We’re excited to announce a big new update that will further enhance our e-signature capabilities for accounting firms in the European Union (EU): advanced electronic signatures (AdES) and qualified electronic signatures (QES).

AdES and QES are legally binding e-signatures that meet the latest EU regulations. While both methods offer high levels of assurance, QES is widely considered the most secure and trustworthy type of e-signature for EU firms because it involves having the signer’s identity verified by a qualified third party.

In this article, we’ll explore how AdES and QES work in TaxDome. But before we do that, let’s answer an important question.

How are AdES and QES different from other e-signatures?

In the European Union, the regulation for electronic ID, authentication and trust services, known as eIDAS, sets out the standards for three different types of electronic signature:

- Simple electronic signatures (SES)

- Advanced electronic signatures (AdES)

- Qualified electronic signatures (QES)

Let’s take a look at what each type of e-signature entails.

Simple electronic signatures (SES)

The most basic form of e-signature available, SES doesn’t require strong signer authentication or identity verification. Instead, it’s enough to know the signer’s email address, or that they received a unique access code before signing.

SES are used for everyday transactions, day-to-day sales and procurement agreements or as part of simple forms that require a signature. As always, all SES are free and unlimited in TaxDome and meet UETA and ESIGN Act requirements.

Advanced Electronic Signatures (AdES)

AdES requires more stringent rules to be met around data security, validity and trust. eIDAS set out the following three key requirements for AdES:

- The signer must be linked to the signature via a unique identifier — think of this like a digital pen owned by the signer

- The signer has sole control over this “digital pen” — nobody else can access it

- The signature must be able to detect if it has been tampered with

Qualified Electronic Signatures (QES)

QES meets the three requirements outlined above but takes things a step further, using qualified certificates and multi-factor verification to identify the signer. QES also uses third parties, known as qualified trust service providers (more on this below), to verify the signatory’s identity, providing an additional layer of assurance.

As a result, QES offers the highest level of security and trustworthiness possible for e-signatures in the EU. In fact, QES are the only e-signatures that are explicitly recognized as being legally equivalent to handwritten signatures in the EU.

All three of these e-signature types are now available in TaxDome. You get unlimited free SES as part of your TaxDome license, while both AdES and QES carry a small fee per signature to cover the verification process. We also offer knowledge-based authentication (KBA) for our US-based customers to ensure compliance with the IRS.

In addition to meeting eIDAS standards, all of our e-signatures meet the key requirements of the Electronic Signatures in Global and National Commerce Act (ESIGN) as well as the Uniform Electronic Transactions Act (UETA).

How do AdES and QES work in TaxDome?

