If you run a partnership in the US, you’ll need to report your financial performance to the Internal Revenue Service (IRS) accurately and on time — or risk being fined for non-compliance. This is where IRS Form 1065 comes in.

In this article, we’ll explain everything you need to know about Form 1065, including:

- What it is — and who needs to file it

- Important dates and deadlines for filing

- Common reasons for late filing

- What to do if you miss the deadline

- How the penalty abatement process works

Understanding Form 1065

Form 1065 is the primary tax document submitted by US-based partnerships to declare any profits, losses, credits, or deductions realized during a given tax year.

According to the official IRS definition, a partnership is a formal arrangement between two or more people to oversee the running of a business and share in any profits or losses. Examples include general partnerships, limited liability partnerships (LLPs), and limited liability companies (LLCs).

Partnerships are known as “pass-through entities” because any income generated from the business — and any corresponding tax obligations — is passed directly to the partners. In other words, the business itself doesn’t pay any tax, but the partners do. Form 1065 facilitates that process by providing the IRS with a comprehensive overview of a partnership’s financial activities.

Important dates for filing Form 1065

The deadline for filing Form 1065 is the fifteenth day of the third month following the end of the partnership’s tax year. So if your partnership’s tax year follows the calendar year — which is the case for the vast majority of partnerships — the deadline for filing is March 15. If this date falls on a weekend or national holiday, the deadline moves to the next business day.

Common reasons for late filing

So why might a partnership miss the deadline for filing Form 1065? In this section, we’ll explore some common reasons.

Misunderstanding the deadline

Partnerships may miss the deadline due to a simple misunderstanding of when it falls. Confusion can arise, for example, given that the deadline for filing individual tax returns typically falls a month later, on April 15.

On top of this, partnerships that have tax years that differ from the calendar year may assume that the March 15 deadline applies to them, resulting in missed deadlines.

Problems gathering the necessary information

Form 1065 requires partnerships to submit detailed information about their financial situation, but accessing that information promptly can be a challenge — especially for partnerships with ineffective record-keeping practices.

Likewise, partnerships that engage in relatively complex financial transactions — including mergers, acquisitions, or international trade — may struggle to consolidate and reconcile financial data for tax reporting purposes.

Errors in previous filings

Mistakes in previous Form 1065 filings may carry over to the following year, making the filing process more complicated and prone to error or delay. If partnerships are engaged in amending previous filings, they may overlook current tax-year obligations.

