an average cost.

Typically, accountants will charge anywhere from $100 to $500 per hour for business accounting services. Below, we’ll give some rough estimates for how much different business accounting services might cost:

- Preparing financial statements: $1,000 to $5,000 per year

- Monthly accounting services: $300 to $2,500+ per month

- Budgeting and forecasting: $200-$400 per hour

Consulting and advisory services

Consulting and advisory services are generally charged on an hourly basis. This is because they tend to be either one-off or sporadic short-term sessions. In some cases, however, organizations might require ongoing advisory services or longer-term advice around specific corporate projects. Here’s how much you can expect to pay:

- Hourly rates: $200 to $500

- Consulting projects: $2,000 to $10,000+ depending on the size and complexity of the project

Audit services

Audit costs vary wildly depending on the size and specifics of your business. The average audit cost in the US is almost $2.4 million. This amount is somewhat skewed by large enterprises, which pay huge amounts of money to be audited. S&P 500 companies, for example, pay over $13 million on average. If you’re running a small business, however, you’ll pay considerably less.

Here are some rough per-project amounts for audit services based on business size:

- Small and medium-sized businesses: $10,000 to $100,000

- Large organizations: $100,000 to more than $10 million

Specialized services

Accountants charge more for specialized services than routine ones. This is because they require specific skills and experience that not all accountants have. Here’s what you can expect to pay for certain specialized accounting services:

- Forensic accounting: $200 to $600 per hour

- International tax planning: $250 to $500 per hour

- Estate planning: $1,000 to $5,000+ depending on complexity

Accountant costs for different types of businesses

The cost of accounting services can vary significantly depending on the size and complexity of your business. In this section, we’ll look at how much different types of businesses can expect to pay and why.

Freelancers and solopreneurs

Freelancers and solopreneurs tend to have simple accounting needs compared to businesses. In addition to help with income tax returns, they may need basic bookkeeping support. In most cases, freelancers will be able to handle these tasks themselves using accounting automation software, but here are some average prices nonetheless.

- Income tax preparation: $200 to $1,000 yearly

- Bookkeeping: $50 to $250 per month

Small businesses

In addition to having few employees, small businesses tend to have simple financial structures. This makes their accounting needs relatively straightforward. In most cases, small businesses won’t require more complex services such as audits.

- Income tax preparation: $500 to $1,000 yearly

- Bookkeeping: $250 to $750 monthly

- Payroll management: $250 to $750 monthly

Medium-sized and large businesses

The larger the business, the more complex the accounting needs. For this reason, medium-sized and large companies can expect to have higher accounting bills and require a wider range of services. While most medium-sized and large businesses have internal accounting teams, here are some ballpark figures for what it would cost to outsource these tasks to an external accountant:

- Income tax preparation: $2,000 to $5,000+ yearly

- Bookkeeping: $1,000 to $5,000+ monthly

- Payroll management: $750 to $5,000+ monthly

- Audit services: $10,000 to $100,000+ yearly

- Consulting and advisory services: $250 to $500 per hour

Enterprises

Enterprises are large corporations that operate across multiple jurisdictions and regions. They have large workforces reaching into the thousands and highly complex financial and legal structures, including multiple entities and subsidiaries. As a result, they can expect to pay significantly more for accounting services.

Enterprises tend to have extensive in-house accounting and finance departments. That said, if they were to engage an external accounting firm, here are some rough costs:

- Income tax preparation: $10,000 to $50,000+

- Bookkeeping: $10,000 to $50,000+

- Payroll management: $10,000 to $50,000+

- Audit services: $1 million to $10 million+

- Consulting and advisory services: $500 to $800 per hour

Comparing costs: in-house vs. outsourced accounting

When it comes to meeting accounting needs, businesses typically have two options: hire an in-house accountant or work with an external accountant. Before making a decision, it’s important to understand the advantages and disadvantages of both options. In this section, we’ll compare the costs and benefits of in-house vs outsourced accounting.

In-house accounting

The majority of businesses choose to keep accounting in-house. In the US, almost two-thirds (62%) of small businesses have in-house accountants. Generally speaking, the larger a business is, the more likely it is to have an in-house accounting team.

Pros:

The benefits of in-house accounting are clear. You get direct control over accounting staff and operations, ensuring fast internal communication and coordination.

Because your accountants are dedicated solely to your business, they can learn the intricacies of your financial systems and controls — something that gets increasingly important the larger and more complex a business becomes. In-house accounting also makes it easier to maintain confidentiality and data security.

Cons:

On the flip side, hiring in-house accountants comes with high costs. Regular accountants earn anywhere from $40,000 to $100,000 per year, with the average accountant salary in the US coming in at $64,000. CPAs and chief financial officers (CFOs) earn considerably more.

