Free online bookkeeping courses are a great way to kickstart your bookkeeping career or expand your expertise. Unlike professional qualifications, they provide a more flexible, cost-effective way to learn the skills you need to move forward.

But with so many to choose from, how do you know where to start? Don’t worry — we’ve got you covered. In this article, we’ll explore some of the best free online bookkeeping courses available.

Key factors to consider for online bookkeeping courses

Here are the top factors to consider while picking online bookkeeping courses.

Course duration and pacing

Take into account the course duration and pacing so that you know how fast you can learn a new skill and how you can incorporate learning into your life effectively.

Before you sign up, make sure you can dedicate the time required each week for lectures, assignments, and projects. If you can’t commit to a set number of hours per week, self-paced courses offer more flexibility.

Instructor availability and support

If you’re an independent learner, that’s great — but sometimes a human touch is an important addition to a course. Check if the course provides access to instructors for questions and one-on-one guidance. Active instructor support can be invaluable for clarifying concepts and providing feedback.

Relevant course content

Review the course topics to ensure they suit your needs. Are you new to bookkeeping and want to start learning the basics first? Alternatively, are you interested in advanced training or want to master a particular bookkeeping tool?

Certificate of completion

Having a certificate stating you’ve completed a course can help supplement your resume and provide concrete proof of your skills. If a course offers a certificate upon completion, it’s worth checking if it’s from an accredited education provider as this carries more weight.

User reviews

Before you choose a course, it’s worth looking at what other people have to say about it. Reviews help you cut through the noise of marketing to see what a course is really like. Pay attention to what reviewers loved and disliked about the course as well as the overall rating.

List of the top 9 free online bookkeeping courses

Here’s a list of our top picks for online bookkeeping courses:

- Bookkeeping for personal and business accounting — The Open University

- Bookkeeping Basics — Coursera

- Bookkeeping — Accounting Coach

- Introduction to bookkeeping and accounting — OpenLearn

- Diploma in Effective Bookkeeping and Payroll — Alison

- ACCA: Introduction to Bookkeeping — edX

- ACCA: Intermediate Bookkeeping — edX

- Bookkeeping — Oxford Home Study Centre

- Accounting Fundamentals — Corporate Finance Institute (CFI)

Apply your skills using an award-winning platform that will help you grow your bookkeeping firm with confidence. TaxDome helps more than 10,000 firms automate their workflows, boost team collaboration, and elevate their client experience.

Bookkeeping for Personal and Business Accounting — The Open University

Bookkeeping for Personal and Business Accounting is a free online course from The Open University Taught by Devendra Kodwani, Professor of Financial Management and Corporate Governance at the Open University Business School. It provides a solid introduction to bookkeeping and personal and business accounting.

Key features

- Self-paced with an estimated three hours per week

- Free certificate upon completion

- Possibility to communicate with other learners

Course curriculum and skills

Over the course of four weeks weeks, you’ll gain the skills and knowledge to manage finances and understand basic accounting principles and processes, including:

- Recording transactions in ledgers

- Understanding debits and credits

- Preparing trial balances

- Accounting for inventory and expenses

- Applying the accounting equation

- Using nominal ledgers

- Creating balance sheets and income statements

Certificates and diplomas

This course offers a certificate for students who complete 90% of course steps and all assessments.

Reviews

The course has an overall rating of 4.5 stars from 143 reviews. Reviewers are keen to praise the learning experience and quality of materials. While some learners believe the course isn’t easy for complete beginners, they comment that it’s detailed and interesting.

Bookkeeping Basics — Coursera

Offered by Intuit, Bookkeeping Basics provides an introduction to bookkeeping concepts and terminology. You’ll gain the skills needed to organize financial records for small businesses.

Key features

- Self-paced, on-demand

- 16 hours of materials

- Free certificate upon completing all materials

Course curriculum and skills

This course teaches fundamental bookkeeping skills and knowledge, including how to:

- Define key accounting terms

- Explain the double-entry accounting method

- Understand the ethical duties in financial reporting

- Apply double-entry bookkeeping to record transactions

- Use accounting software

- Generate accurate financial statements

Certificates and diplomas

Students get a free certificate upon completion.

Reviews

The course has a rating of 4.6 stars from 4,104 reviews. Many learners found it a helpful introductory refresher on core concepts and practical skills. They praised the easygoing presentation style and real-world applications. However, common complaints included glitchy practice modules and a desire for more hands-on exercises.

Bookkeeping — Accounting Coach

Bookkeeping from Accounting Coach provides both free and paid online lessons on bookkeeping concepts and best practices.

While the course has tons of free materials, it offers two subscription plans that open access to even more content, as well as certification. The pricing for the PRO and PRO+ subscriptions are $49 and $99 respectively, and this is a one-time fee.

Key features

- Self-paced with 20 lessons

- A combination of free and paid materials

- Paid certificate of completion

Course curriculum and skills

This course provides a comprehensive overview of accounting fundamentals, financial accounting, and bookkeeping skills. In addition to learning accounting basics, you understand the following areas:

- Preparing financial statements

- Recording adjusting journal entries

- Reconciling accounts

- Calculating depreciation

- Inventory and cost of goods sold

- Understanding working capital and liquidity

- Accounts receivable/payable

- Payroll processing

- Nonprofit accounting

Certificates and diplomas

The course offers a certificate of completion after passing the exam for PRO and PRO+ subscribers.

Reviews

With over 2,000 testimonials, learners praise this free bookkeeping course for presenting concepts in an exceptionally clear, easy-to-understand manner. Many mention struggling with accounting in traditional classroom settings or textbooks before finding this resource.

Introduction to Bookkeeping and Accounting — OpenLearn

Introduction to Bookkeeping and Accounting is a free course from Open University. It provides an introduction to the fundamental rules of double-entry bookkeeping and how they are used to produce the balance sheet.

Key features

- Self-paced learning

- 8 hours of study

- Free statement of participation available

Course curriculum and skills

This course teaches you fundamental skills in numerical accounting, double-entry bookkeeping, and financial statement preparation. You’ll learn how to apply essential math skills like percentages and ratios for bookkeeping tasks.

Here’s what the curriculum includes:

- The accounting equation

- Mapping transactions across ledger T-accounts using double-entry methodology

- Performing the accounting cycle of journalizing to constructing trial balances and closing entries

- Preparing key financial statements like balance sheets, income statements, and statements of owner’s equity

Certificates and diplomas

This course offers a free statement of participation upon completion.

Reviews

This course has a rating of 4.2 stars from 177 reviews. Overall, learners found this free bookkeeping course to be an excellent starting point for grasping core concepts. Many praised its simplicity, ease of understanding, and clear organization of basic principles.

Diploma in Effective Bookkeeping and Payroll — Alison

Effective Bookkeeping and Payroll is a free, CPD-accredited online course from Alison. It covers effective bookkeeping and payroll fundamentals, enabling learners to master payroll administration, taxes, budgeting strategies, subsidiary ledgers, and special journals.

Key features

- Self-paced learning

- About 10 to 15 hours to complete

- Multiple choices of diploma

Course curriculum and skills

This course provides practical skills in core bookkeeping and payroll tasks. You’ll learn how to:

- Process payroll for salaried and hourly employees

- Implement budgeting strategies

- Utilize subsidiary ledgers and special journals

- Understand business partnerships

- Analyze cash flow from operations

- Apply GAAP principles for accounting

- Manage accounts receivable through categorization and organization

Certificates and diplomas

While the course itself is free, Alison offers three types of paid diplomas via the Alison Shop upon achieving 80% or higher in each course assessment:

- A downloadable PDF diploma for $69

- A physical diploma with official branding for $112

- A framed Diploma with official branding for $134

Reviews

Former students are keen to praise the instructor’s clear delivery and use of examples. Overall, the reviews convey a positive experience with the course, noting that it enabled a solid understanding of bookkeeping and payroll concepts.