How to avoid late filing of Form 1065

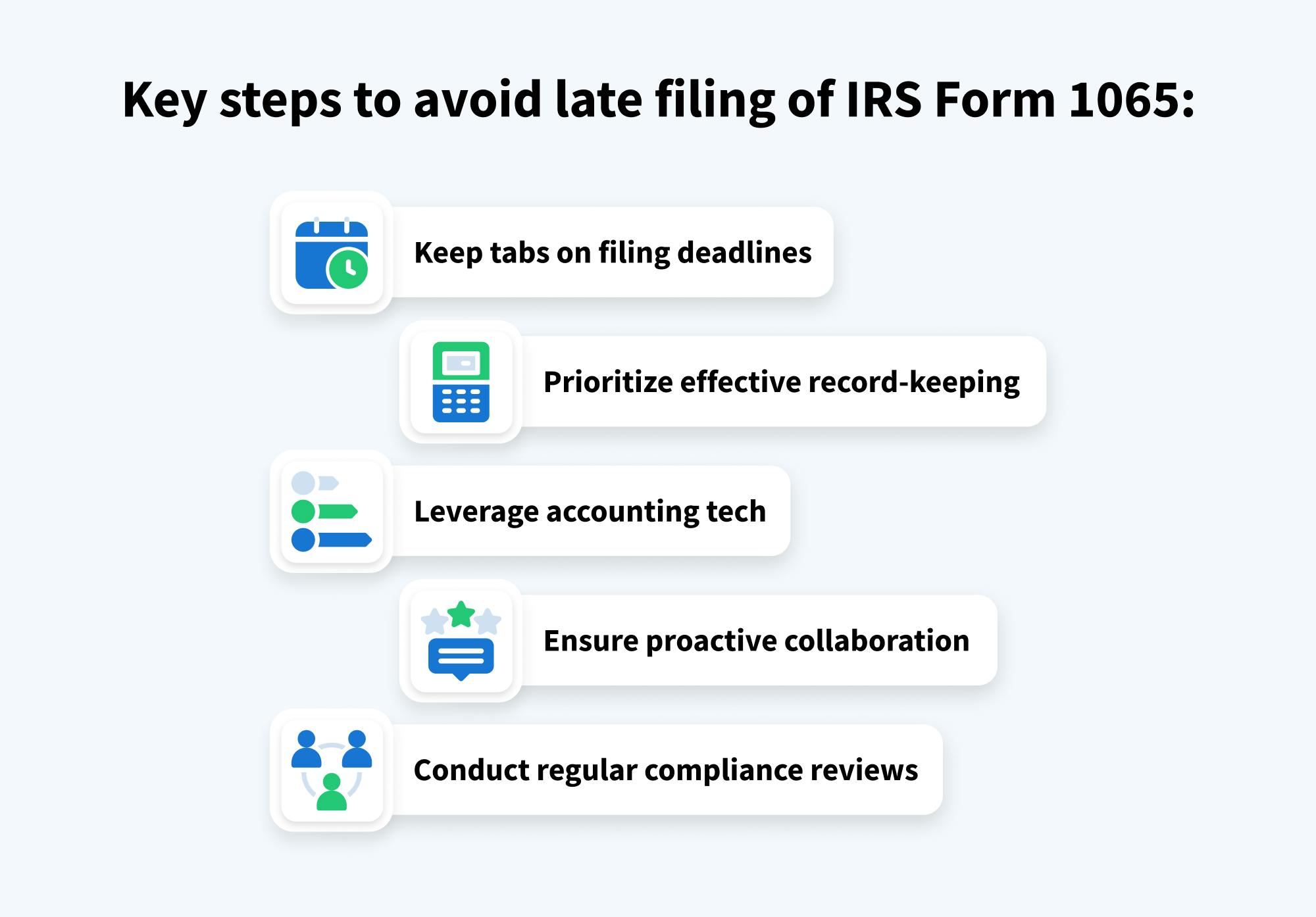

Here are five strategies and best practices you can employ to avoid late filing — and the financial penalties that come with it!

1. Keep tabs on filing deadlines

The first step is to understand when the deadline is. If your partnership’s tax year follows the calendar year, the deadline is March 15. If your partnership follows a different tax year, the deadline will fall on the fifteenth day of the third month following the end of your tax year.

Once you’ve established your deadline, set up reminders at different intervals to ensure that you are on track to complete and file your form on time.

2. Prioritize effective record-keeping

You can avoid filing headaches by simply being organized. Make sure you have an efficient and consistent system for managing and storing financial data and documents. It’s also important to regularly reconcile your accounts to ensure that your financial records are accurate and up to date.

3. Leverage accounting tech

By leveraging accounting software, you can streamline and automate many of the processes associated with bookkeeping and accounting. This not only saves you time but also ensures that your financial data is accurate and up to date.

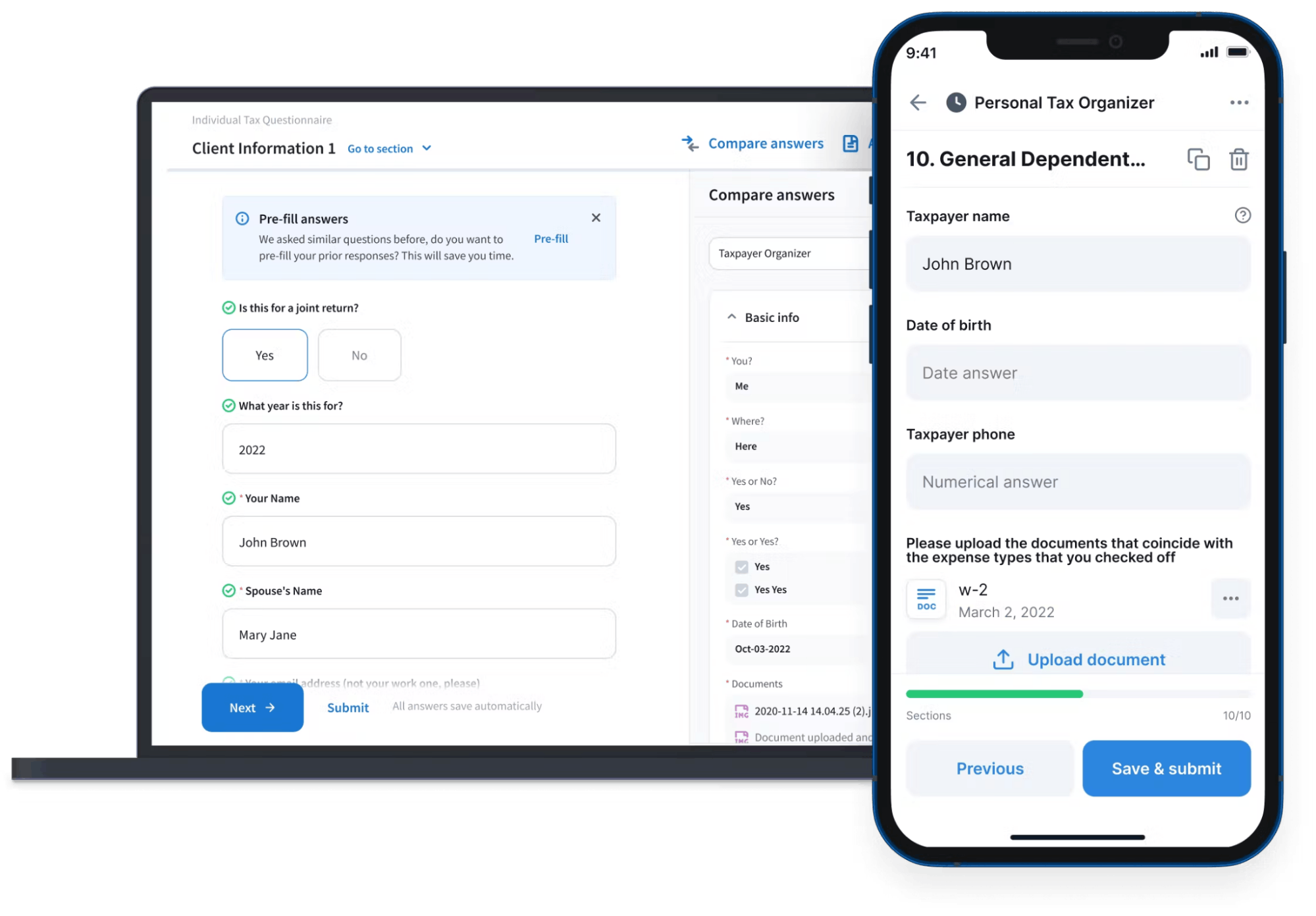

For accounting professionals, practice management software such as TaxDome has an array of tools designed to help firms work more efficiently:

- Document management — securely store, manage, and e-sign client documents

- Tax organizers — gather client documents and data via smart forms and questionnaires

- Project and task management — assign tasks and get a global view of who’s working on what

- Process automation — automate entire workflows from start to finish and send auto-reminders

- CRM for accountants — a central hub for managing your client data and communications

4. Ensure proactive collaboration

For partnerships, tax compliance is often a team effort. To make collaboration smoother, set up clear lines of communication between anyone involved in the tax preparation process. Ensure that everyone understands timelines, deadlines, and responsibilities.

5. Conduct regular compliance reviews

Tax laws can change from year to year, so it’s important to stay up to date with the latest IRS updates. Conduct regular compliance reviews to identify any potential issues — and address areas of concern as soon as they arise.

Steps to take if you miss the deadline

Say you do miss the deadline for filing Form 1065 — what do you do then? In this section, we’ll explain the steps you need to take.

1. File as soon as possible

If you’ve missed the deadline you should aim to file your Form 1065 as soon as possible. Fines tend to be calculated on a monthly basis — the later the filing, the higher the penalty.

2. Apply for an extension

If you need more time, you can apply for an extension (usually six months) by filing Form 7004. You’ll need to complete this form before the deadline for filing Form 1065 — so for calendar-year partnerships, by March 15.

It’s important to note, however, that filing for an extension doesn’t extend the deadline for paying taxes. To avoid penalties, you’ll need to estimate and pay any taxes due by the original filing deadline.

3. Respond to correspondence promptly

Make sure you respond promptly to any correspondence with the IRS about late filing. Ignoring or delaying communications only makes the situation worse, potentially leading to further fines or even enforcement actions.

4. Prevent future mishaps

Finally, it’s important to learn from the factors that caused you to miss the filing deadline — and put steps in place to ensure that they don’t happen again. You could set up a system with automatic reminders to give you ample time to prepare and file future forms. You might even want to look into delegating these responsibilities to a professional accounting firm.

Penalty abatement for Form 1065

If you missed the filing deadline due to a valid reason that you had no control over — or what the IRS refers to as a “reasonable cause” — you can request abatement of the penalty. In other words, you can ask the IRS to reconsider their decision. In this section, we’ll explain what this process entails.

Eligibility

To be eligible for penalty abatement, you must be able to prove that you missed the deadline due to events beyond your control, rather than as a result of negligence or oversight. Valid reasons include natural disasters, medical emergencies, financial hardship, or any other unexpected event that prevented you from filing on time.

In addition, the IRS may take into account your compliance history when deciding whether to grant penalty abatement or not. Partnerships with a history of late filing will be in a weaker position than those who have missed the deadline for the first time.

Necessary documentation

Form 843 is the official IRS form for requesting penalty abatement. You’ll also need to gather any supporting documentation to back up your request, such as:

- Medical records

- Insurance claims

- Disaster declarations

- Financial statements

- Correspondence with the IRS

The request process

To request a penalty abatement, you have two options. First, you can fill in Form 843 (see the official IRS instructions here). Second, you can write a penalty abatement letter to the IRS, detailing the reasons why you weren’t able to file Form 1065 on time and providing all supporting documentation.

If you choose to write a penalty abatement request letter, you must ensure that it contains all the critical information found on Form 843, including:

- A clear statement detailing the reason you weren’t able to file Form 1065 on time

- Key information such as name, address, TIN, etc.

- All supporting documentation

When dealing with the IRS, it’s important to be as honest, transparent, and clear in your communication as possible. Take the time to prepare your letter or Form 843, focusing on providing all the necessary information to make your case. It’s also a good idea to keep copies of all forms, letters, supporting documentation, and correspondence with the IRS for future reference.

Conclusion

Filing Form 1065 before the deadline is crucial for partnerships to remain compliant with IRS regulations — and avoid potential penalties and repercussions.

In this article, we’ve highlighted the common reasons why partnerships fail to meet the filing deadline and some strategies for ensuring that doesn’t happen to you. We’ve also covered the process of requesting penalty abatement for situations where late filing was out of your control.

We hope you found this article useful. By following the information and steps outlined here, you can ensure compliance and avoid the fines and stress that come with late filing.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers