IRS Form 8821 is an essential tool for any US-based accountant or tax professional. It gives you legal authority to receive information about your client’s tax affairs directly from the IRS, including previous tax returns, transcripts, and payments made.

In this article, we’ll highlight everything you need to know about filling out Form 8821, so you can tackle the coming tax season with confidence. For a more general overview, check out this article: Everything you need to know about IRS Form 8821.

Let’s get started.

How to file Form 8821: a step-by-step guide

Here, we’ll guide you through each section of Form 8821, outlining exactly what you need to complete and how.

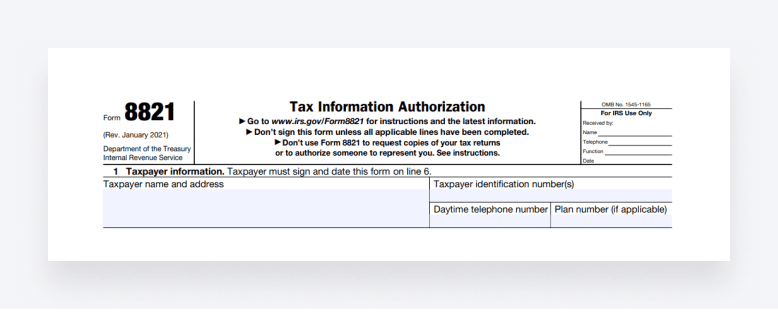

Section 1. Taxpayer information

First up, you’ll need to provide the personal details of the taxpayer you intend to serve, including:

- Name and address

- Taxpayer identification number (TIN) for an individual

- Employer identification number (EIN) for a corporation, partnership or association

- Phone number

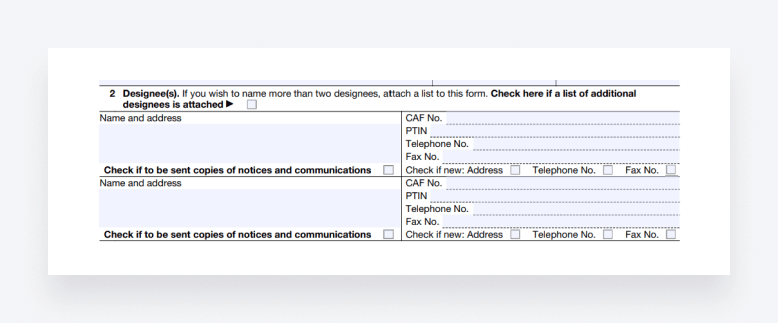

2. Designee(s)

In this section, you need to provide details of the designee, i.e. the person or entity authorized to access tax information on the client’s behalf — in other words, you. This information includes:

- Name and address

- Centralized Authorization File number (CAF) — if this has not been assigned, write “NONE”, and the IRS will issue one

- Preparer tax identification number (PTIN)

- Telephone and fax numbers

Check the checkbox at the bottom of the name and address section if you want to receive copies of notices and communications from the IRS. There are also checkboxes to check if the address, telephone number or fax number you are providing is new.

As you’ll see, the form has space for two designees. If your client wants to name additional designees, you can attach a separate list to the form containing all the relevant information, then check the box at the top of section two relating to this.

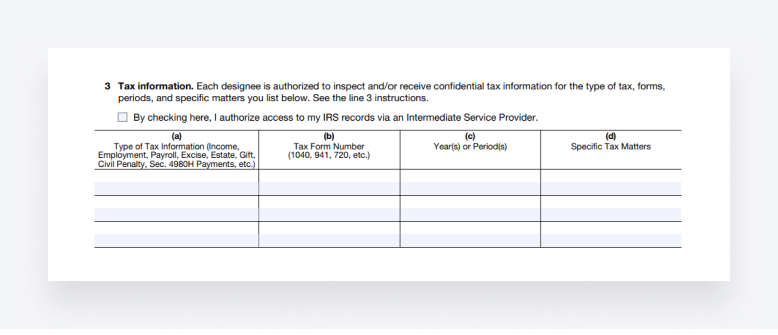

3. Tax information

In this section, you specify exactly what type of tax information you (the designee) will be authorized to access and over what period of time. It is split into the following four sections:

- Type of tax information

- Tax form number

- Year(s) or period(s)

- Specific tax matters

The key here is to be as specific as possible. For example, you could enter “Income tax”, “1040”, and “Calendar year 2022” in the respective sections if you need to access information relating to a previous individual tax return. Avoid general terms such as “All taxes” or “All years”.

You’ll also notice a checkbox at the top of this section. If checked, the taxpayer authorizes you to access their IRS records using an Intermediate Service Provider. If unchecked, you’ll only be able to access their information directly from the IRS. Be sure to check with your client what their preference is here.