ACCA: Introduction to Bookkeeping — edX

Introduction to Bookkeeping is a free course from ACCA (the Association of Chartered Certified Accountants), delivered on the edX platform. It provides a strong introduction to bookkeeping for future business leaders, accountants, and entrepreneurs, preparing students for the ACCA Foundation level FA1 exam.

Key features

- Self-paced over 6 weeks

- 5-8 hours per week

- No prior bookkeeping knowledge needed

Course curriculum and skills

Course topics align with ACCA certification. You’ll gain conceptual and practical bookkeeping knowledge and skills and will be ready to pass an exam. Specifically, you’ll learn about:

- Business transactions

- Banking

- Double-entry bookkeeping

- Payroll

- Ledgers

- Reconciliations

- Trial balances

Certificates and diplomas

While the course itself doesn’t come with a certificate, it will help prepare you to pass an ACCA exam and become a certified bookkeeper.

Reviews

There are no course reviews on the edX website, but the certification speaks for itself — it’s a highly valued diploma all over the world.

ACCA: Intermediate Bookkeeping — edX

If you enjoyed ACCA’s Introduction to Bookkeeping course, Intermediate Bookkeeping goes beyond the introductory level to build business-ready bookkeeping skills. It’s ideal for those looking to expand their abilities and prepare for ACCA certification exams.

Key features

- Self-paced

- 5-8 hours per week over 6 weeks

- Free access

Course curriculum and skills

The course will provide you with conceptual and practical knowledge of:

- Preparing financial statements

- Journal entries

- Recording transactions

- Trial balances

- Correcting errors

- Accounting for partnerships

Certificates and diplomas

Again, this course doesn’t offer a certificate, but it will help you pass the ACCA exam and become a certified bookkeeper.

Reviews

The edX website doesn’t provide reviews for this course. However, ACCA’s reputation for excellence indicates the course’s quality for building in-demand bookkeeping skills.

Bookkeeping — Oxford Home Study Centre

Bookkeeping is a free, CPD-approved introduction to bookkeeping fundamentals. It’s available to anyone but is primarily aimed at unemployed learners seeking practical skills.

Key features

- 20 hours of materials

- No entry requirements

- Self-paced learning

Course curriculum and skills

This course covers fundamental bookkeeping concepts and skills. By the end, you’ll know how to:

- Compare cash and accrual methods

- Discuss accounting objectives and limitations

- Explore accounting branches

- Prepare financial statements

- Record transactions in journals

- Manage accounts payable/receivable

- Calculate depreciation, inventory, interest and payroll

- Construct general ledgers and trial balances

- Utilize accounting software

Certificates and diplomas

Upon completing the course, you can purchase one of several paid certificates.

Reviews

This course has a rating of 4.9 stars based on 53,974 reviews. Judging by the reviews, it’s one of the best bookkeeping courses for beginners, with clear study materials and an excellent support team.

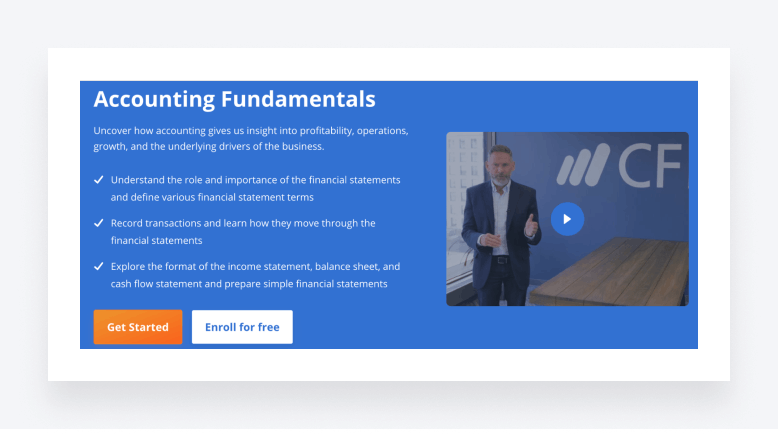

Accounting Fundamentals — Corporate Finance Institute (CFI)

Accounting Fundamentals is an introductory online course by CFI that explains key accounting principles central to finance roles. It’s designed for beginners, with no prior accounting knowledge required.