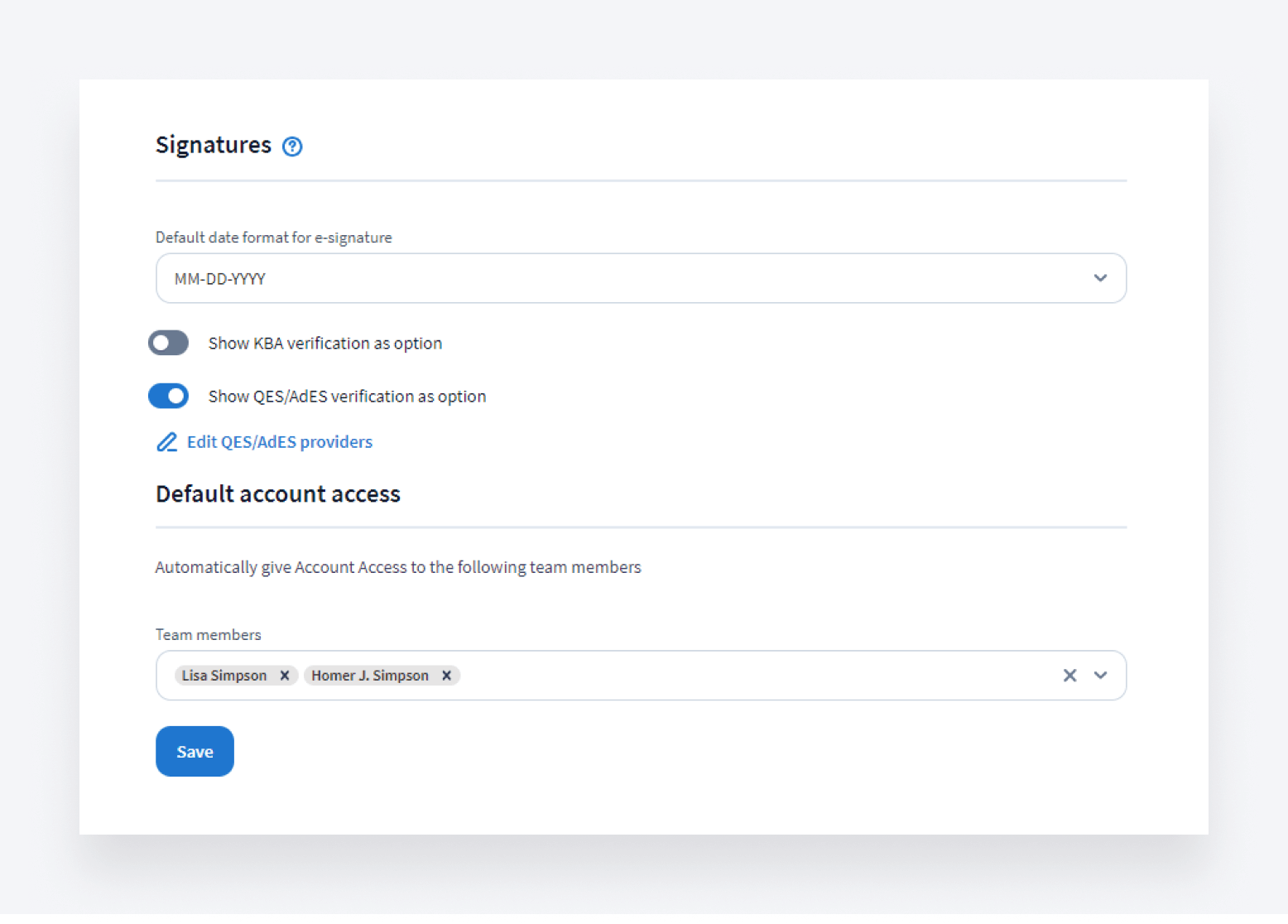

QES/AdES is enabled as a signing option by default for firms based in Europe. If your firm is outside of Europe, you can choose whether you want to show QES/AdES verification as a signing option by going to the Signature section of your Firm Settings tab.

