Do you know how long your onboarding process takes on average?

What about the broader industry?

What if we told you that according to data gathered by Karbon, the average onboarding process for a new client was 60 days? You would perhaps agree that it is somewhat too slow for the Internet age where nearly every process is automated.

Why client onboarding process is a must

In business, you only have one chance to make a great first impression – and slow is rarely the sentiment you want to convey.

This idiom not only describes chance encounters and first meetings but could also be applied to the client onboarding process. At this stage, your firm establishes its credentials and sets expectations as to how you work and what you can do to help your clients achieve their business goals.

An optimized and efficient onboarding procedure for new clients not only helps you work together more effectively towards achieving shared objectives, but also determines the contours of the relationship.

“But what about legacy clients?” you might be asking yourself.

A standardized onboarding process not only helps new clients and your firm get off on the right foot, so to speak, from a business perspective, but it can also help bring your older clients up to speed with your new process. In fact, you will likely need an onboarding process anytime your company introduces a new service, tool, or process into the marketplace.

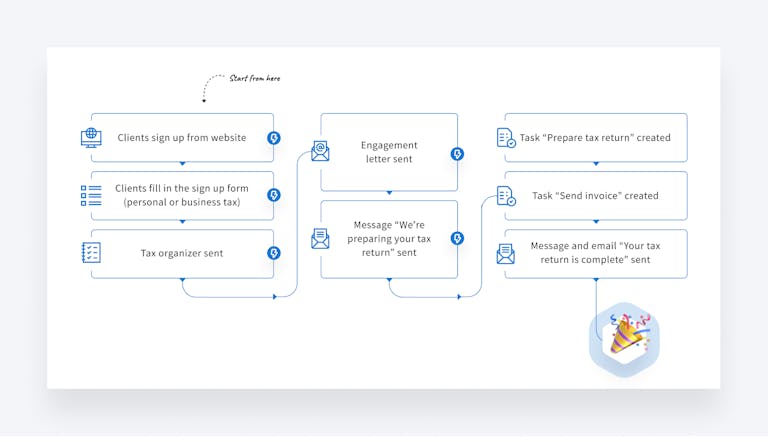

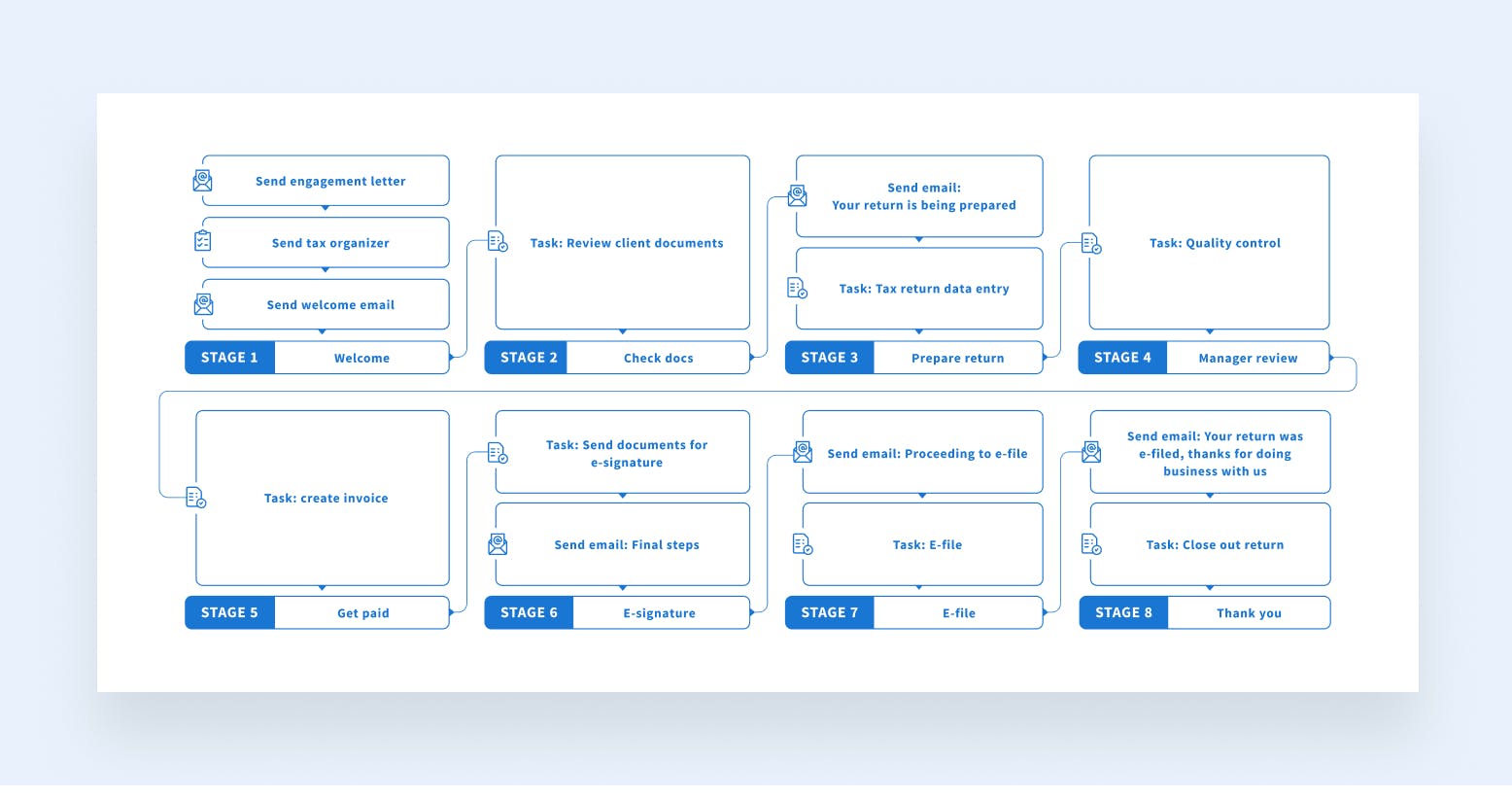

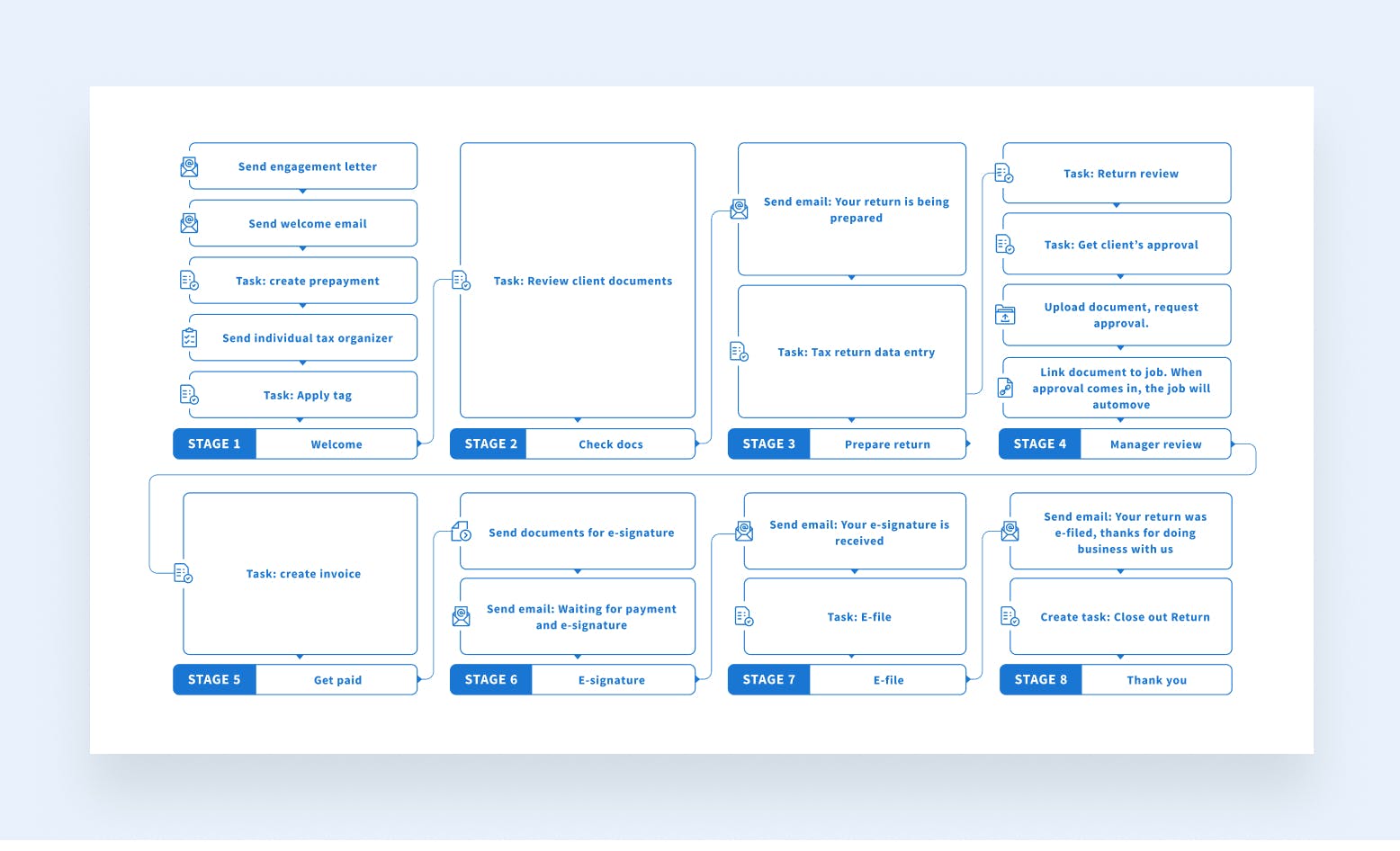

An example of a client onboarding pipeline created in TaxDome.

Automate your workflow with TaxDome and set your firm on the path to success for the 2022 tax season:

Use the slides from the webinar to consolidate the information and apply it in your practice.