In addition to salaries and benefits, there are overheads such as equipment, software licenses, and office space to consider. Then there are additional costs associated with ongoing training and development. What’s more, in-house accounting teams are harder to scale up and down with demand. All of these factors make in-house accounting virtually impossible for new businesses on a tight budget.

Cost considerations:

- Accountant salaries: $40,000 to $100,000 per year

- CPA and CFO salaries: $100,000 to $250,000+ per year

- Benefits and overheads: an additional 20-30% of salary costs

- Software and tools: $500 to $2,000+ per year

- Hardware and office equipment: $1,000 to $5,000+

Outsourced accounting

Only a third of small businesses choose to outsource their accounting, and even fewer large companies do so. Nevertheless, there are huge benefits to outsourcing — especially for smaller businesses that prioritize flexible, cost-effective services. In recent years, outsourcing has grown in popularity, with almost a 40% increase in total spend on outsourced accounting services.

Pros:

The biggest benefit of outsourcing your accounting is flexibility. You only pay for what you need, and you can scale the service up and down during times of high or low demand. This allows small businesses on a tight budget to receive expert accounting support without committing to crippling long-term costs.

Besides the direct costs involved, there’s less to think about with outsourced accounting. You don’t need to spend time and money on recruitment campaigns. You don’t need to worry about employee engagement, ongoing training, or providing a suite of benefits and perks. In this respect, outsourcing represents a much simpler approach.

Cons:

Outsourced accounting doesn’t suit everyone, however. As a business owner, you naturally get less control over day-to-day operations. You also have to deal with communication issues, as well as an additional risk vector when it comes to data security and regulatory compliance.

At the same time, there are potential issues relating to performance. An external accountant may be working with multiple clients at any given time. They’ll never get to know the financial and operational nuances of your business like an internal accountant would. This makes it a less attractive option for larger, more complex businesses that can easily afford an in-house team.

Cost considerations:

The exact costs a business will pay for outsourced accounting services depend on the service types, business size, the complexity of the work, and other factors. The costs get dramatically higher the bigger a company gets, with expensive and complex services such as yearly external audits becoming necessary. Below are some ballpark figures based on different business sizes:

- Freelancers: $100 to $1,000+ per year

- SMEs: $5,000 to $100,000 per year

- Larger businesses: $100,000 to $1 million+ per year

- Enterprises: $1 million to $10 million+ per year

As you can see, there’s no single best approach when it comes to accounting. The most effective strategy will depend on the size of your business, your budget, and other factors. You can see a comparison of the pros and cons of both approaches in the table below.

| Pros | Cons | Best for | |

| In-house |

|

|

Larger businesses with steady cash flow that want full control. |

| Outsourced |

|

|

Smaller businesses that prioritize flexible, scalable, and cost-effective services. |

In many cases, however, larger businesses combine both approaches. They have a team of in-house accountants and finance experts to manage day-to-day operations, but they may dip into the external market when they need specific expertise for time-limited projects, such as an independent audit or forensic accounting.

Tips for reducing accounting costs

Whether you build an in-house team or outsource to an external expert, the cost of securing accounting expertise can be huge. In this section, we’ll look at some strategies you can implement to reduce accounting-related expenses without compromising on quality.

DIY accounting

If you’re a freelancer or small-business owner, there are some cases when you can take accounting into your own hands. Straightforward tasks such as invoicing, simple tax filings, and basic bookkeeping are all prime candidates. This can save you a considerable amount of money — although it will take up some of your time.

Modern software such as QuickBooks Online and Xero make DIY accounting and bookkeeping easier than ever. They provide simple and intuitive platforms where you can automate entire accounting workflows. Practice management software such as TaxDome makes it easier to manage tasks, documents, and workflows. There are similar options for tax preparation as well.

There are all sorts of online resources you can tap into to get up to speed on accounting basics. Most software providers offer tailored learning materials and webinars, then there are YouTube tutorials, accounting blogs, podcasts, and message boards where you can learn best practices and get answers to questions.

Negotiate fees with accountants

Generally speaking, accountants are keen to stick to their quoted pricing. In some cases, however, you may be able to negotiate lower fees — especially if you have a long-term relationship with them or require multiple services. Here are a few ways you can reduce your accounting fees:

- Bundled services: some accountants may be willing to offer bundled services at a discount, e.g. combining bookkeeping, tax preparation, and payroll in one reduced price

- Retainer discounts: it may be possible to get a sweeter deal if you commit to a long-term monthly retainer

- Loyalty discounts: accountants often provide discounts for returning customers as a way to say thanks for sticking with them