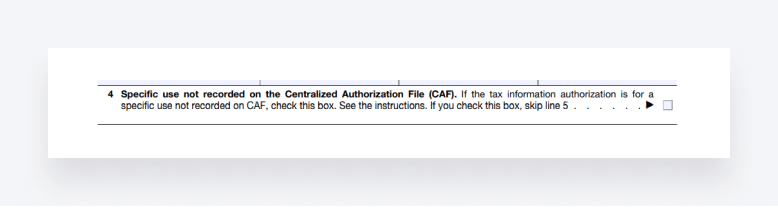

The IRS records most tax information authorizations on the CAF system, but not all. If you are submitting Form 8821 for a specific use that isn’t recorded on the CAF, you’ll need to check the checkbox in this section. Here are some examples:

- Requests to disclose information to loan companies or educational institutions

- Requests to disclose information to federal or state agency investigators for background checks

- Requests for information regarding certain forms (see here for a detailed list)

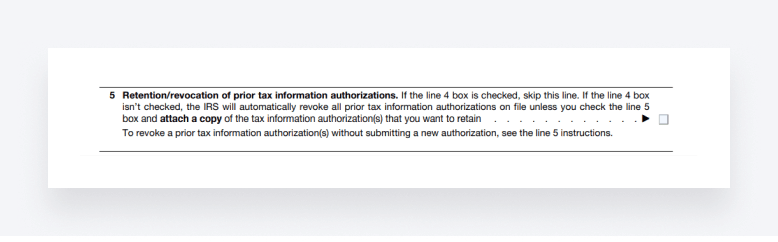

If you check this checkbox, you’ll need to skip section 5.

If you leave the checkbox in this section unchecked, the IRS will automatically revoke all tax information authorizations relating to the taxpayer once this form is submitted. If your client wants to leave certain authorizations active, you’ll need to check the box and attach information about the specific authorizations that should be retained.

To revoke a prior authorization without submitting a new form, simply write “REVOKE” across the top of the authorization you want to revoke. You’ll also need to get the client to sign and date the form under the original signature.

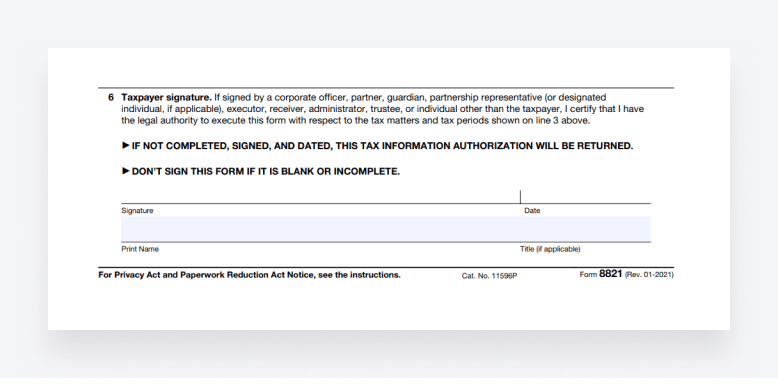

6. Taxpayer signature

In this last section, you’ll need to get your client to sign and date the form. If you plan to file the form by mail or fax, you’ll need to get a handwritten signature. If you submit the form online, however, you can use an electronic signature. You can find detailed instructions about how to submit forms in this IRS article.

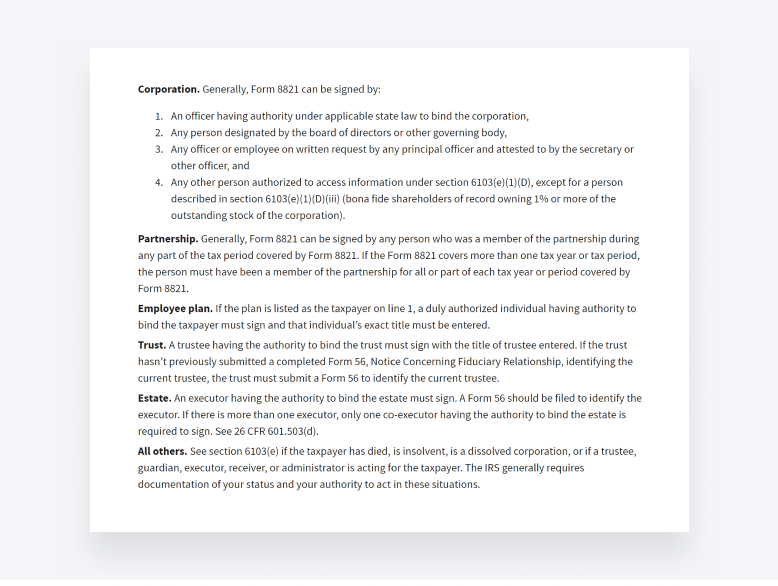

Form 8821 can be filed by any individual or entity that pays tax. If you are completing the form for an entity, you’ll need to make sure that the person signing has the authority to do so. Here’s some guidance from the IRS website on this matter:

Common mistakes to avoid when filling out Form 8821

Although Form 8821 is a fairly simple form to complete, the smallest mistake or discrepancy can lead to delays or complications. In this section, we’ll highlight some frequent errors and explain how to prevent them, ensuring a successful and hassle-free submission.

1. Inaccurate or incomplete information

Providing inaccurate or incomplete information about the taxpayer or designee can lead to the form being rejected or delayed. Make sure you carefully review all details before submitting the form, using official documents as a reference. Ensure all required fields are filled in accurately.

2. Mismatched signatures

Discrepancies between the signature on the form and the signature on the IRS records can also cause issues. Make sure your client uses the same signature as on their most recent tax return.

3. Incorrect tax matter selection

Choosing the wrong type of tax matters can lead to issues further down the road, meaning you might not have access to the information you need. This is why it’s important to clearly understand the purpose and scope of the authorization before filling out the form.

4. Too much ambiguity

Form 8821 requires you to be as specific as possible, especially in section 3, where you specify the type of tax information you want access to and during which periods. Avoid general descriptions and be as clear as possible.

5. Forgetting to set an expiration date

If you want your authorization to run until a specific date, remember to set an expiration date. If you don’t, the form will automatically expire after seven years, so you may end up receiving tax-related updates from the IRS that are no longer relevant or needed.

6. Using outdated forms

Filling out an outdated version of Form 8821 will lead to it being rejected. Always download the latest version of the form from the IRS website.

7. Failing to retain a copy

Failing to keep a copy of the completed Form 8821 can cause issues later on. You might need the form if you want to make amendments or revoke authorizations. Be sure to make a photocopy or digital scan of the filled-out form for your records.

8. Sending to the wrong IRS address:

To avoid costly delays, double-check the IRS address provided on the form and cross-reference it with the latest information on the IRS website.

9. Forgetting to attach supporting documents

Some sections of Form 8821 may require you to attach additional information. Neglecting to attach the required supporting documents can lead to delays. Make sure you read the instructions carefully and include any necessary documents to support the information provided on the form.

Form 8821 submission methods: online vs offline

Once you’ve completed Form 8821, the final step is to submit it to the IRS. In this section, we’ll explore the different ways you can do that and the pros and cons they offer.

Online submission

In today’s digital world, it makes a lot of sense to file your Form 8821 online. To do this, you’ll need a Secure Access account with the IRS.

Pros

- Speed and efficiency: online submissions tend to get processed faster

- Instant confirmations: you’ll get notified straight away once a form has been submitted

- Reduced paperwork: going digital eliminates the need for physical paperwork

- E-signatures: when you file digitally, you can use legally binding signatures, eliminating the need to print, sign, and scan the form

Cons:

- Internet connectivity: a stable internet connection may be a limitation in certain situations

- Security concerns: despite it being secure, some individuals may have reservations about submitting sensitive information online

Offline submission (mail or fax)

If you or your client prefers it, you can also use a traditional paper form and send them via mail or fax.

Pros:

- Accessibility: can be submitted without the need for an internet connection, making it a popular choice for more tech-averse clients

- Traditional documentation: some clients may prefer the familiarity of traditional paper forms

Cons:

- Processing time: offline submissions tend to take longer to process compared to online ones

- Confirmation delays: confirmation of receipt won’t be immediate, leaving room for uncertainty

Post-submission guidance for Form 8821

So you’ve successfully submitted Form 8821 — congratulations! While the hard part is over, there are still some important factors to consider post-submission to ensure a smooth and effective authorization process. Here are some examples.

Manage IRS responses

It’s important that you retain any communications from the IRS for your records. If you submitted the form online, you should receive immediate confirmation. For mailed submissions, you’ll need to wait for confirmation from the IRS.

Rectify errors or omissions

The IRS will contact you if any issues with your form need rectifying, so regularly check for updates and notices. If this happens, promptly address any issues by providing the necessary corrections or additional information. Failure to do so may result in additional delays or complications.

Maintain detailed records

Keep all confirmations, correspondence, and records related to Form 8821 in an organized file. This includes any additional documents submitted. Also, make sure that you keep a copy of the original Form 8821 that you filed, so you always have access to information relating to the tax matters and time periods you have authorization for.

Understanding follow-up procedures

If you specified an expiration date on the form, be aware of when the authorization expires. You may want to renew it if ongoing representation is necessary. You’ll also need to understand the process for revoking the authorization if needed.

Stay informed

IRS procedures and tax laws can change, so be sure to keep updated on the latest updates or changes. You can sign up for e-news subscriptions with the IRS, which cover a range of tax-related news feeds.

Additional Resources

Before we wrap this guide up, here are some valuable resources where you can find official instructions, guidance, and additional assistance on Form 8821.

- Official IRS website: a treasure trove of information and resources

- Form 8821 download: access the current version of the form

- IRS e-news subscriptions: stay up to date with the latest IRS news and updates

- IRS Form 8821 instructions: the most detailed instructions straight from the IRS

- Taxpayer Assistance Center office locator: find your (or your client’s) local IRS office

- Online submission portals: instructions on how to set up an account with the IRS

- The American Institute of CPAs (AICPA): news, resources, and learning materials for accountants and tax professionals

Conclusion

Form 8821 is one of the more straightforward IRS forms to fill out, but it can still cause confusion, which can result in delays and issues further down the line. We hope that this guide provides you with all the information you need to file Form 8821 quickly and effectively.

Thanks for reading!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.