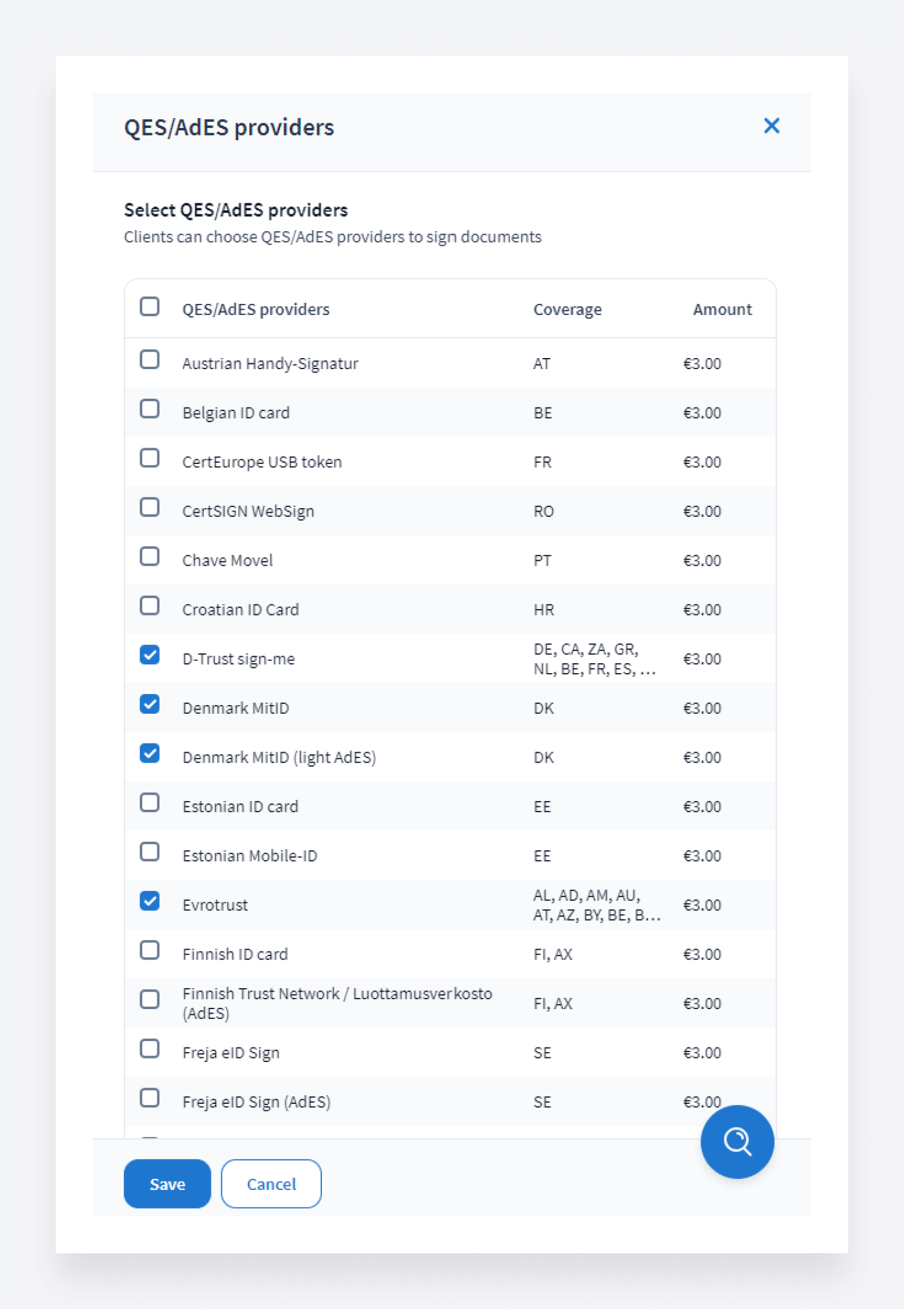

When toggled on, you’ll be able to see a list of QES and AdES providers, the EU countries they cover, and the amount they cost per signature. All providers are selected by default. To deselect the ones that don’t meet your requirements, simply click on the respective checkboxes.

Note: AdES providers have “AdES” in brackets next to their name — all other options are QES providers. The process of requesting a QES or AdES is identical until the actual verification stage.

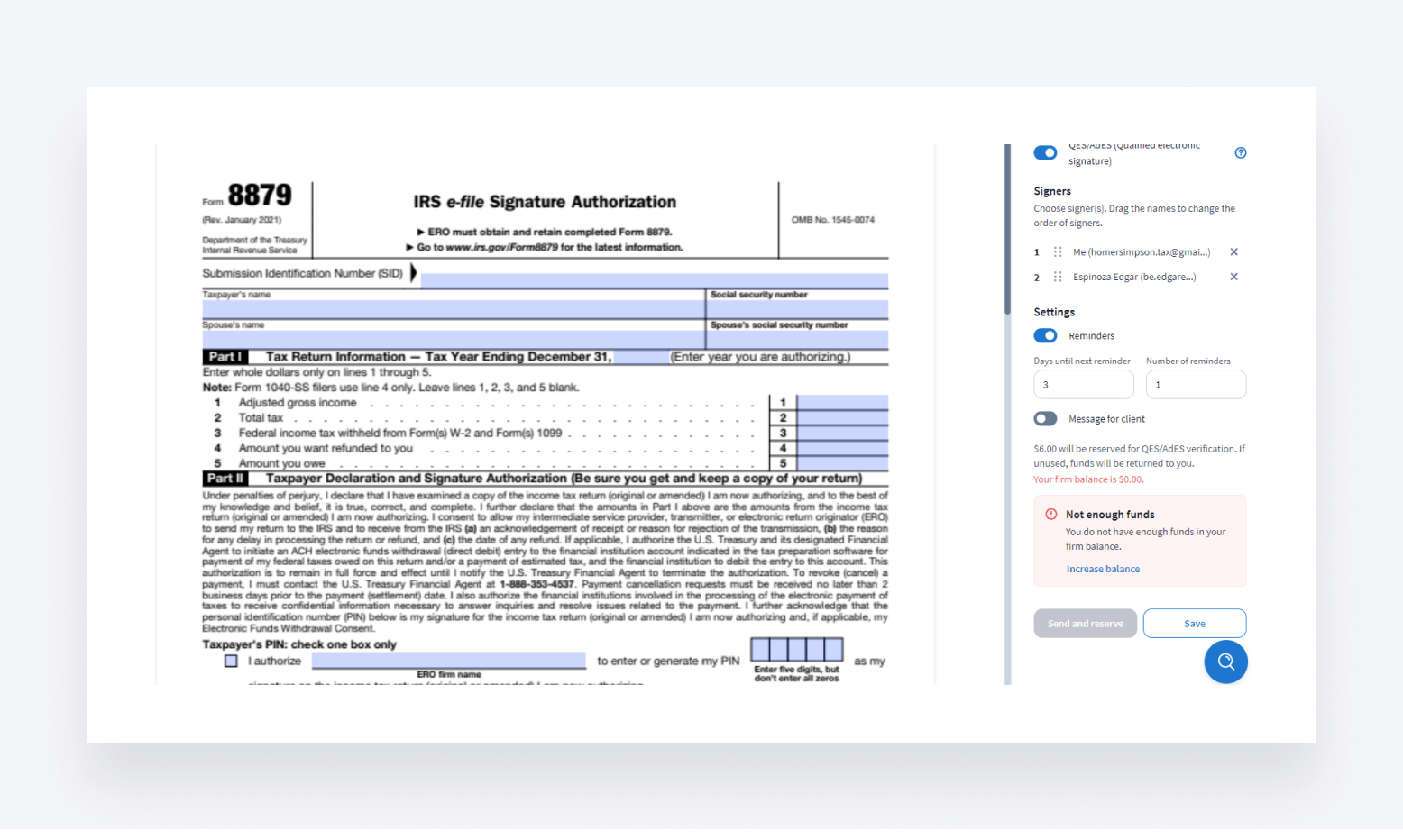

Now, when you open a document and request a signature, you’ll have the option to choose QES/AdES. If you leave this toggled off, you’ll request a SES by default.

If you opt for QES/AES, you’ll then need to specify who should sign the document — for example, yourself and your client or clients. You’ll also need to arrange the signers in the order you want the document to be signed. Unlike SES, the order of signers is very important for QES/AdES and dictates when people are notified to sign.

You can also toggle on automatic reminders and create personalized messages for clients at this stage.

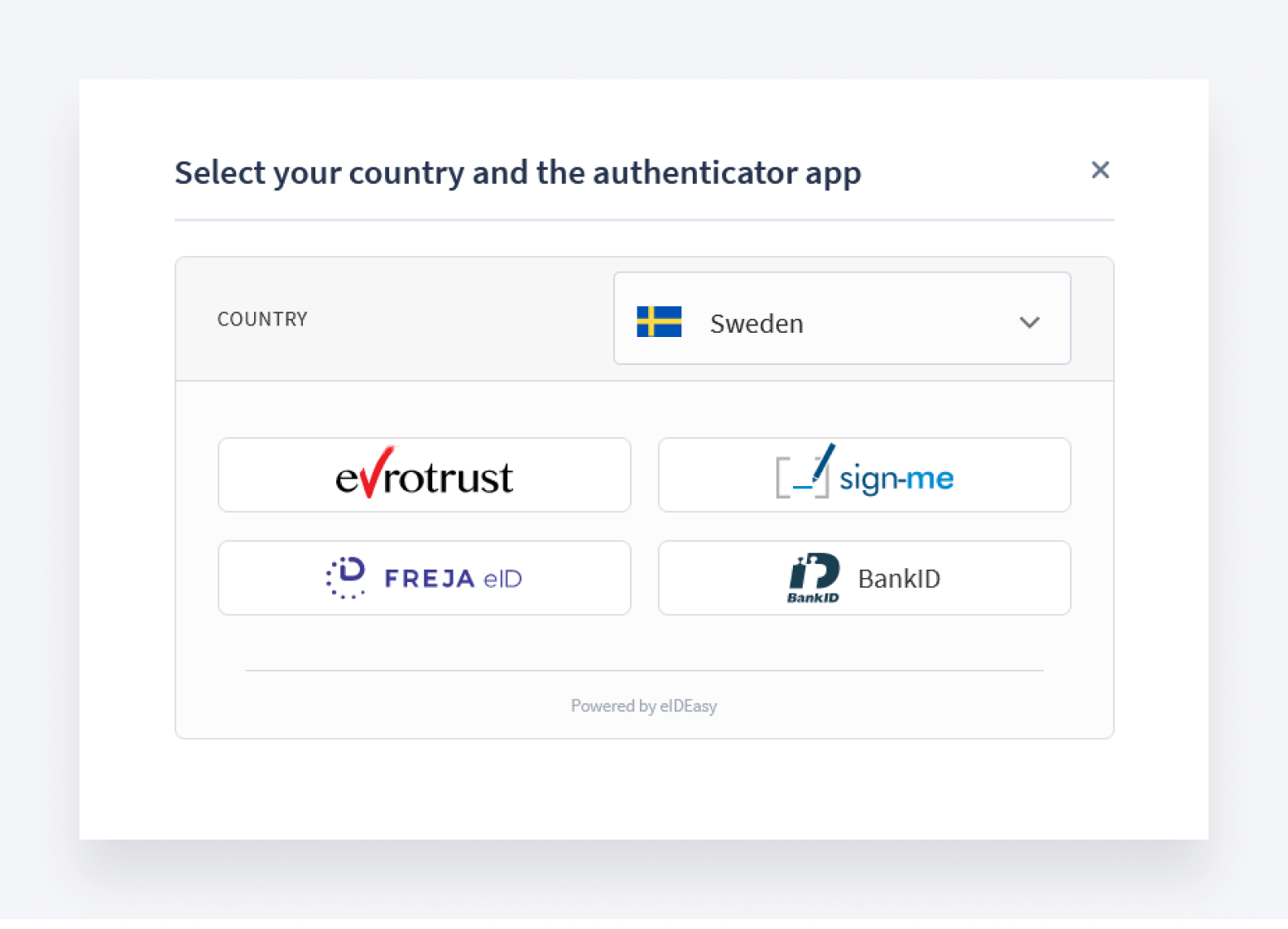

Once requested, the first signer will receive a notification that the document is ready for their signature. When they click on the “Sign document” button, a pop-up will appear showing the different methods available for the country selected. These methods will correspond to the boxes that were left checked in your Firm Settings tab.

By selecting a provider, the signer will be guided through the necessary steps and information required, which will differ for each provider. There are also slightly different verification processes for QES and AdES.

After the first person has signed it, the next person will be notified to do the same, and so on until all signers have signed the document.

Why use AdES and QES in TaxDome?

There are plenty of situations where AdES and QES are required by law, and each country in the EU has its own use cases. Even if using these methods isn’t mandatory, it makes sense to do so for any high-value or sensitive documents, because it gives you the most possible assurance that the document was signed by the signer, and that the signature hasn’t been tampered with.

Before this update, you had to jump into a separate e-signature tool and then back to TaxDome if you wanted to obtain an AdES or QES. Now, you can do everything in TaxDome, making life easier for you and your clients.

This new feature is also cost-effective, with most methods costing as little as 3 Euros per signature, which is significantly less than most competitors charge. There’s no need to pay for packages upfront to cover your needs — you can gather signatures flexibly on a pay-as-you-go basis.

If you’re a firm that operates in the EU, this update will allow you to get the most secure, trustworthy and legally compliant e-signatures possible. We’re looking forward to you giving it a try. If you have any questions about how it works, don’t hesitate to reach out to our support team.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.