Utilize specialized platforms

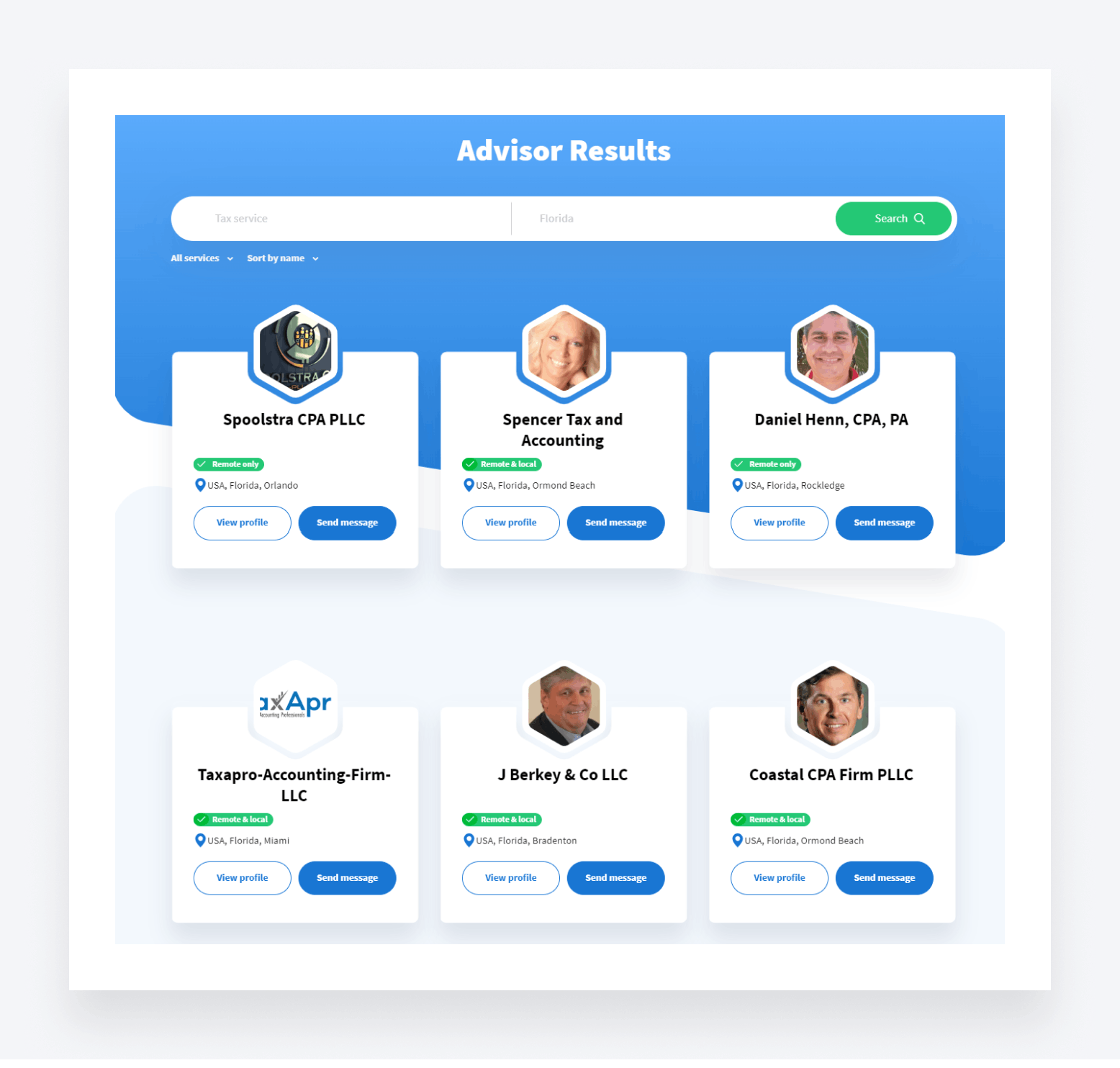

Searching for the right accountant can be a time-consuming and confusing process. With so many to choose from, how do you know where to start? By using specialized industry directories, you can streamline your search and save time.

TaxDome Advisors, for example, is a dedicated online directory for accounting, tax, and bookkeeping professionals. You can sort of by service type and region to quickly connect with local industry experts. In addition to deep industry expertise, all of the professionals on Advisors are committed to using the best technology to provide an outstanding client experience.

To sum up

Accurate and compliant accounting is essential for any business. While it’s possible to take on some simple accounting tasks yourself, the larger and more complex your business is, the more you’ll need a professional accountant. But expertise comes at a cost.

In this article, we’ve outlined roughly how much you can expect to pay for different accounting services. We’ve looked at the different pricing structures accountants use. We’ve also covered the pros and cons of in-house accounting versus outsourced accounting. as well as some tips for reducing your overall accounting costs.

Using an industry-specific directory can save you precious time if you’re in the market for an accounting professional. With TaxDome Advisors, you can quickly connect with accounting and tax pros from across the globe — and ensure the best possible client experience. Give Advisors a go and see for yourself.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.