When your workload increases, it pays to be organized. Of course, organization looks different for many people and businesses based on their goals and needs. For accountants, staying organized is essential if you want to successfully balance communication, marketing, growth, and focused accounting work. That’s where having an effective accounting workflow comes in.

What is an accounting workflow?

An accounting workflow lays out the steps involved in completing a process. Think of it as an organizational tool. Your workflow takes you from the first step of completing a particular job to the end.

For bookkeepers, workflows standardize monthly processes. From making journal entries throughout the month to closing and reconciling these entries, a bookkeeping workflow creates an organized process to follow.

For tax professionals, a workflow might include collecting documents on income and expenses, preparing and reviewing tax returns, client reviews and signatures, filing taxes, and collecting payment for services.

Why it’s essential to manage workflows in an accounting firm

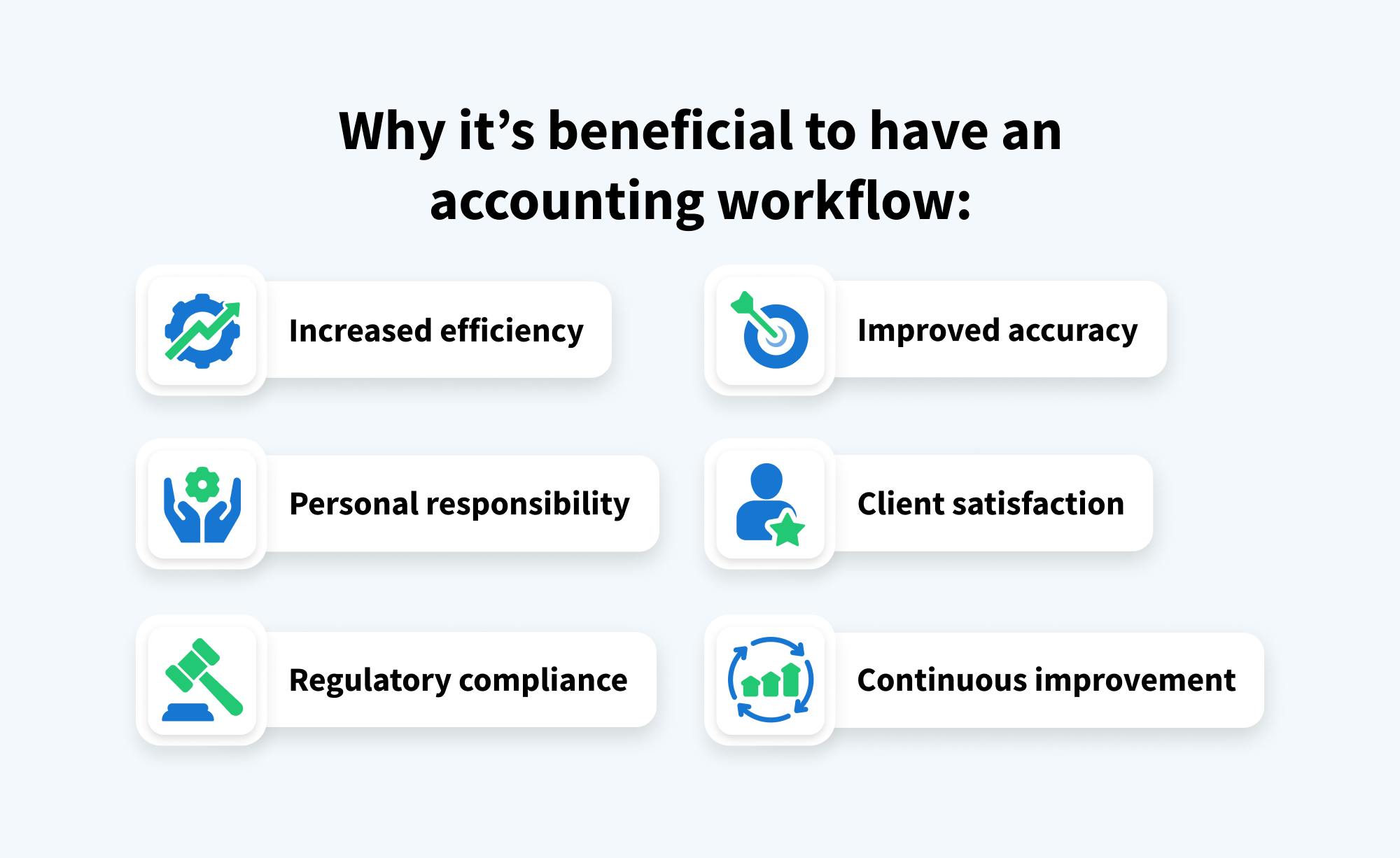

While the particulars of each firm’s workflow vary based on the specific services offered, the importance of an organized workflow is universal. Implementing an effective workflow offers the following benefits to accounting firms of all sizes.

Let’s take a closer look at these benefits.

- Increased efficiency: a well-defined workflow reduces the time and effort required to complete tasks. By clarifying who does what and when you can eliminate redundancies and accelerate task completion.

- Improved accuracy: with each step designed to catch and correct mistakes, structured workflows reduce the likelihood of errors. This accuracy is not only vital for compliance but also for building trust with your clients.

- Personal responsibility: clearly defined workflows mean specific tasks are assigned to individual team members. This promotes accountability within the team, as each member knows what they are responsible for and understands how their work impacts the overall outcome.

- Client satisfaction: efficient and accurate workflows lead to faster turnaround times, which result in higher client satisfaction.

- Regulatory compliance: an effective workflow incorporates compliance checks at critical points to ensure that all financial reporting and tax filings meet regulatory standards. This helps prevent violations and solidifies your firm’s reputation as trustworthy and compliant.

- Continuous improvement: as your firm changes, so will your workflows. This adaptation is essential for evaluating the effectiveness of your workflows and discovering improvements in efficiency.

Key elements of an effective accounting workflow

An effective accounting workflow involves several essential components. Here’s what you need to make your workflow functional, strategic, and adaptable.

Automation tools and software

Finding the right tool to help you do the job is the first step in creating a better workflow. Fortunately, technology provides accountants with amazing tools, such as workflow management software.

Workflow management software significantly enhances the efficiency of accounting firms by automating a variety of administrative tasks, such as:

- Sending engagement letters

- Document requests

- E-signature requests

- Invoices

- Reminders

This saves your firm time by reducing manual effort, which allows staff to focus more on higher-level tasks.

Some software even offers insights into your team’s efficiency and productivity, helping you to refine your workflows to maximize these key benefits.

Using templates

Not only do accounting templates save you the time and effort it takes to do everything from scratch each time, but they also provide consistency and standardization across all documents or reports. This facilitates efficiency by allowing staff to populate documents quickly without focusing on layout or design. It also reduces the likelihood of errors.

Templates also serve as valuable training tools for new team members. They illustrate the standard procedures for document creation and handling within your firm. This aids in training and ensures that less experienced team members can still produce work that meets your firm’s standards. Templates also make it easier to delegate tasks confidently, knowing the output will consistently meet requirements.

Standardized processes

Standardizing processes in an accounting workflow is about creating a consistent approach to handling tasks. Think of it as having a template for how team members execute tasks. In fact, standardized processes offer the same benefits as templates. They help improve efficiency and accuracy, and make it easier to train new staff in executing their duties.

Firms with standardized processes can also feel more confident that they’re adhering to compliance standards along the way.

All this leads to better consistency when it comes to delivering a quality, compliant experience to your clients.

Integration

When working with multiple platforms to complete accounting tasks, integration can help make everything much easier.

Take QuickBooks Online, for example. This is a must-have for many accounting firms, but it may not offer all of the workflow features you need to maximize efficiency.

Hopping between multiple programs costs time and can make you and your team feel scattered as you work. So, having workflow management software that integrates seamlessly with QuickBooks and other essential software is a key element in improving your accounting workflow.

Scalability

With improved efficiency comes the ability to take on more clients and grow your business. However, adjusting your workflow to accommodate a significant number of new clients does have its challenges. To effectively scale your workflow, consider the following:

- Implement comprehensive technology solutions: workflow management software is built to scale as firms grow, so using it to reimagine your accounting workflow is a must

- Offer thorough training and development: the more your team knows about the software you use the better equipped they are to get the most out of its solutions

- Optimize your resource allocation: utilize time-tracking tools to gain insights into your team’s efficiency and eliminate bottlenecks and other inefficiencies

- Review and refine your workflow: identify areas for improvement by regularly reviewing your processes and making necessary changes

Feedback mechanisms

Reviewing and refining your workflows isn’t only about looking at numbers, however. There are several resources for firms to gain feedback about the effectiveness of their workflows.

Staff feedback is invaluable because employees interact with workflow processes daily. Encouraging staff to share their observations and suggestions can uncover inefficiencies, redundancies, or issues that need clarification.

Client feedback is another essential source of information. Regularly asking clients about their experience with the firm’s services helps ensure the workflow is client-centric and meets their needs. This feedback can highlight aspects of the service delivery that are working well or reveal areas where clients face difficulties.

Additionally, management reviews contribute a strategic layer of feedback, focusing on how well the workflow aligns with the firm’s overall objectives. This helps create an accounting workflow that operates smoothly on a day-to-day basis and supports broader business goals and strategies.

5 Examples of Accounting Workflows

Of course, there are different workflows within an accounting firm that seek to achieve different goals. Here’s a look at a few workflows you may want to improve within your firm.

1. Client onboarding

Effective client onboarding helps streamline communication, sets clear expectations, and gets you the necessary information to serve your clients. You’ll begin with an initial engagement letter that clearly outlines your terms and conditions, services, prices, and other vital information your clients need.

Once everything is agreed upon and your client has signed the engagement letter, you’ll need to gather all essential information and documentation. This is where CRM (customer relationship management) and practice management tools come in handy. They can:

- Automatically send the initial communication

- Collect and store the signed document

- Provide any welcome materials

- Send a list of necessary information and documents the client needs to provide

- Automatically import this information into your CRM

You can save a lot of time in this process if your workflow is standardized and automated — especially when you’re onboarding a lot of new clients all at the same time.

2. Client communication

Communication is a key aspect of running an accounting firm, whether you’re updating clients on the status of their jobs or requesting additional information. To keep this communication as organized and efficient as possible, it’s best to have clear communication channels through a single source so you’re not wasting time jumping between your email inbox or any other chats you may utilize.

This single source can help you communicate with clients in a variety of ways. For example, TaxDome allows clients to securely communicate with accounting professionals through synced email, in-portal chats, the client mobile app, and even SMS text messaging. All this communication is then delivered to accountants and bookkeepers within the TaxDome platform, making it easier to keep track of everything and save time.

3. Accounting true-up

True-up is essential for ensuring that your financial records accurately reflect your firm’s real financial status. It adjusts preliminary estimates, accruals, and provisions to match actual amounts and corrects any mismatches between estimated figures and real outcomes.

Key parts of this workflow include:

- Adjusting tax provisions after tax returns are filed

- Updating accruals for expenses like utilities and rent based on actual invoices

- Reconciling inventory costs

- Adjusting asset depreciation according to usage

Read more in our blog about true-up best practices to help you create an effective workflow.

4. Monthly financial closing

Speaking of workflows for keeping your firm’s financial records in order, you’ll save your team time and energy if you have a consistent workflow for your monthly financial closing. To do this, you’ll need to establish clear processes for each step, identify who is responsible for each, and set timelines for completing these tasks.

- Reconcile all accounts

- Review accounts receivable

- Review accounts payable

- Adjust journal entries

- Prepare financial statements

- Review and approve

After everything is completed and approved, share the final reports with everyone involved. This keeps everyone informed about the firm’s financial performance and aware of the entire workflow, so they can offer feedback for improvement.

5. Accounts receivable

Keeping track of the money clients owe you is vital for understanding your business’s financial health. Templates help you organize and clear everything while having a streamlined process.

Using a template for accounts receivable provides a multitude of values and benefits, such as:

- A consistent and standardized process that reduces the likelihood of errors

- Time savings due to not having to spend time formatting

- Increased ability to track and manage financial data

- Saving time when preparing for audits

- Reduces the effort it takes to train new team members while maintaining standards

How to implement and maintain an accounting workflow

Creating an effective accounting workflow is not always a straightforward process — there’s some trial and error involved. But these adjustments are part of developing a system that truly fits your firm’s unique needs. By following a structured approach, you can establish a strong foundation to work from. Start with these steps:

- Assessment of current practices

Conduct a thorough review of the existing accounting processes and workflows within your firm. Evaluate how transactions are recorded, how data flows through the system, and how tasks such as invoicing, payments, and reporting are managed. This will identify inefficiencies, redundancies, and areas where your current workflow is lacking. - Research accounting workflow tools

Look for accounting workflow software that fits your needs. Consider features, costs, integration, and scalability. You want something that’s easy to use, saves you time with automation, helps improve accuracy through organization, and provides other useful features to your workflows. - Train your staff

Organize comprehensive training sessions that cover how to use the new tools effectively, any changes in workflow processes, and how to handle any issues that arise. Make sure you provide adequate time for this training so that your staff are well prepared for when the new workflows go into effect. - Monitor for optimization

Continuously monitor your new workflows to discover anything that was missed or where there are opportunities for improvement. This will not only increase efficiency over time but will also train your firm to adapt to changes.

Once you have your workflow in place, develop key performance indicators (KPIs) to help you monitor and optimize your workflow automations. Gathering feedback from team members at all levels will also help you make adjustments that improve everyone’s efficiency.

Key takeaways

Creating streamlined accounting workflows that utilize automation saves your firm time and money by allowing team members to focus on higher-level tasks and serve more clients.

If you’re looking for a practice management solution that not only streamlines your workflows but also offers powerful AI-powered reporting features, a top-rated client mobile app, and secure communication and document management, then request a demo to discover how TaxDome is taking accounting firms of all sizes to the next level.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.