According to a research by Finances Online, 46% of accountants believed that project management is a crucial skill for future accountants. Modern companies that provide accounting, tax preparation and other similar services see that clients’ expectations are shifting and new technologies are disrupting even this conservative industry.

As a result, such companies are trying to meet and exceed rising expectations, in particular by adopting and perfecting their project management processes.

According to PMI research, businesses that have mature project management and delivery processes are more likely to meet their project goals than the ones that don’t enhance their processes — 77% as compared to 56%. The obvious conclusion is that project management does directly affect the bottom line.

This is especially important to consider during the busy season, when many accountants have to work longer days to deliver all their projects. What’s the key to surviving this period? Proper project management.

In this article we’ll dig deeper into the topic of accounting project management and examine:

- What is accounting project management? Its scope and objectives

- Stages of accounting project management

- Top 5 techniques for efficient project delivery

- Commonly used technologies and software

- Future trends for project management in accounting

What is accounting project management?

Accounting project management is a comprehensive approach that involves applying project management principles to accounting engagements. Such an approach enables accounting firms to plan resources effectively and ensure timely delivery of work to clients.

Most of the processes in accounting project management are recurring and require creating templates for better efficiency. Then, these templates can be used for multiple customers with a bit of customization.

According to the description above, most accounting work is qualified as a project, e.g. monthly bookkeeping or client onboarding. Other projects are:

- Implementing new accounting systems

- Automating financial reporting processes

- Rolling out new revenue recognition standards

- Developing auditing protocols

- Ensuring tax compliance

Scope and objectives of accounting project management

The goal of accounting project management is simple: deliver accounting projects on time and within budget, minimizing risks and realizing expected benefits. However, this concise objective can sometimes transform into a lengthy process.

The scope could be summarized as planning, executing, monitoring, and closing of projects related to accounting functions. This may include such initiatives as business process transformations, e.g. automating accounting workflows.

In the fast-paced and dynamic modern business environment, effective project management is crucial for the accounting industry. It involves:

- Ensuring accuracy: guarantee precision in financial data and reports

- Meeting deadlines: complete financial projects and tasks promptly

- Optimizing resources: utilize human and financial resources efficiently

- Mitigating risks: identify and address potential risks in financial projects

How accounting project management is different from regular project management?

Here are some key distinctions between general project management and accounting project management — primarily in applied skills:

- Specialized domain knowledge. Managers require expertise in the company’s specific accounting processes, systems, and compliance needs.

- Strict regulations. Initiatives must conform to financial reporting standards, tax codes, SOX (Sarbanex-Oxley Act), GAAP (generally accepted accounting principles) and numerous other regulations.

- Data sensitivity. Accounting data is highly confidential and often stored under stringent security protocols to prevent breaches.

- Extreme accuracy. In accounting projects, errors can have significant financial implications.

- Risk management. Accounting projects face threats such as cybercrime, non-compliance, and data breaches, requiring constant monitoring.

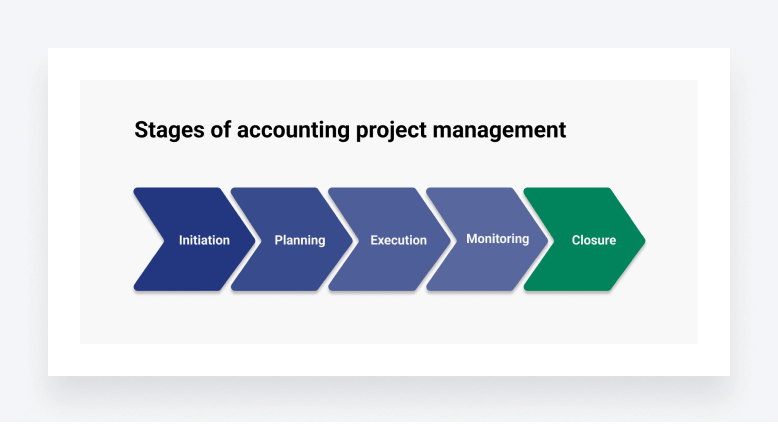

Stages of accounting project management

Usually, accounting project management involves several stages as a process. Let’s break them down.

Project initiation

In this phase, managers define the project’s objectives, scope and feasibility. They also identify key stakeholders and establish a project charter.

Planning

Detailed planning includes creating a roadmap for the project. Here, project managers (PMs) define tasks, allocate resources, set timelines, and establish communication channels.

Execution

With the plan in place, the project moves into the execution phase. PMs ensure tasks are carried out according to the established plan and monitor progress.

Monitoring and controlling

To ensure the project stays on track, managers continuously monitor it. This phase involves tracking performance, managing changes and implementing corrective actions when necessary.

Closure

The final phase involves project completion, client approval, and a comprehensive review.

At this stage, it’s a good idea to document all the wins and losses encountered during the project: obstacles faced, how they were overcome, poor and brilliant decisions, and so on. This documentation will aid in future improvements.

Now, let’s explore how accounting project management is performed and examine the top techniques.

5 effective techniques for successful accounting project management

To guide your accounting project through the listed stages step by step and gradually achieve its goal, you need to be familiar with proven techniques.

Here are five effective strategies that will help you successfully deliver the project.

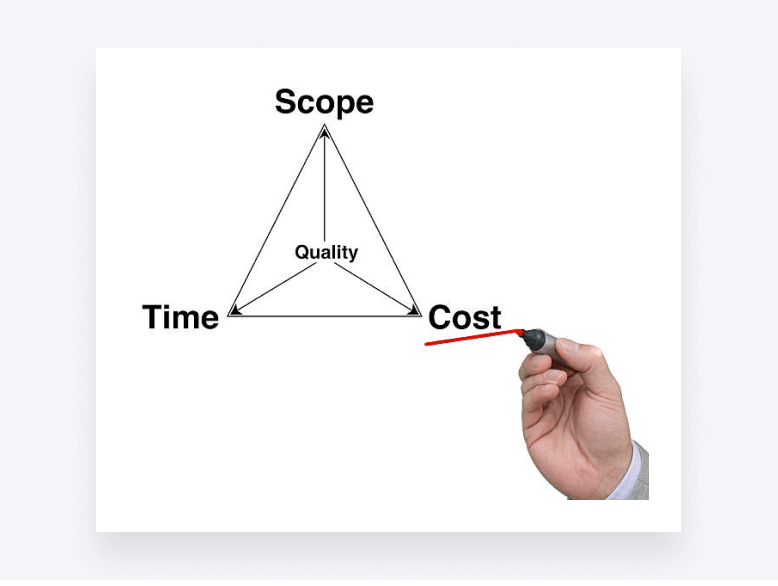

1. Clearly define the scope, time, and cost

This is also known as the triple constraint in project management.

All projects consist of three interrelated variables:

- Project scope: tasks required to achieve the goal

- Time: the schedule of the project and deadlines

- Cost: financial or resource constraints

These three variables visually form a triangle.

If one of these variables undergoes a significant change, the other two must also be adjusted to compensate for the first one, maintaining a balanced figure.

Start every project by collaborating with stakeholders to define key deliverables, milestones and success criteria. Creating a detailed project scope and objective statement ensures alignment and prevents scope creep.

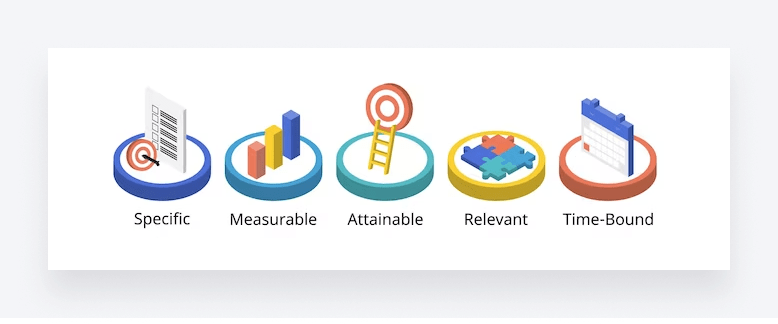

The best way to achieve this is to set SMART (Specific, Measurable, Attainable, Relevant and Time-Bound) goals. For example, a goal for an accounts receivable automation project may sound like this:

Implement a software platform by Q3 to automate invoicing and collections processes, enabling a 2-day faster receivables turnover and $200k in annual cost savings.

2. Break down the project into manageable tasks

When defining the scope, prevent the complexity of accounting projects from becoming overwhelming.

Use work breakdown structures to divide large projects into logical phases and smaller, manageable tasks.

For instance, an automation of billing tasks might be divided into:

- Map and analyze current billing workflows

- Identify automation software options

- Configure rules and templates

- Sync to an accounting system

- Validate billing accuracy

- Go live with new automated billing

Each phase can have granular tasks with assigned owners.

3. Assemble a skilled team

Accounting projects demand the right blend of financial expertise, business acumen and technical skills — a fundamental aspect of the cost variable.

Build a balanced team that includes subject matter experts in accounting, IT, operations and project management. Clearly define roles and responsibilities so that everyone understands their areas of ownership.

4. Monitor performance using key metrics

Tracking key performance indicators (KPIs) is crucial for controlling project scope, cost, time and, ultimately, quality.

According to the Wellington’s report “The State of Project Management 2021”, project managers often lack easy access to KPIs and end up spending one or more days manually creating reports to fetch this crucial data. This is why it’s important to monitor all KPIs for efficient reporting and quick course correction if needed.

Useful metrics for accounting projects may include:

- Milestones met

- Expenses vs. budget

- Resource utilization

- Defect rates

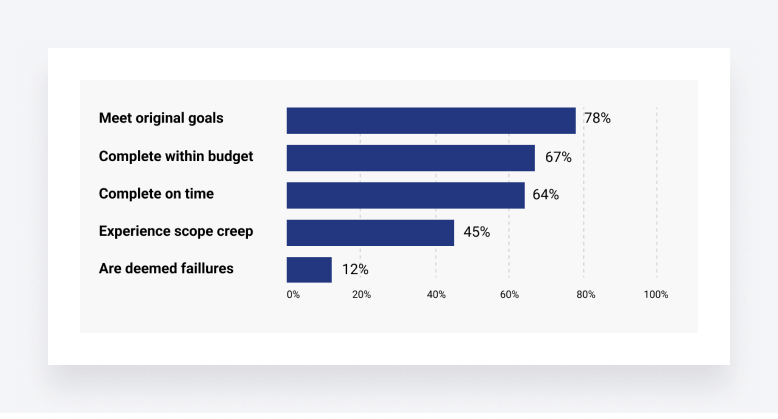

Here are also some statistics on how projects perform with set KPIs in reality:

As you can see, establishing clear KPIs and managing projects properly result in a 78% rate of meeting original goals, which is a significant achievement.

5. Facilitate team collaboration and efficient communication

Consistent communication ensures that accounting projects stay aligned. Here are some tips for building efficient communication processes:

- Schedule regular team meetings to keep a finger on the pulse of the project

- Use centralized, real-time reporting tools to communicate project progress to stakeholders and support decision-making

- For distributed teams, utilize communication apps like Slack

In today’s digital world, applying all these accounting project management techniques without technology is either impossible or simply ineffective.

Let’s explore what tools and technologies aid accounting professionals on this complex journey of project management.

Technologies and software for PMs in accounting

Here are some top solutions worth mentioning.

Project management software

How could we not mention the most obvious and fundamental option here? Though there are tons of options available, selecting the right tool can be a challenge. Check out our comprehensive guide to choosing the right project management software for accountants.

Robust project management software such as Asana or Trello provides centralized platforms to plan projects, assign tasks, and track progress.

Such accounting-specific project management software as AccountingSuite Workflow or Scoro enable easy creation of project plans with status dashboards, budgeting, status tracking and more to manage accounting initiatives.

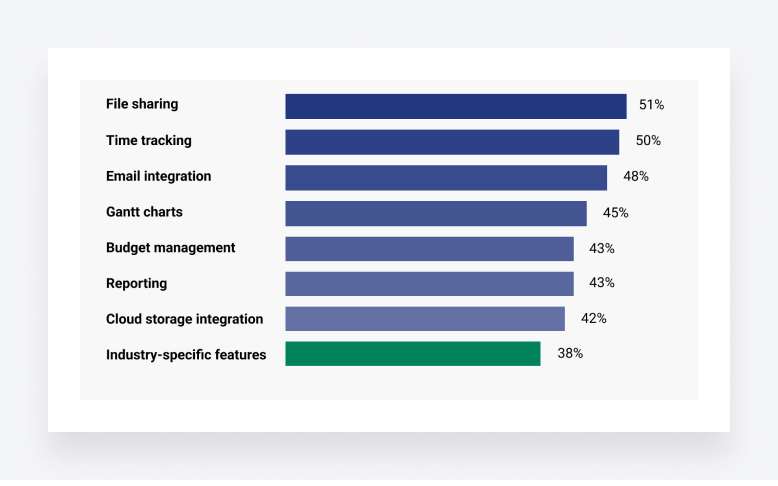

Features like Gantt charts, time tracking, calendars, file sharing and reporting help streamline project execution.

Practice management software

Solutions like TaxDome enable accounting teams to efficiently manage their practice with features such as document management, workflow automation and client portals.

Modern practice management tools can even replace software for project management and offer multiple integrations. These tools usually come pre-packed with a comprehensive set of features that facilitate seamless project execution.

Additionally, practice management software boasts industry-specific features, crucial for running an accounting project specifically. Here’s a diagram that illustrates the features managers want to see in a robust project management tool — try comparing this with the practice management tool you’re using right now:

Accounting software

Cloud accounting systems such as NetSuite and Microsoft Dynamics integrate accounting with key business processes.

Built-in automation and workflows enhance efficiency on accounting projects, particularly those involving core processes like billing and financial reporting.

Analytics and reporting tools

As discussed, you’ll undoubtedly set KPIs for your project.

Business Intelligence tools like Tableau provide real-time visibility into KPIs across accounting initiatives. Dynamic dashboards allow tracking project status, identifying issues, and drilling into details.

Collaboration platforms

Email, instant messaging, video conferencing and such team chat apps as Slack help distributed project teams collaborate effectively.

Even such a simple and habitual tool as a shared drive is, in fact, a great collaboration solution that enables centralized access to project files.

Document management tools also offer collaboration features, such as shared workspaces and commenting.

Resource management tools

Resource management tools assist in balancing the “cost” side of the project management triangle.

Tools like Float and Teamdeck.io facilitate optimal allocation of people and skills across finance department projects, aiding in budget control.

Given that technology is continually evolving and changing, let’s see how it shapes the future trends in project management.

Future trends in accounting project management

The much-anticipated trends in accounting project management include:

- AI and automation

- Rise of data analytics

- Flexible resourcing models

- Shift to value-based services

- Enhanced cybersecurity

Let’s take a look at some key trends shaping the future of accounting project management — in no time, every manager will have to keep abreast of these trends.

AI and automation

Artificial Intelligence has multiple use cases in accounting already and could be a vital addition to project management.

Here’s what AI can do to make project management easier:

- Automate repetitive tasks and low-value processes

- Improve data accuracy

- Provide predictive insights

- Enhance the client experience

And this list can go on and on since new AI tools are being developed continuously.

Accounting firms are already leveraging AI for document review, fraud detection, forecasting, and more.

For instance, KPMG uses AI for predictive project budgeting. By analyzing data from past projects, their tool forecasts budgets more accurately than traditional methods.

Rise of data analytics

Data analytics will become invaluable for accounting project planning and control.

By utilizing data analytics, PMs can identify early warning signs of budget, expense or timeframe overruns and take corrective action.

Analytics dashboards with real-time KPIs will offer enhanced visibility into project performance, which unfortunately is not always available for project managers right now.

Flexible resourcing models

As we’re living in the era of remote work, talent management will evolve just as our working patterns do. Now, accountants work from home frequently and firms often make it into lists of top companies offering remote positions.

As we’ve already discussed, efficient communication is one of the key steps to delivering accounting projects effectively, project managers will need strong virtual collaboration abilities to coordinate distributed resources.

Enhanced cybersecurity

With growing digitalization and the widespread use of software, cyber risks are multiplying.

Accounting projects involving cloud platforms, large data sets and remote access will require stringent cybersecurity protocols. It will be one of the new tasks for future PMs to implement secure system access, data encryption, vulnerability testing and other measures to ensure client information stays safe.

By staying ahead of these accounting project management trends, finance teams can deliver maximum value to the business while future-proofing their capabilities.

To sum up

For accounting teams, project management excellence is now non-negotiable. With emerging technologies and rising expectations, sound execution is imperative.

But there is good news: by focusing on fundamentals such as clear scoping, assembling a balanced team and using modern project management tools, accounting project professionals can turn any challenge into a success story.

The key to running a solid practice is keeping a finger on the pulse of modern tech trends that greatly impact how most industries operate today. For example, using modern practice management tools that streamline project delivery and cutting-edge technologies like AI for advanced automation and analytics.

By investing in technology for practice management, accounting professionals can finally shift their focus from the now and to future planning.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.