Key features

- 5 hours of self-paced learning

- Downloadable Excel practice files

- Free certificate upon completing all materials

Course curriculum and skills

Through exploring the interconnections of financial statements, you will learn:

- How to use and format financial statements

- Double-entry bookkeeping

- Key accounting terms

- Recording transactions

- Preparing multi-year financial statements

Certificates and diplomas

A certificate of completion is available to anyone who completes all lessons and passes assessments with an 80% score. In addition, this course is part of the Financial Modeling & Valuation Analyst (FMVA) certification if you want to dig deeper into the topic.

Reviews

The majority of course reviews are rated five stars. Students praise the passionate professor, engaging delivery, variety of Excel practice files, and step-by-step walkthroughs that build confidence in accounting skills.

Free online bookkeeping courses: a comparison table

Here’s a comparison table of all the courses we’ve listed in this article for a more comprehensive view:

| Course/Parameter | Duration | Key skills | Reviews | Certification | Other |

| Bookkeeping and personal accounting — The Open University | 12h |

|

4.5 stars, 143 reviews | Yes | Taught by an Executive Dean at the Open University Business School |

| Bookkeeping Basics — Coursera | 16h |

|

4.6 stars, 4,104 reviews | Yes | Led by the Intuit Academy Team |

| Bookkeeping — Accounting Coach | Varies based on selected materials, 2h+ |

|

2000+ positive testimonials | Yes, paid | Paid subscription unlocks more materials and certificates |

| Introduction to bookkeeping and accounting — OpenLearn | 8h |

|

4.2 stars, 177 reviews | Yes | Review, track learning, assess progress on the platform |

| Diploma in Effective Bookkeeping and Payroll — Alison | 10-15h |

|

Positive | Yes, paid | CPD-approved |

| ACCA: Introduction to Bookkeeping — edX | 40h |

|

– | Yes, paid | Globally-recognized certification |

| ACCA: Intermediate Bookkeeping | 48h |

|

– | Yes, paid | Globally-recognized certification |

| Bookkeeping — Oxford Home Study Centre | 20h |

|

4.9 stars, 53,974 reviews | Yes, paid | CPD-approved |

| Accounting fundamentals — CFI | 5h |

|

Positive | Yes | CFI is a leading global provider of online finance courses |

Tips for making the most of free online courses

Even a great course can be a waste of time if you don’t approach it in the right way. Here are some tips to help you maximize the benefits of free online courses:

- Set specific learning goals. Outline the knowledge and skills you aim to take away before starting a course. Periodically track progress toward these goals.

- Set aside dedicated study time. Treat online bookkeeping courses like real classes and schedule specific days and times each week for watching lectures and doing assignments.

- Join online course communities. Participate in forums and discussions to gain insights from instructors and fellow learners.

- Apply learned skills. Find ways to apply course knowledge through real-life projects or work experience to reinforce retention.

- Supplement with additional resources. Don’t just rely on course materials — use websites, videos, podcasts, blogs, etc. to dive deeper into interesting topics.

- Earn credentials when possible. Completing courses that provide certificates or diplomas can enhance your resume and help demonstrate your skills.

- Keep building knowledge. Use online bookkeeping courses as a gateway to more learning. Take related follow-up courses, read suggested resources, watch videos, etc.

The bottom line

With the demand for qualified bookkeepers continuing to grow, gaining recognized credentials and expert knowledge can set you apart. We hope this list of free online bookkeeping courses with certificates helps you on that journey.

In addition to bookkeeping fundamentals, you need the right tech. Check out the TaxDome Academy to see a broad collection of training courses. You’ll learn how you can use TaxDome to automate your bookkeeping workflows, manage documents, engage your clients, and more.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.