How your firm benefits from having an optimized client onboarding process

Aside from making things easier at the start of any process, an optimized client onboarding process checklist also provides your firm with tangible benefits in terms of returns. How so? Efficient new client onboarding checklists have demonstrated correlations with increased client retention rates as well as the overall profitability of the client relationship.

How important is client retention to the success of your firm?

Research has shown that a 5% increase in your client retention rate could yield as much as a 25% boost to your firm’s profit. As you can readily see from the numbers, a checklist of client onboarding helps you streamline processes and reap tangible financial gains as a result.

Firm of the Future reports, “When looking at the best accounting firms onboarding, one major common factor is that they have a dedicated resource just to onboard new clients (or dedicated time each week). The underlying reason this is successful is because it eliminates the lag time between client requests. As soon as one request or task is complete, the next one is waiting in the client’s inbox. It leverages the emotional high of the client in completing a prior task, while also capitalizing on the situation that your project work is top of mind.”

Onboarding new clients checklist will make the outcome of client interaction more certain and predictable than ever before, thus allowing you to make strategic decisions about the immediate term and long-term business relationship.

New client onboarding checklist templates

At TaxDome, we understand that each and every firm is different and has different needs. Therefore, one-size-fits-all solutions or templates aren’t the best advice when it comes to bookkeeping services or accounting.

We’ve gathered client onboarding checklist templates that help our clients grow their practice. These CPA firm new client checklist templates lay out every step of the process in clear detail. Feel free to use them to get started customizing your process to suit your firm’s needs.

Client Onboarding Template 1: new tax client checklist

Here’s the best one to start with and works best for solopreneurs.

The initial process starts with a contract, organizer, and welcome email. We suggest using tax organizers (questionnaires) to request client data: prior year’s tax return, W2, SSN, 1099 R, etc. If you don’t want them to upload data through the organizer, send this accounting onboarding checklist via email or create a to-do list for clients in TaxDome.

At stage 4, you can request client approval on your document (you can automate this in TaxDome) or set an online call with them. In this latter case, you can replace the second task with a ‘Send message with calendar invite’ one.

At stage 6, you can lock documents to a bill in TaxDome, so that clients will see that you uploaded their return but won’t be able to access them until they pay your bill. Once they pay, the return is automatically unlocked.

At stage 8, you can use a thank you email to ask clients for a review. Client reviews are one of the most effective ways to grow your client base at no cost.

Client Onboarding 2: upgraded new tax client checklist

This checklist is a more twisted variation of the previous one. We suggest you have a prepayment in the Stage 1 to ensure you won’t be chasing clients after your work is done.

At stage 1 we included applying tags. Tags make it easier to quickly sort clients out and perform bulk actions.

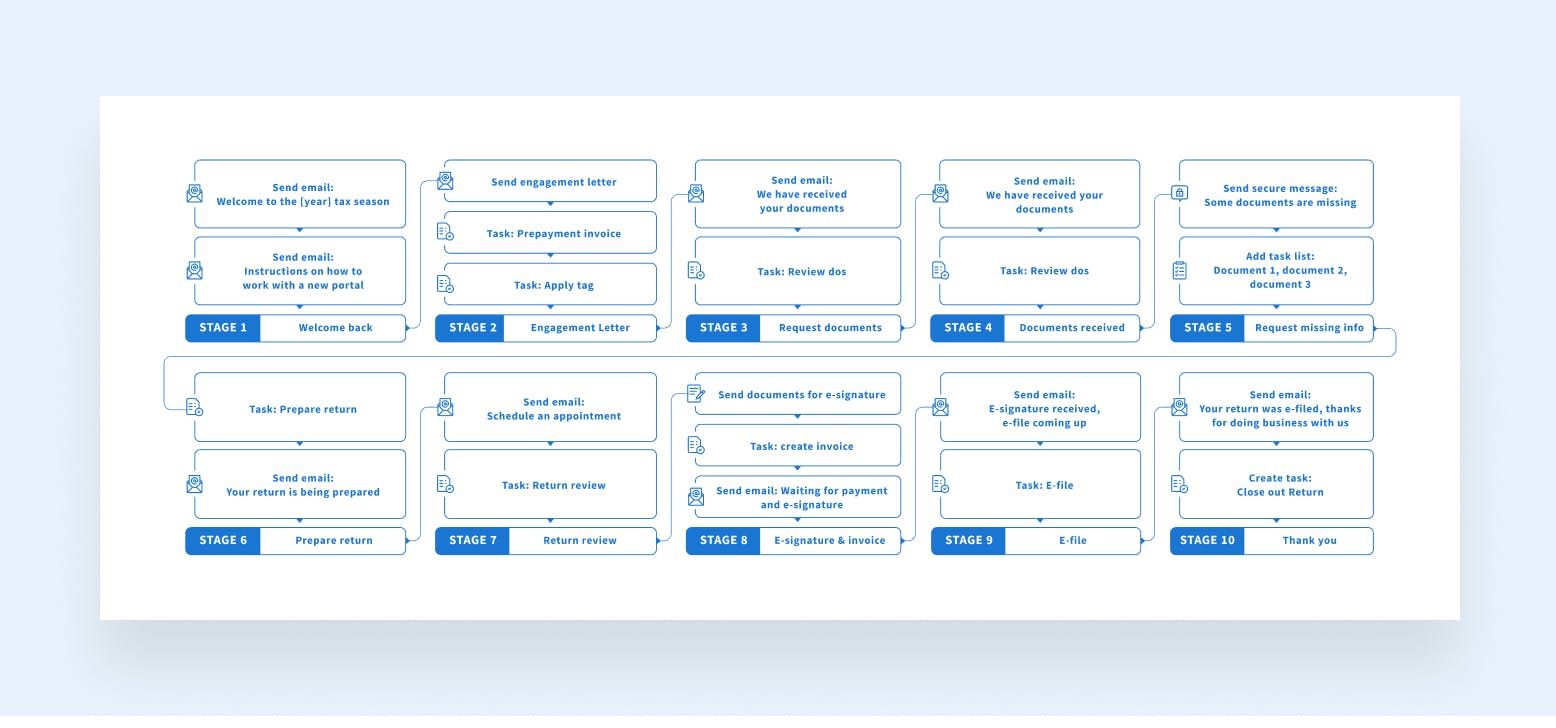

Client Onboarding 3: returning client onboarding

Use a kick off email to let returning clients know about your working hours, hourly rates and other changes. For example, that you’ve become 100% virtual firm and don’t accept documents offline, or that you charge a deposit this year. Reassure them that their tax returns are fully under control.

If you want to introduce your clients to TaxDome, you can follow the guide with ready-made email templates and include them into your kick off email.

We also outlined Stage 5 where we outreach clients if we need more documents from them. If you don’t need an extra reminder to ping a client, remove this step.

At Stage 7, you can have an appointment with clients before preparing their returns to discuss their options or afterwards to review the results together — it’s up to you. And don’t forget to include the link to your scheduler!

Watch Cassandra Centeno, owner of Total Tax Services, on how she automated her firm’s client onboarding with TaxDome:

A Comprehensive Solution

Your new client onboarding checklist template helps set the tenor of the business relationship to follow. Use this as an opportunity to communicate expectations, service offerings, and glean necessary and required information from your new client.

TaxDome lets you fully automate a new client onboarding process, including sending engagement letters, invoices, organizers and automatically reminding clients to finish them up. This robust system allows your firm to more strategically acquire new business, deploy capital, and grow revenues.

Join our daily Demo to see how you can incorporate it into your practice.

Join demo

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers