Plenty has changed in the past few years, because the Covid-19 pandemic forced change on every industry and to many business practices. Tax preparers, bookkeepers and accountants have experienced this effect more than most as the global situation ravaged both vast economic markets and small business finances. In this post-Covid environment, tax practice companies need to step up fast and make changes if they are to remain viable, organized and beneficial to others who are struggling with similar issues.

This new reality has changed almost every aspect of business. As a tax practice, bookkeeping firm or accountancy business, the rapid adjustment of everything from day-to-day activities to marketing efforts to services offered is a must. Using the best practice management software for small tax firms can help smooth the transition onto a new pathway to success.

Information Communication Technology — a solid foundation for success in the 21st century.

Before exploring the options available to small financial firms and independent tax or accounting professionals, let’s look at how the post-Covid world has affected all types of business operations.

What Has Covid Changed for Accountants?

One of the biggest changes to affect accountants, bookkeepers and tax preparers was the temporary shutdown or complete closure of huge numbers of businesses nationwide; these represent the clients and customers who ultimately pay everyone’s bills and salaries. Even established accountants find themselves struggling to make up for losses in revenue caused by the pandemic, and, while things are beginning to rebound, the overall landscape of small- and medium-sized businesses in the US has changed permanently.

The pandemic has also affected the finance and tax rules for many businesses and individuals, and accountants and preparation specialists must stay up to date with the latest changes in order to be compliant with the regulations and provide their clients with the best service. The Coronavirus Aid, Relief, and Economic Survey (CARES) Act’s policies change frequently, for example. This affects both personal and business operations, income and tax responsibilities.

As the handling of bookkeeping and other records happens well in advance of the tax due dates, these practices are already well-established for this year. This is probably true even if the tax remittance deadlines are changed again, but it is important to keep an ear to the ground to ensure continued compliance and the future observance of best practices. The post-Covid world remains in flux and the only certainty is that things are still subject to considerable change.

The way that a firm responds to this issue can determine future success or failure. Cutting costs, limiting staff numbers and focusing on more precise services may help to keep things viable, but no one wants to see their place in the market shrink or lose money. Better organization helps, which is why adopting CRM for accounting practice along with task workflow management software for accountants, bookkeepers and tax professionals has become an integral part of smart practices. Providing your customers with a centralized tax client portal to simplify their journey can also deliver a significant boost to their engagement and satisfaction.

Enabling customers to upload and sign documents digitally drives satisfaction, engagement, and loyalty.

Other post-Covid changes that require new and more sustainable operations include:

Tax Firms Switch to Remote Work

When human connection and face-to-face meetings break down, digital technology and the Internet step up. The ability to communicate and do business remotely has given tax preparers, accountants and bookkeepers a true opportunity to thrive when other types of service providers might struggle. After all, it is quite possible to examine ledgers, databases and revenue sheets over a secure Internet connection. Person-to-person meetings via a screen are also helpful.

Integrating client meetings, daily tasks, marketing, and filing and submission practices with an automated tax practice management software option makes things easier. Instead of spending the company’s profits on new office furniture, better signage or an expanded location, firms need to invest in more robust computer equipment, secure networks, telecommunications, and data storage and retrieval systems.

After all, if some or all of the staff work from home, they still need powerful hardware, integrated software and sufficient security to get the job done properly. The same goes for client portal solutions for accountants, who need to be able to interact with clients without friction and with maximum efficiency.

In the past, the overhead costs of a tax professional workflow included office rental, equipment costs, Internet and digital access expenses, regular utilities, office supplies like paper and pens, and more. These items, that once sat neatly within a business budget, now present a challenge. If all the team members work from home, a company no longer needs as much office space, so certain questions arise: Is it possible to exit a lease without penalties? Should the firm hold on to their square footage in case things change? Are there options to sublet or otherwise turn space into profit? What can a company do with items such as unused reams of paper and coffee filters from the break room? Perhaps the best strategy would be to rechannel those funds to the maintenance of a mobile-friendly accounting client portal and slash office expenses significantly?

This post-Covid era has seen some return to in-office work but remote employment is here to stay. Multiple research studies and polls have shown that working remotely leads to higher productivity, more enthusiasm for the job and a much better sense of overall well-being. However, other research highlights concerns about issues such as providing sufficient care toward stressed workers and those struggling to manage family responsibilities and healthcare.

95% of employees are more productive when working remotely

For many, the switch away from personal meetings and handshakes has presented challenges to their usual methodology. Employees need new types of support, assistance and appreciation to keep them engaged and working to elevated levels of efficiency and productivity.

A New Focus on Staff Well-Being and Support

People are experiencing higher degrees of stress than ever before as Covid affects their work, family and personal health. Employees can be anxious about heading to the office or meeting with a new client. Is it safe? Will they be able to manage things emotionally? These are important questions, because comfort and a sense of security can affect work performance. One of the most important changes for tax practices, accountants and bookkeeping companies during these pandemic times involves supporting staff in the best ways possible.

What does this look like?

- Demonstrate trust in their ability to do the job well

- Balance independence with oversight – avoid overbearing monitoring

- Take time to recognize and support accomplishments

- Provide training or mentorship where applicable and appropriate

- Communicate and discuss company goals, visions and plans

- Make an effort to promote inclusivity and teamwork for all

An organization needs comfortable and healthy employees in order to function with the utmost efficiency. Remote work options via tax workflow software may help some people feel safer and more relaxed, but unfortunately, others who prefer a stricter managerial style or more hands-on assistance may suffer from the experience. A certain level of disconnect and lack of enforced enthusiasm can lead to lower productivity; team members may feel left out of the loop or miss the social aspect of work so much it becomes detrimental to collaboration.

Remote workers might miss office social bonds and feel left out of the loop.

Remote worker isolation has become a real problem and management must be able to recognize emerging issues before they affect the functioning of the whole firm. This takes a lot more in the post-Covid world than knocking on a door and saying, “Get back to work!” In a traditional office setting, coworkers form bonds and socialize in ways that help alleviate strain and create a sense of belonging and working together toward a single goal. The lack of that when working in remote CRM for CPA firms can hurt attitudes, reduce work ethic and stymie communication.

By creating a supportive system of self-governance and new training for the remote management of staff, any company has a better chance of retaining top talent and continuing to impress customers. The smart firm provides everything remote workers need to do their jobs properly and comfortably, and empowers leaders with the skills and knowledge they need to manage this new way of doing business effectively. Using comprehensive tax office management software like a project management Kanban board keeps everyone up to date and working together toward the business’s primary goal.

More people-centric practices help the tax prep and bookkeeping specialists and administrative staff perform their jobs well. It is not only about getting work done but also concerns how people feel about the work they do. Working in an end-to-end CRM for bookkeepers helps your employees to be more productive with reduced levels of stress. This new focus on support and well-being from a personal perspective also translates into greater levels of engagement with the target audience.

Tax Practice Management Tips to Engage Clients

The first, and some say easiest, way for a firm to maintain or increase revenue is to retain their existing clients. Due to the myriad changes brought by the pandemic to the accounting industry and to business practices, transitioning clients to new methods of collaboration makes perfect sense.

However, growth only comes with a constant infusion of new paying customers. The ability to maintain operations and market share during these difficult times will set one firm ahead of others who did not have an adaptation strategy. Flexibility in tax workflow management and overall marketing strategy are vital keys to success that cannot be ignored. Investment in reliable and useful CPA CRM software is an option that is certainly worth considering today.

Tips to Support Existing Clients During Covid

In order to maintain profits, you should transition existing clients to new ways of doing business. Those who are used to in-person meetings with paperwork, handshakes and precise scheduling may balk at the idea of video conferences and email communication through a client portal for accountants. Of course, many things will not change in day-to-day operations, for example, phone calls remain a cornerstone of business communication. Secure document transfer has been done digitally for a decade or more in the bookkeeping and tax preparation industries and is an integral part of any document management software for accountants.

Nevertheless, it is important to understand that the higher levels of stress and a lack of certainty about personal financial security and business profits can lead to client issues. This is especially true if their income has taken a hit due to the pandemic. After all, no one wants to pay taxes in the first place, so if they see their revenue or income decrease, it makes things even worse.

Providing clear organizers and forms helps simplify gathering the needed information.

How can a professional tax practice support clients and ensure they do not decamp to another company during these singular times? While most recommendations on the subject focus on good business practices in general, there are aspects that Covid has pushed to the top of the list of priorities. Above all, adopt a robust method of organization and collaboration so everyone is on the same page and fully informed of new methods and processes. Tax practice management software for accountants, such as TaxDome, can help.

Regular Communication Brings Peace of Mind

Calling or messaging clients about their accounts is essential to the operations of a bookkeeper or other financial services provider. In the volatile and uncertain post-Covid world, regular communication beyond the most basic makes a world of difference. While it may be impossible to contact every individual client with every update or new opportunity, digital avenues do exist.

- Schedule social media posts at a specific time and on a particular day to establish consistent client communications.

- Update website content with industry news, tax law changes or simply suggestions of general interest to the target audience.

- Create new methods of communication such as chatbots or ticket systems to provide immediate attention and responses.

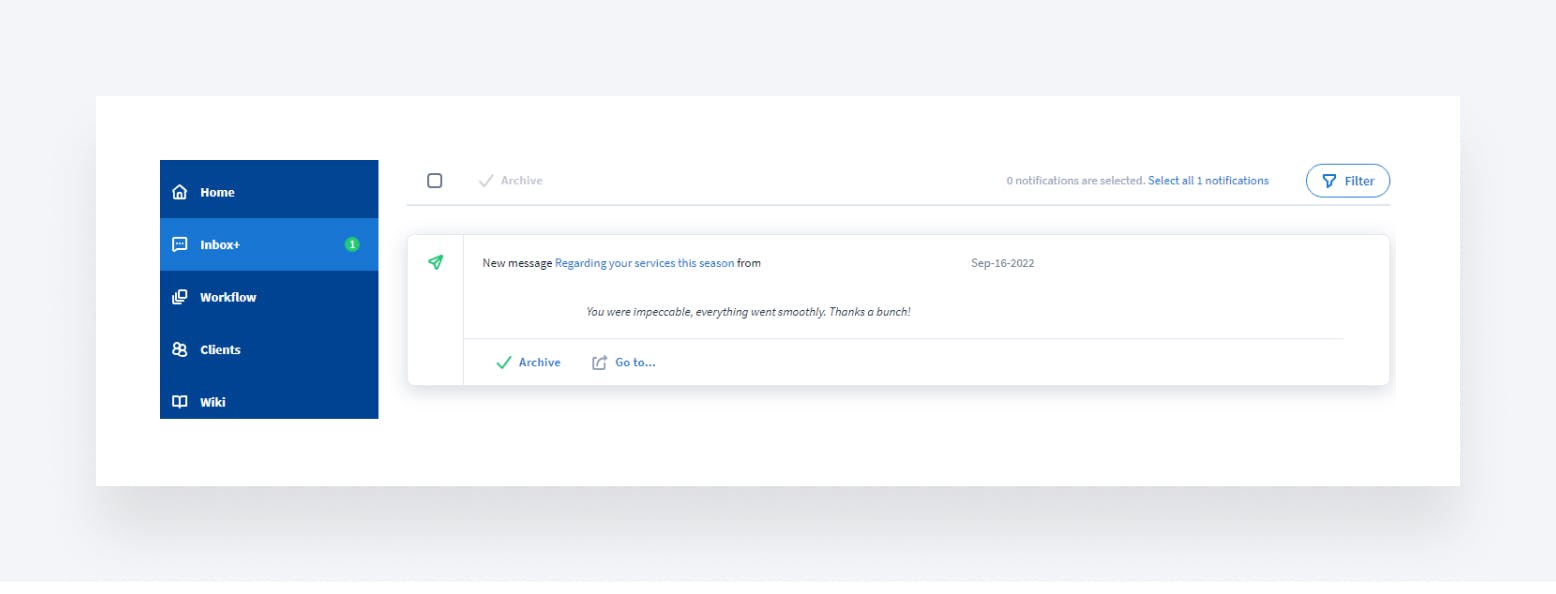

A centralized communication/collaboration hub helps keep customers in the loop.

Delivering such updates through a client portal software for accountants can help keep clients in the loop, but be careful not to spam them with irrelevant information. Instead, think about offering personalized discounts to engage with them.

Special Offers and Discounts Grab Interest Fast

A sale or special discount always gets attention. When revenue falls due to the pandemic, or indeed any other issue, firms often look for ways to save money. A bookkeeping or tax preparation provider that offers such savings will garner more attention than competitors who are less flexible on pricing. Although this does not mean that offering budget services is the only way to retain clients. Align special offers with the status of the brand and the demographic of the target audience. It is especially convenient to operate with tax workflow management software, where you already have your clients filtered and categorized.

Sending bulk emails to all eligible customers helps save a ton of effort (and save on email marketing services).

Educate Clients About Digital Usage and Security

People who are used to doing business across a desk may struggle with digital communications via tax practice workflow software. These old-school clients, who appreciate and expect a more personal approach, may need reassurance about these unfamiliar methods. Security matters so much when it comes to finance, and the sensitive and proprietary information shared with tax preparers should always be closely guarded and controlled. Educate clients about security protocols and the measures taken to ensure their data is safe at all times, like knowledge-based authentication or KBA.

Customers can enable the 2FA and KBA to further enhance the security of interaction with your company.

Establish Clear Communication and Access Guidelines

While regular communication creates engagement, it is important to establish rules or guidelines that work for all clients and the people providing the services. Dealing with the pandemic-driven changes to industry and the economy requires flexibility to keep revenue high. Create and share a clear and unequivocal set of rules for access to help and information. Unfortunately, some employers and clients may view remote workers as on-call all the time. After all, the concept of business hours and in-office activity disappears when you can log in to a CRM for accountants platform from anywhere and at any time. Make sure everyone understands how meetings and other communications work using the new digital methods. Options include:

- In-house networks on the company’s website

- Virtual meeting services like Zoom

- Free chat programs solely for when secure communication is not required

- Screen-sharing programs for one-on-one video calls

One of the best ways to keep existing clients engaged and to display the value of customer service involves welcoming feedback at all times. This is not just about asking for a review on Yelp or a comment on a social media feed – it’s more about turning their use of client portals for accounting firms into a dialogue, rather than a chore. Allow customers to complain, ask questions or leave a compliment with the understanding that they will receive a prompt response.

Communication through a centralized portal helps keep both company and business up-to-date.

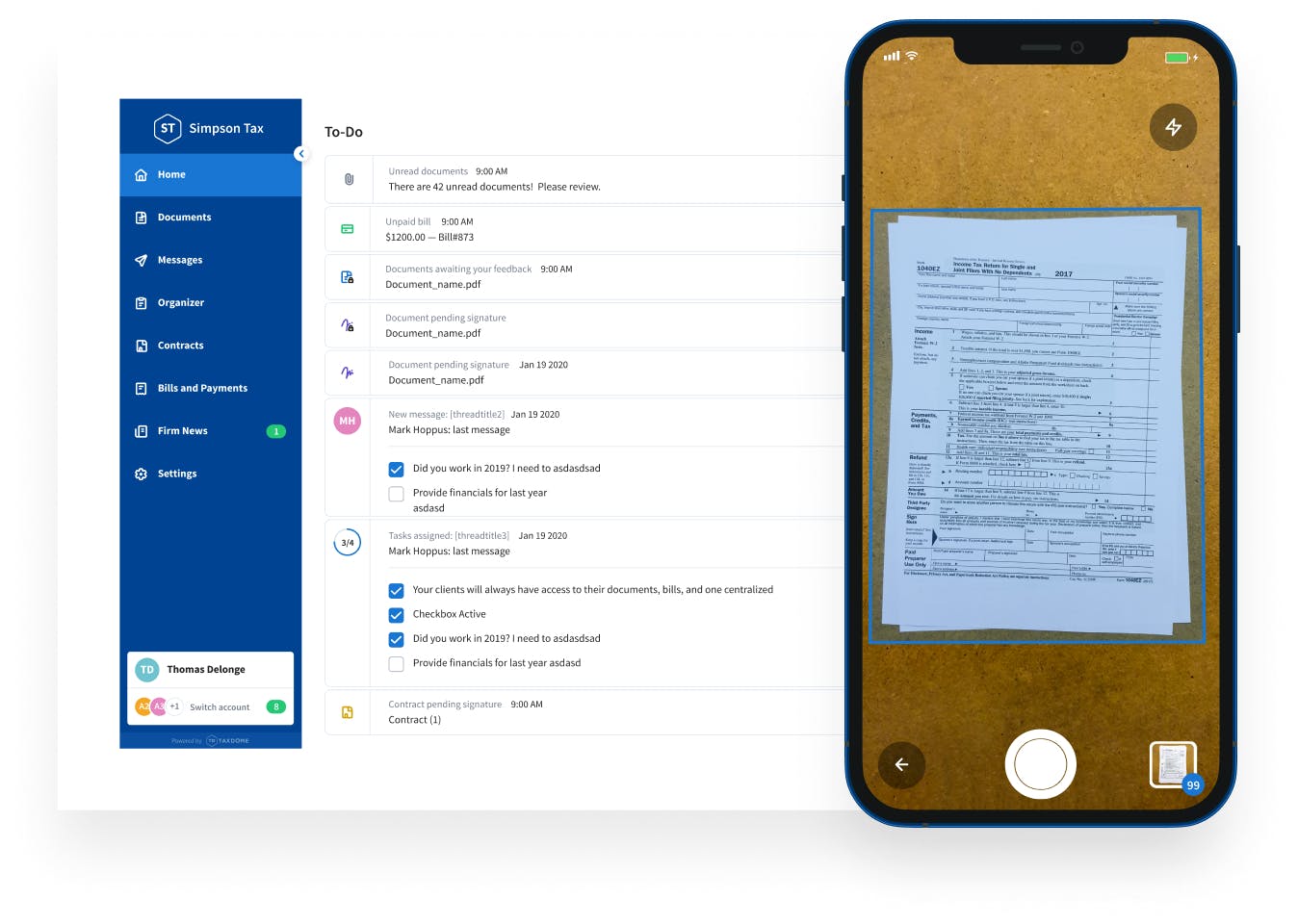

A client-centric process using management software with an integral customer relationship management (CRM) feature can help. This should include internal data organization so the entire accounting team can see everything they might need to know about the client. It also helps to have a secure communication portal where clients can access their own information and contact the office at will. Lack of immediate access can lead to dissatisfaction and distrust, so the right software platform like TaxDome with its associated mobile app can help.

Turning Satisfied Clients Into Referral Sources

Word-of-mouth advertising has topped the list for successful lead generation and conversion for the entire history of business. People are much more likely to purchase a product or hire a service provider if someone they know and trust recommended them. In the world of online marketing and reputation management, turning clients into fans is an important part of success.

Some tax preparation companies undoubtedly bank on their brand names alone, rather than the convenience of document management software for CPA firms they offer to their clients. They benefit from referrals and clever marketing that transform mere satisfaction into support. Although an individual tax preparer or small accountancy firm may not reach those stellar industry levels, it is possible to benefit from a truly engaged customer base.

Great customer experience lays the ground for word-of-mouth advocacy and promotion.

What is the difference between someone who will continue using a service without complaint and one who will advise everyone they know to hire a specific company? This primarily depends on whether the USP aligns closely with their interests and visions of success. You can transcend expectations and reap the rewards when your customers tell their friends that your firm has the best tax workflow software that they have ever experienced.

However, it is inadvisable to rely on recommendations and word of mouth alone to increase client lists and, in any case, financial services marketing has numerous aspects. Remember that in the post-Covid world, more individuals and small businesses focus on security, comfort and trust than they do on basic results.

Attracting New Clients for Tax Preparation and More

Tax preparation is an important service that many people need but it can be difficult to attract new clients. It can be hard to know how to market a tax preparation service when day-to-day operations change so much, so unexplored avenues and different marketing strategies make sense. No matter how good the product or service is, the company’s ability to get that information in front of a target audience remains the most important thing.

Luckily, the world of Internet marketing was well-established before Covid-19 came into the picture. Every tax preparation firm, accountant and bookkeeper should already have a strong online presence, established management software for accountants and some digital strategies in place to engage new clients.

Popular and effective digital marketing practices include:

- Search engine optimization both on and off the company website

- Inclusion in Google My Business and other review sites

- Opt-in email subscriber list and regular newsletter communications

- Engagement on the social media platforms used specifically by the target demographic

- Video content that informs, engages and educates potential and existing clients

In order to make any of these things effective for your client accounting practice, the first step involves the precise understanding of your target audience. People who work in financial fields usually focus on either business entities or individuals with certain income levels. For example, solo practitioners and small bookkeeping firms may target freelancers and the owners of small- and medium-sized businesses specifically by offering intuitive CRM bookkeeping software for an individual or family. Large firms with the resources and service providers to handle more complex or extensive finances could target high-net-worth individuals or corporations.

A specific focus on the coronavirus pandemic has changed marketing techniques in both subtle and overt ways. Despite a return to a semblance of normality in some parts of the country and the world, health and safety remain at the forefront of most consumers’ minds. In order to engage new clients, it is important to do more than just answer questions about business operations. Approach the effects of the pandemic proactively by explaining any changes you have implemented, safety precautions taken and your continued dedication to offering the best available service, in spite of the headwinds. Show the human face of the company and demonstrate empathy by letting the target audience see your efforts for themselves. You can accomplish this with social media posts, sending meaningful letters to existing clients, including safety information with onboarding paperwork, and remaining dedicated to healthy business practices.

A significant way of attracting new clients and holding on to existing ones is the improvement of your company’s reputation. This could focus on a global or national audience or specifically target the local community and business base. Most of all, brand recognition and reputation management exist on the Internet because the vast majority of people search for companies online before making initial contact. This is why software for accounting firms must not only be intuitive and secure, it must also provide SEO and a mobile-friendly experience, with white-labeling and brand customization options on top.

What Boosts Brand Reputation in the Post-Covid World?

As mentioned above, the way people look at businesses nowadays has changed beyond all recognition. This is especially true for individual consumers who focus on emotional responses to the brand more than the base practical characteristics of the accounting firm management software that it offers. Even small- and medium-sized companies look for something special when searching for professional help.

The client portal, workflows, email integration, billing, and automated tasks have helped me get organized for the tax season. My clients are telling me how nice the client portal looks! Joe Bourque, EA JB Taxes, EA

At its most basic, brand reputation speaks to how well clients rate the services and the subsequent reviews they leave online. A five-star company will get more positive attention than a two-star one. Nevertheless, it is important to note that consumers and business owners can spot fake reviews and excessively positive ratings with more ease than ever before. Therefore, you should only allow honest and natural feedback to nurture your brand’s online reputation.

These basic reputation and engagement tasks include:

- Maintain contact with active and past clients

- Use digital connection effectively to keep the brand in mind

- Provide assistance that goes beyond the services offered

- Follow up all communications and interactions

- Keep focused on company identity and mission

The seismic shifts brought by the Covid-19 pandemic to the economy and businesses of all kinds mean that brand recognition means something different these days. But trust and safety when working in CPA practice management software will always remain important, of course.

How well a company takes care of its employees also matters. In addition, its vision for the future, sustainable and environmentally conscious practices, and elevated personal attention will all give a considerable boost to a firm’s overall reputation. Remember, these days, people want to do business with companies that stand for something beyond profits.

This is an important thing to understand if a tax preparer wants to stand out from the competition. Companies stuck in the old ways of doing business will wither on the vine if they fail to provide for the needs and wants of their current clients.

A New Focus on Standing Out From the Competition

Even though many businesses shut down due to the Covid-19 pandemic, competition for tax preparers, bookkeepers and accountants remains stiff. This is partly due to the ease of performing these services remotely. After all, every US citizen can access their individual tax document storage, can’t they? In order to stand out from the competition, develop a compelling brand story and a unique selling proposition (USP).

What is a unique selling proposition? In short, a USP is anything that sets one firm apart from the others in the same industry or sector. It creates a one-of-a-kind feeling that attracts clients because they feel like they are getting something special.

USPs for tax preparers, bookkeepers and accountants may include:

- Focus on bookkeeping for a specific business sector

- Solve a unique and unexpected pain point for a smaller audience

- Offer budget-friendly financial service packages beyond tax preparation

- Educate and build a community instead of solely providing services

Setting a business apart from the competition gives it a firmer footing in the industry and helps to bring success. The creation of a USP transforms a simple difference into something that can help overcome challenges caused by the pandemic and changes to the way tax professionals do business.

Both local bookkeepers and national tax preparation brands benefit from community focus. A personal touch can make a company stand out from competing firms much more noticeably than simply using better accounting firm practice management software. Support local initiatives, assist respected organizations with donations or by volunteering, and show your backing for sports teams or other popular local groups. Make sure you demonstrate genuine support rather than simply paying to show off a logo or rack up social points as if marketing were a simple popularity contest.

Great products have passionate communities with lots of support and feedback.

These empathetic initiatives align with the team’s soft skills and engage new clients more effectively. They carry over from initial contact and the demonstration of dedication to quality service through the onboarding process, turning a verified lead into a customer.

Establish a Simple and Comfortable Client Onboarding Process

Once a tax preparation company grabs the attention of a new client, the onboarding process sets the tone for the rest of the professional relationship. While this depends partially on the firm’s marketing and sales operations, it has more to do with communication, education and establishing trust.

Many of the ways to support existing clients which were mentioned earlier can also help to introduce new ones to accounting workflow, business methodology and the CPA firm practice management software which is used. This includes establishing lines of communication and creating a long-term schedule for ongoing meetings. These differ widely depending on whether a client only needs tax preparation before the April 15th deadline or wants long-term bookkeeping and finance services.

In-depth training shortens the learning curve, helping you and your clients get value faster.

Although the specifics cover a wide range of things, cementing the client relationship always includes the following:

- Explaining what services work for the client

- Discussing the budget and establishing costs and a payment process

- Signing contracts and permission to access financial and sensitive information

- Setting up communication pathways and expectations of access

- Understanding the needs, concerns and goals of the client

- Handling all legal matters surrounding tax preparation and data

Every aspect of the tax practice management process is affected by the echoes of Covid-19 and what it has done to the world of finance and business. Retaining current customers presents a challenge as methodologies must shift towards accounting workflow automation. Attracting new clients forces accountants and bookkeepers to utilize new skills they may not have established in the past. automating accounting workflows

With all the new information, processes and communication types at issue, one solution stands out as a smart choice for every company in this industry. Tax practice management software like TaxDome helps solopreneurs, corporate leaders, small business owners and team managers to organize data, streamline processes and keep everyone on task for maximum efficiency.

Adopt the Use of Tax Practice Management Software

As early as 2018, a couple of years before the pandemic began, over a quarter of accountants surveyed stated that they used tax practice management software regularly. Now that Covid-19 has pushed the financial services industry toward virtual meetings, digital data sharing and communication, and remote work, the need for an accounting practice management program has increased considerably. No accounting firm or bookkeeping professional who wants to stay competitive can afford to ignore the organizational power of this type of asset.

Many different software programs exist that provide specific benefits for a company. Every business has a secure email platform, a client management system, employee timesheets and scheduling software, and some way to store files safely. An accountancy or bookkeeping firm with many different services and clients to handle can benefit from an inclusive and comprehensive software platform to manage everything in one place.

Top Features of the Best Practice Management Software

The decision to use task management software for accountants may involve an exploration of the most desired features. Why settle for just some when comprehensive platforms are available? The features fall into multiple categories that focus on the internal organization of employees and processes, document management, storage and security, client control and communication, and more. The following options that are available in the top practice management software for small tax firms also work well for large accountancy groups and individual bookkeeping professionals.

Client Access Portal

A huge part of maintaining sufficient communication with clients includes their ability to access information and updates at their convenience. Nothing makes this easier than a dedicated client tax portal with accompanying app which is usable on all mobile devices and smartphones. This is one of the most important features that every tax preparation practice needs for adequate interaction and to give clients the desired control and comfort level.

Customer Relationship Management (CRM)

Perfect for both long-term clients and brand-new ones, a customer or client relationship management portal allows companies to categorize and separate people at different stages of the professional relationship. Pre-qualify new ones, add information to existing ones, keep track of workflow tasks, deadlines and more. This functionality in a management software platform enables you to always know exactly who needs what and when. Using streamlined, intuitive and convenient CRM for tax professionals improves customer satisfaction across the board.

Automated Workflow Table

With the possible reduction in employee numbers due to the pandemic and an eye on saving money, automating tax preparation tasks makes a lot of sense for any tax preparation company. These capabilities help to create push-button processes for things like onboarding, communication, recurring schedules, reminders and other aspects of tax workflow automation. Team members will appreciate the project management Kanban board style and the ability to customize templates. As the needs of different firms vary widely, it is this type of flexibility that creates the highest level of function for all concerned.

More than project management: always see where your team stands, so that you can scale your business effortlessly.

Document Creation, Editing and Secure Storage

The world of tax preparation, bookkeeping and accounting involves a huge number of documents but the days of handling hard copies are mostly over. This is especially true in the post-Covid world where digital access and remote communication have taken over from in-person meetings. The best management platforms for tax preparers must have a secure way to handle documents. First, utilizing the ability to create customized contracts, letters and forms means more capability for client needs. Second, opting to edit PDFs and digitally sign all types of official forms streamlines processes. Third, choosing a system with unlimited cloud storage ensures the security of all paperwork now and in the future.

Unlimited document storage in the cloud with watertight security helps keep financial data safe and sound.

Integrations With Popular Tax Programs

Although clients come to an accountancy or bookkeeping company for help with tax preparation and other financial record-keeping and handling services, many still use popular bookkeeping programs or tax preparation services. The ability to organize data from multiple sources facilitates a much smoother process with minimal risk for error in information transfer. These can include QuickBooks, TaxAct, DrakeSoftware, ATX, ProSeries, TaxWise, Xero, Lacerte, ZohoBooks and more.

Better still is the option to integrate other popular programs with the tax practice management software. Imagine the convenience of a real-time connection to credit card payment processors like Stripe and email servers like Gmail, Outlook and Yahoo. Integrations to a huge list of external apps through Zapier explodes functionality exponentially.

What Functionality Is Needed?

When researching accounting practice management software for small tax firms or individual tax preparers, a fully featured management suite may not seem like the best option. Decide which functions provide support for regular activities associated with client care, project management and document handling. Then consider the importance of finding it all in one user-friendly platform.

Although growth may seem a tough prospect in the post-Covid environment, the goal of any company is to expand enough to retain profits. A constant influx of new clients is necessary to offset the effect of established ones who shut down, drift away or no longer need tax preparation services for whatever reason. Running functions which are just sufficient for current operations will likely not fulfill future needs; better to focus on growth and opt for an accounting client management software solution that provides for any scenario.

Task Management Software Improves Operations

Many professionals and business owners look for client or customer benefits when choosing a project management system. However, these types of platforms also help with organization and management of the business itself. For example, a project management Kanban board shows each accountant, tax clerk or administrative staff member exactly what they have to do and by what deadline. The ability for everyone to log in to one cloud-based practice management software platform at any time and see updated information about client care and document handling helps negate the risk of human error.

With the ever-increasing popularity of remote work and telecommuting due to the Covid pandemic, these capabilities are more important than ever. By using software like TaxDome, managers or company owners can track work time and billable hours with a system that prevents the negative outlook sometimes caused by excessive oversight. Inter-office communication that is shareable, trackable and secure allows for cleaner collaboration, even when most workers are at home.

In the end, tax practice management software should provide the opportunity to handle all aspects of business while compensating for challenges brought about by this new reality. Organization, security, integration and communication remain the cornerstones of successful accounting, bookkeeping and tax service businesses.

Workflow automation provides transparency and enables you to manage and scale your practice with ease.

Even though a couple of years have passed since the Covid-19 pandemic first affected business operations around the world and across the country, some firms still struggle to retain their competitive edge. Remote work opportunities have become a normal and accepted part of the company function. Virtual meetings and digital communication within the accounting firm workflow process have taken over from conference rooms and handshakes across office desks. The new challenges have destroyed many businesses, but the possibility of success and growth still remains.

Tax preparers, accountants and bookkeepers of all types can shift focus, learn new methods and adopt more successful processes and platforms to help them succeed. These new opportunities get an undeniable boost from the adoption of powerful, comprehensive and user-friendly practice management software for small tax firms. With the right digital tools on hand, it is possible to thrive and profit in the post-Covid world.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers