Successful firms use great technology — it’s that simple. Choosing the right software is the key to unlocking efficiency, productivity, and a superior client experience. But with so many options to choose from, where do you start?

In this article, we’ll look at 10 of the best accounting practice management platforms for UK-based accounting firms. Read on to discover what they offer, how they compare, and which is the right choice for your business.

What is accounting practice management software?

As the name suggests, practice management software provides the tools you need to manage all aspects of your firm. Think of it like the software version of a Swiss army knife, combining multiple different tools in one centralised platform.

Most practice management platforms offer tools for client communication, document management, internal collaboration, time and billing, automation, and more. This allows you to simplify your accounting tech stack significantly and save time and money. If you choose the right software, you can run your firm using just your practice management platform and your accounting or tax software.

What are the advantages of using practice management software?

Practice management software brings a whole host of benefits to accounting firms, making it one of the most essential components of an accounting tech stack. Here are some key examples.

Improved efficiency and productivity

While most practice management platforms offer task automation, the best ones automate entire workflows, including all client communication, document gathering, task management, billing, and more.

This means you can set many of your accounting processes to autopilot, allowing your practice management software to handle all those repetitive tasks that typically take so much of an accountant’s time. In other words, you can get more done faster, with fewer resources.

Enhanced organisation and transparency

By centralising all your client information, documents, and communications in one place, practice management software makes it easier to manage client relationships. At the same time, you get complete visibility into tasks, responsibilities, deadlines, and workloads, providing greater transparency and accountability across your organisation.

An incredible client experience

By automating client communications, practice management software ensures that your clients are always kept in the loop. At the same time, features such as client portals and mobile apps provide a seamless digital space where your clients can interact with your firm. Gone are the days of paper forms, phone calls, and unsatisfied clients!

A consolidated tech stack

Practice management software combines multiple tools and capabilities in one platform. So instead of jumping between various apps to get a job done, you can manage everything in one centralised place. Not only does this simplify your accounting tech stack, but it also makes it much more cost-effective, replacing multiple software licences with just one.

What are the most important features of practice management software for accounting firms?

No two practice management platforms are the same. Some excel in certain areas, while others are great all-rounders. To help you understand what to look for, here are some key features to expect from a comprehensive practice management platform.

Workflow automation

As we mentioned already, workflow automation is an incredibly powerful tool that enables you to automate entire accounting processes, such as client onboarding or tax preparation. Note: this isn’t the same as task automation, which automates individual tasks.

The best platforms offer highly customisable workflow automation, with templates that enable you to get set up and implement best practices as quickly as possible.

Customer relationship management (CRM)

A CRM provides a centralised place to manage all your client data, documents, and communications. It also provides a complete historical record of all your interactions with accountants, providing your team with all the information they need in one place.

A CRM is an essential tool for any modern accounting practice, but not all practice management systems come with one. For those that don’t, users have to integrate with an external CRM, which often isn’t designed with accountants in mind.

Document management

Document management is an essential part of any decent practice management system, enabling you to store, organise, and exchange documents securely. Not all platforms offer the same document management features, however. While some offer unlimited file storage and e-signatures, others include strict limits that can hamper growth.

Team, task, and project management

Your practice management platform should replace the need for third-party project management apps, providing a powerful way to manage your team’s workload, increase visibility into progress and deadlines, and boost internal collaboration.

Time, billing, and payments

You want your practice management platform to completely replace any third-party apps you use for time-tracking, invoicing, and payments. This way, you can centralise all your data relating to the hours your team works, how much you’ve billed your clients, and whether they’ve paid or not.

Sure client portal

A client portal is a must-have feature for accounting firms looking to provide an outstanding client experience. Client portals provide a secure place where clients can view, upload, and e-sign documents, communicate with accountants via chats, receive invoices, and pay bills.

The best client portals are customisable, allowing you to add your firm’s name, logo, and other important branding elements. Bonus points go to practice management platforms that offer client mobile apps, enabling clients to interact with your firm on the go.

Reporting and analytics

Practice management platforms house a lot of data. The best ones enable you to turn that data into actionable insights that can power smarter decision-making across your firm, helping you to understand how your team is performing, which clients are the most lucrative, and more.

Integration options

Although comprehensive practice management platforms enable you to wave goodbye to a lot of your software licences, there are times when you’ll need to integrate with third-party tools, such as your accounting or tax software. Look for platforms that offer native integrations with your existing tools, so you can connect and share data seamlessly.

Pricing

When looking for a practice management solution, pay close attention to pricing. Some offer simple, transparent pricing plans with no limits on usage, while others bamboozle you with overly complex pricing plans and strict usage limits that make it difficult to understand what you need, what you’ll pay, and how it will scale.

We’ve just scratched the surface of what practice management software can do in this section. To explore essential features in more detail, check out this guide: Key features of practice management software for accountants.

The 10 best accounting practice management software platforms for UK firms

So which is the best accounting practice management software for you? In this section, we’ll guide you through some of the best options on the UK market — and what makes them stand out from the crowd.

- TaxDome

- BrightManager

- Karbon

- Pixie

- Capium

- Client Engager

- Senta

- Practice Ignition

- Xero Practice Manager

- Glide

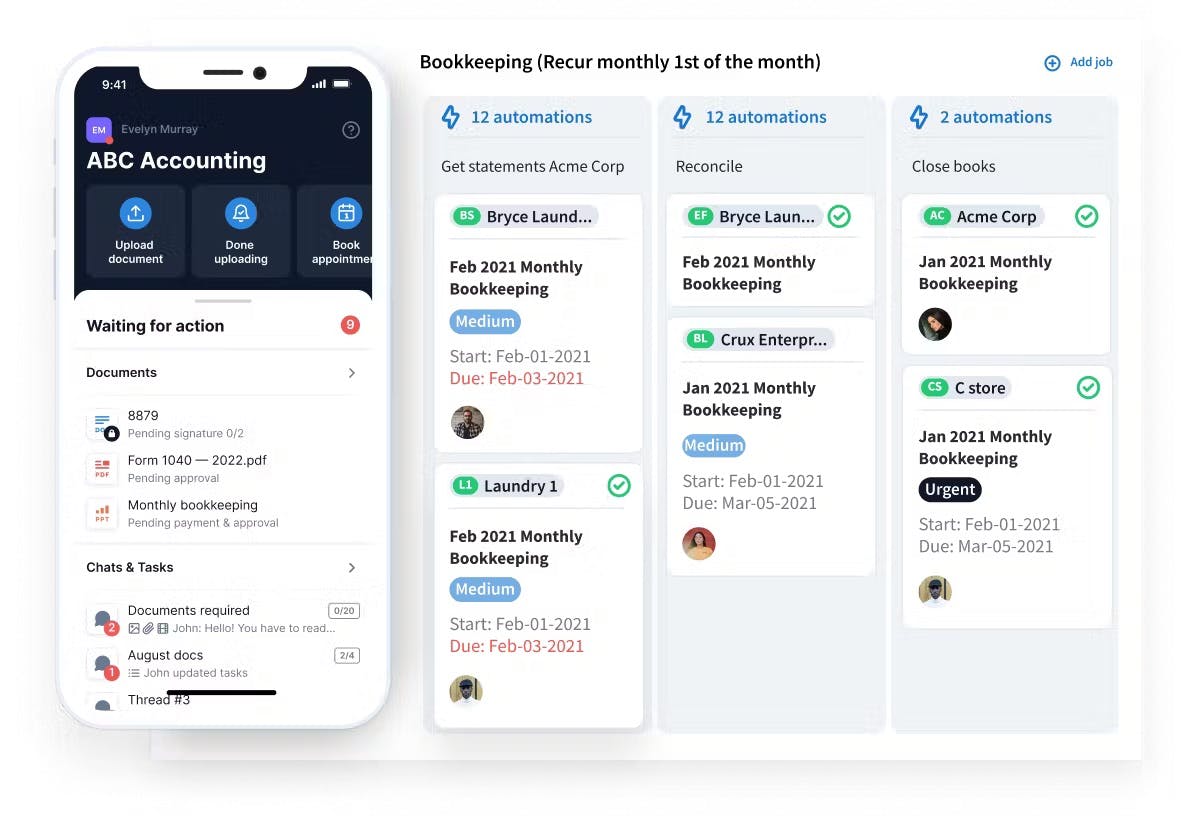

1. TaxDome

TaxDome is an award-winning practice management platform that boasts a comprehensive suite of tools designed to streamline and automate accounting workflows. With an average rating of 4.7/5 on popular software review sites G2 and Capterra, TaxDome is a market leader that serves accounting firms of all sizes.

Key features

TaxDome’s extensive feature set covers everything you need to manage clients, teams, projects, documents, and workflows. You get everything you’d expect from practice management software, but with several key features that differentiate it from the competition, including:

- Customisable workflow automation and templates

- A built-in CRM designed with accountants in mind

- Firm mobile app for running your practice on the go

- Custom-branded client portal and client mobile app

- Synced email, secure chats, and two-way SMS

- Proposals and engagement letters

- AI-powered reporting

For UK clients, TaxDome also offers a native integration with Companies House. With a few clicks, you can connect your TaxDome portal to Companies House and download client information and key reporting dates automatically.

For a deeper dive, here’s an overview of TaxDome’s features.

Unique selling points

TaxDome’s workflow automation is a true game-changer, allowing you to not only automate individual tasks but entire processes from start to finish. Once your pipelines are set up, simply add a job and watch TaxDome do the work for you.

Another unique selling point is TaxDome’s mobile apps, including the top-rated client mobile app, which allows clients to manage all their interactions with your firm from the palm of their hand. Most competitors still don’t offer this.

In addition to the standout features we’ve listed above, TaxDome differentiates itself with clear and transparent pricing, as well as unlimited e-signatures, clients, storage space, and support for all customers.

Potential limitations

From a feature perspective, TaxDome is the most comprehensive software on this list, so there are no limitations to speak of. That said, because TaxDome is designed for a global audience, there are some features — such as the IRS integration and KBA signatures — that you won’t need to use as a UK-based accounting firm.

Pricing

TaxDome offers one pricing plan — TaxDome Pro — for all clients. This plan is priced at £40 per user per month. You get access to all TaxDome features, and there are zero limits on usage, nor any hidden costs.

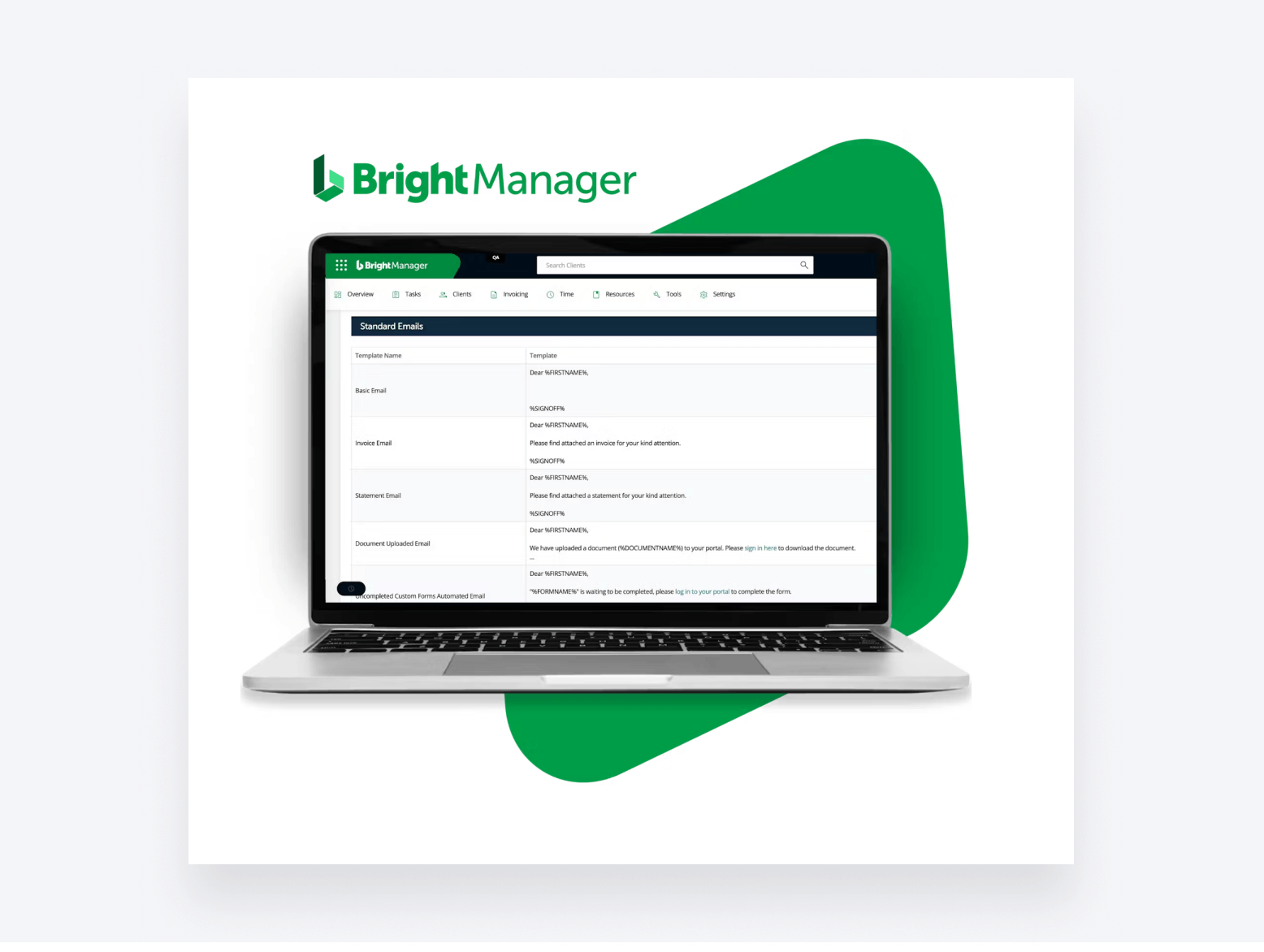

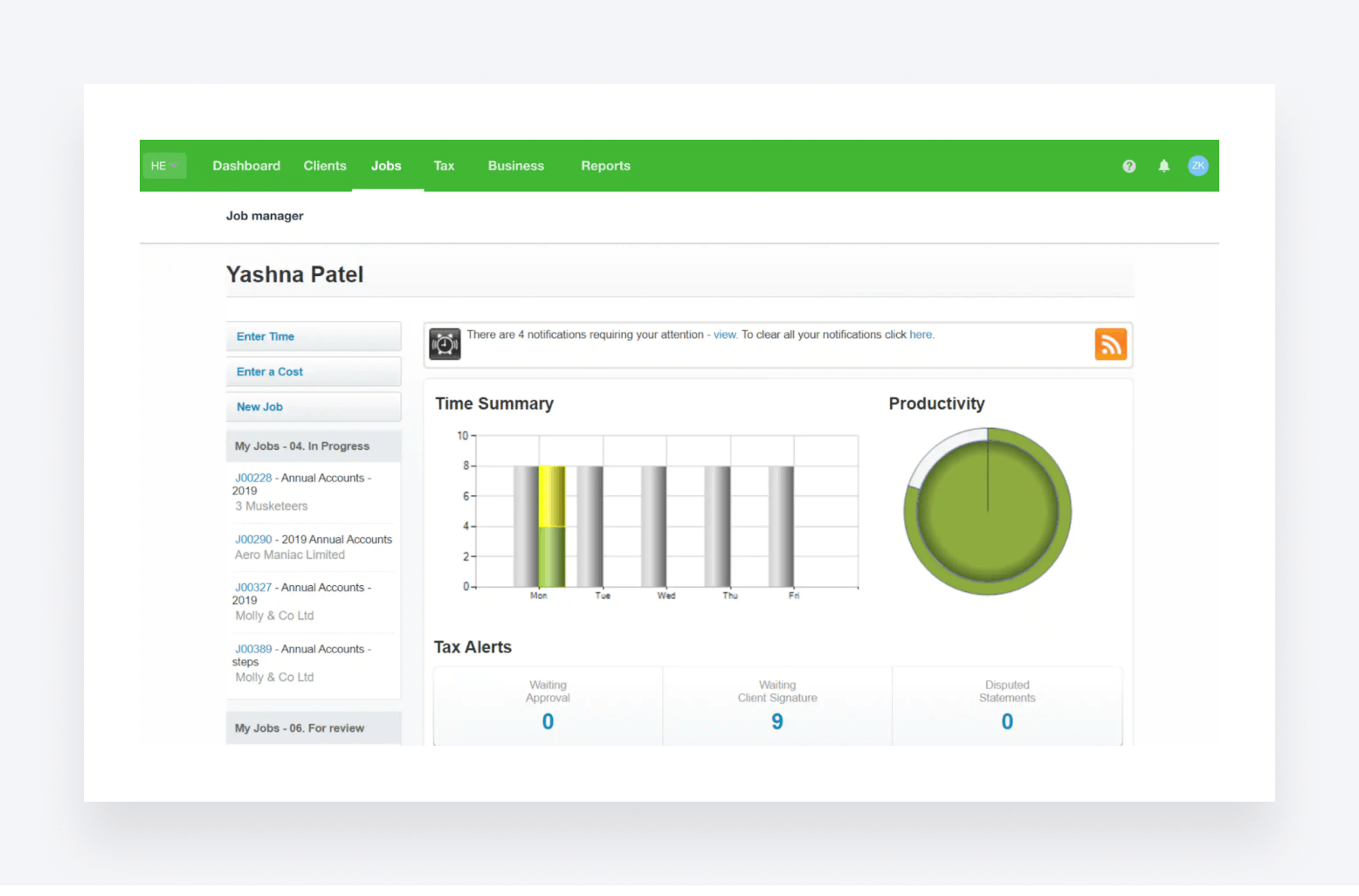

2. BrightManager

BrightManager is practice management software designed for accountants and bookkeepers in the UK and Ireland. It’s part of the wider Bright software suite, which includes solutions for payroll, proposals, accounting, and tax.

Key features

BrightManager offers a range of automation features designed to speed up key accounting processes, including:

- Automated client communication (email and SMS)

- Automated task management

- Automated client onboarding, including proposals, engagement letters, and e-signatures

BrightManager also offers a client portal, custom forms, and a time-tracking feature that shows you which tasks team members are working on in real time.

Unique selling points

BrightManager offers several handy features designed with UK accounting firms in mind, such as integrations with Companies House and HMRC. It also works seamlessly with other Bright software, such as BrightPay or BrightAccountsProduction.

Potential limitations

While BrightManager allows you to automate some tasks, it doesn’t offer advanced, customisable workflow automation. Likewise, there are some features for tracking client interactions, but the lack of firm and client mobile apps also limits accessibility for clients.

Pricing

BrightManager costs £42 when billed monthly, or £33.60 when billed annually. Enterprise pricing is also available, but you’ll need to contact Bright for a quote.

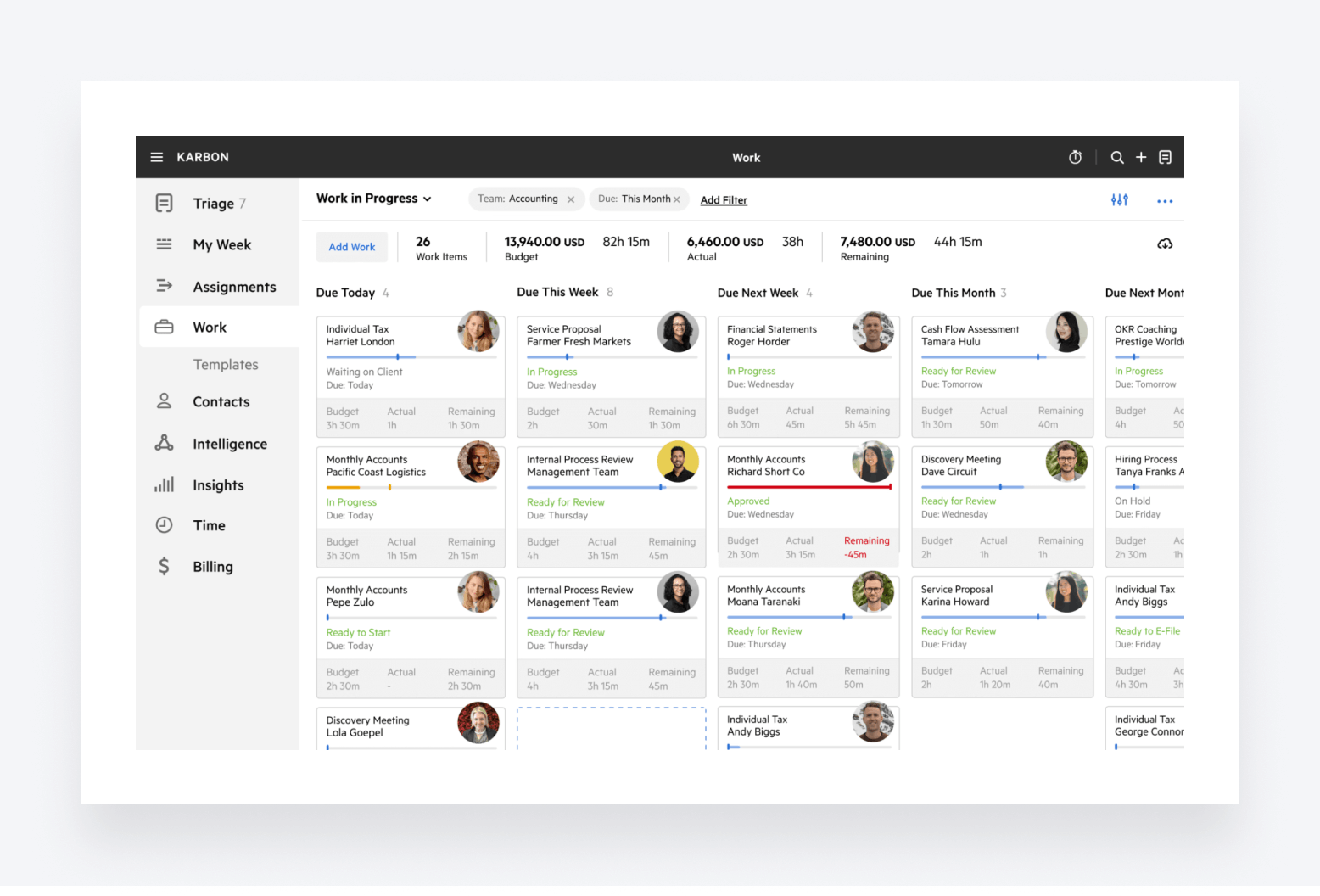

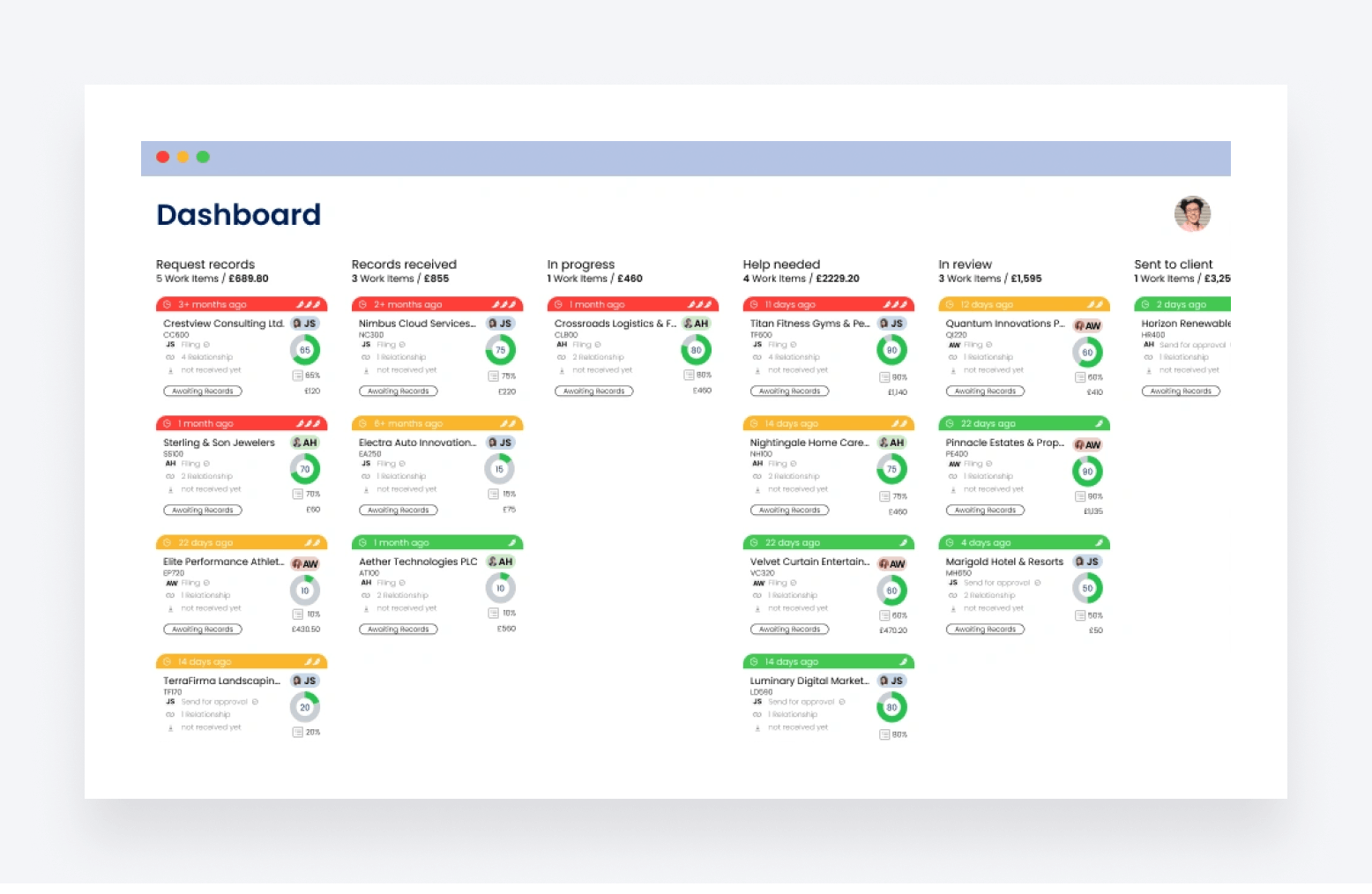

3. Karbon

Karbon is a popular practice management software for accounting firms worldwide. While it has a fairly extensive list of features, it requires integration with other platforms to provide a complete practice management experience.

Key features

Karbon offers most of the features you’d expect from a practice management platform, including:

- Team collaboration

- Workflow automation

- Project management

- Client management

- Document management

- Billing and payments

- Business analytics

Unique selling points

Karbon’s AI feature integrates ChatGPT directly into the platform, allowing users to automate tasks such as email writing and conversation summarising. There’s also Karbon’s Practice Intelligence feature, which allows you to track business performance and gain important insights. You also get a shared inbox for improved team collaboration.

Potential limitations

Several important features are missing altogether in Karbon, including customisable organisers (forms), secure messages, a virtual drive, and e-signature capabilities. To gain this functionality, you’ll need to integrate with third-party applications. There’s also no client mobile app, which may be a deal breaker for some firms.

What’s more, Karbon limits certain features based on the pricing tier you choose. Some features, such as storage, are limited even on the most expensive pricing plan, which could be a barrier to growth.

Pricing

Karbon offers three pricing tiers: Team at £34 per user per month, Business at £49 per user per month, and Enterprise, which comes with custom pricing. You pay less when billing yearly.

Team and Business both have limited functionality, as well as limits on feature usage, clients, teams, storage, and service levels.

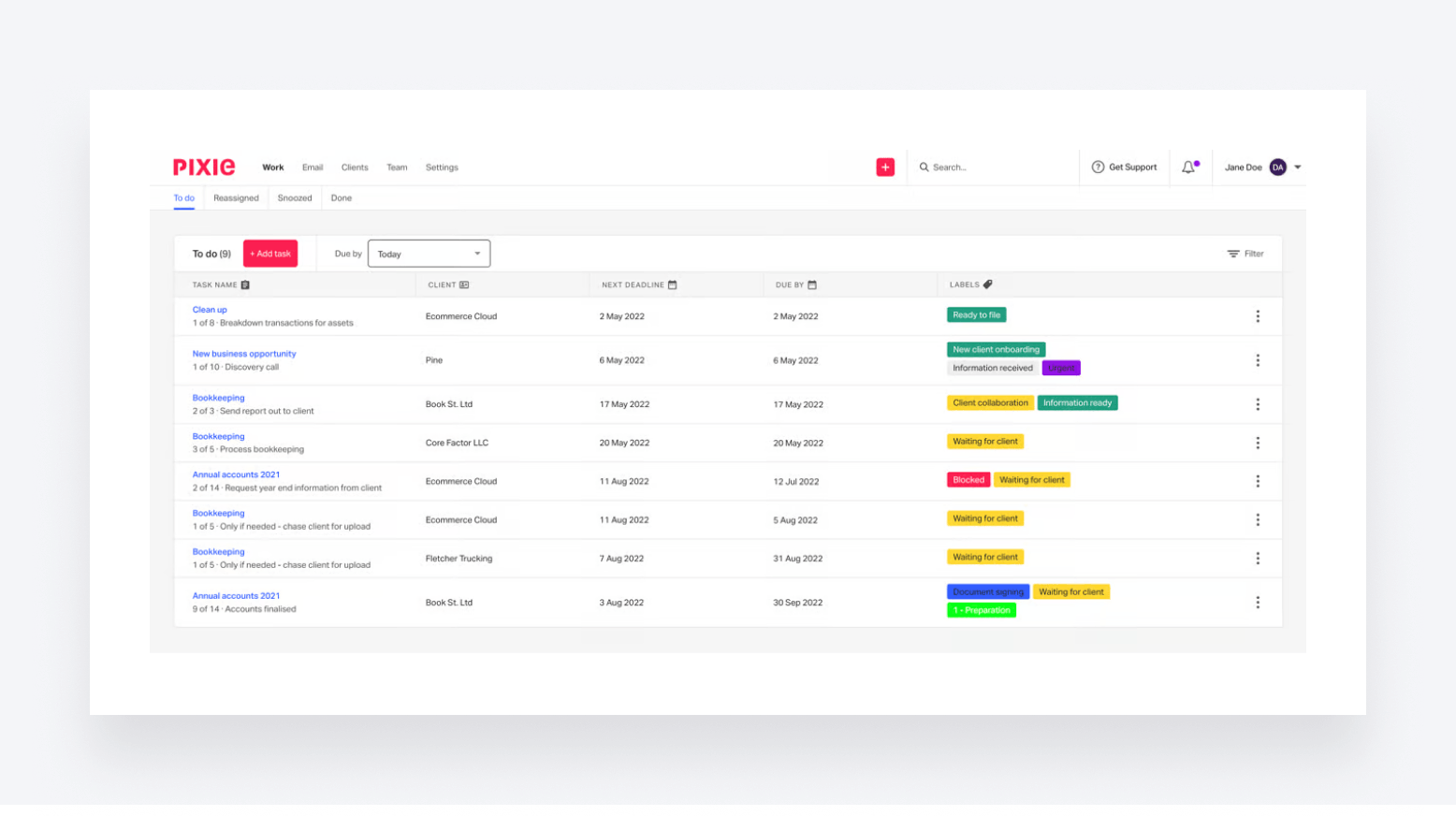

4. Pixie

Pixie is another cloud-based practice management solution for accountants and bookkeepers. It’s known for its ease of use and a range of task-management features designed to save you time and improve organisation.

Key features

So what does Pixie offer? Here are some of its core features:

- Team management and reporting

- Workflow management

- Recurring tasks and task automation

- Streamlined client onboarding

- Document management and e-signatures

Unique selling points

Pixie offers some handy features, such as automated recordkeeping, where emails and files are automatically added to client records. You also get a built-in CRM, which isn’t always a given for practice management software. Finally, Pixie scores very highly on review sites for its simplicity and ease of use.

Potential limitations

By its own admission, Pixie’s automation capabilities are “simple”. You can automate individual tasks and send automated client reminders, but if you’re after advanced workflow automation that’s highly customisable, you’ll need to look elsewhere. Another major issue is the lack of mobile apps.

Pricing

Pixie’s pricing is based on your number of clients, with the following four tiers, all of which allow for unlimited users:

- Less than 250 clients: £99 per month

- 251-500 clients: £149 per month

- 501-1000 clients: £249 per month

- For more than 1000 clients, you need to contact Pixie for a quote

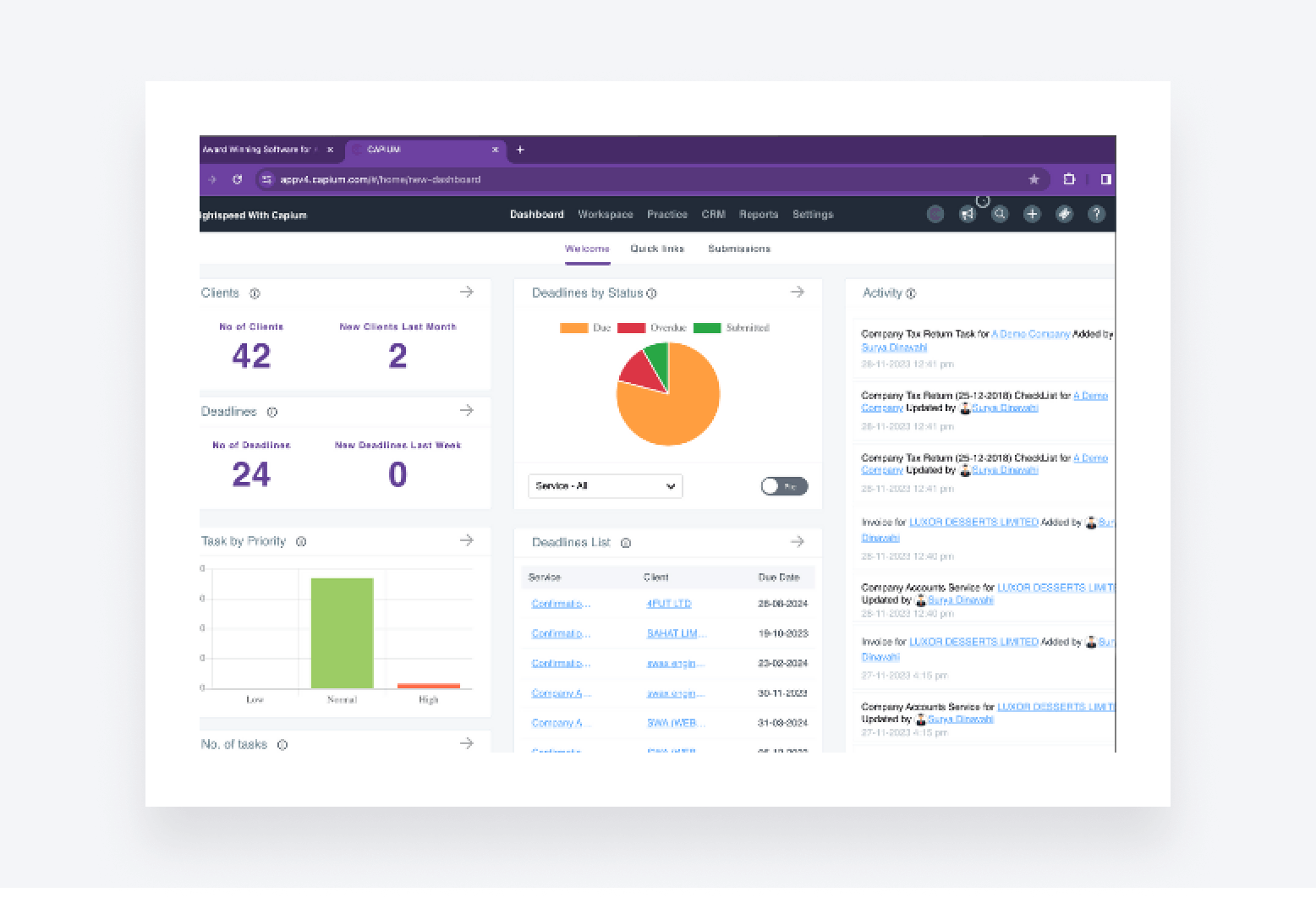

5. Capium

Capium is a suite of cloud-based software for accountants and SMEs, which includes solutions for practice management, tax, accounting, bookkeeping, payroll, and more.

Key features

Here’s what Capium’s practice management software offers:

- Task management, including task automation

- Intuitive CRM

- Billing, reporting, and automatic reminders

- Document management and e-signatures

Unique selling points

For UK-based accountants, Capium connects to HMRC for 64-8 client authorisation as well as giving the option to file company accounts through the platform. You can submit requests to become a client’s agent directly on the platform. You also get seamless integration with other Capium modules, providing a complete tax software ecosystem.

Potential limitations

Capium offers some basic automation features, such as auto-reminders, but it’s not an ideal solution for automating complex workflows. Capium does offer an app, but it’s poorly rated and seems to cover the accounting and bookkeeping aspects of their software suite, not practice management.

Pricing

Because Capium offers multiple software modules as well as pricing plans based on your number of clients, it can be tricky to understand exactly what you’ll pay. We recommend taking a look at their pricing page for more information.

6. Client Engager

Client Engager is a practice management platform designed primarily for UK-based accounting and bookkeeping firms of all sizes.

Key features

While this list isn’t exhaustive, it covers the core practice management features that Client Engager offers:

- Task management

- Automated reminders

- Customisable dashboards

- Client portal and mobile app

- Customisable forms and engagement letters

- Time tracking

You also get integrations with Companies House for rapid importing of client data, as well as an HMRC integration, which will be released in the summer of 2024.

Unique selling points

Client Engager offers some cool features that you won’t find in every practice management software, such as a dedicated tool for pricing services, professional clearance letters, and the ability to create a “values” page for your accounting firm. The addition of a client mobile app is also worth noting.

Potential limitations

Client Engager’s automation capabilities span reminders, emails, and tasks, but that’s about it. Robust document management features seem to be missing as well, and there’s no time and billing feature or built-in CRM.

Pricing

Pricing is calculated on a sliding scale depending on how many clients you have. You also pay extra for Xero integration. For more information, check out Client Engager’s pricing page.

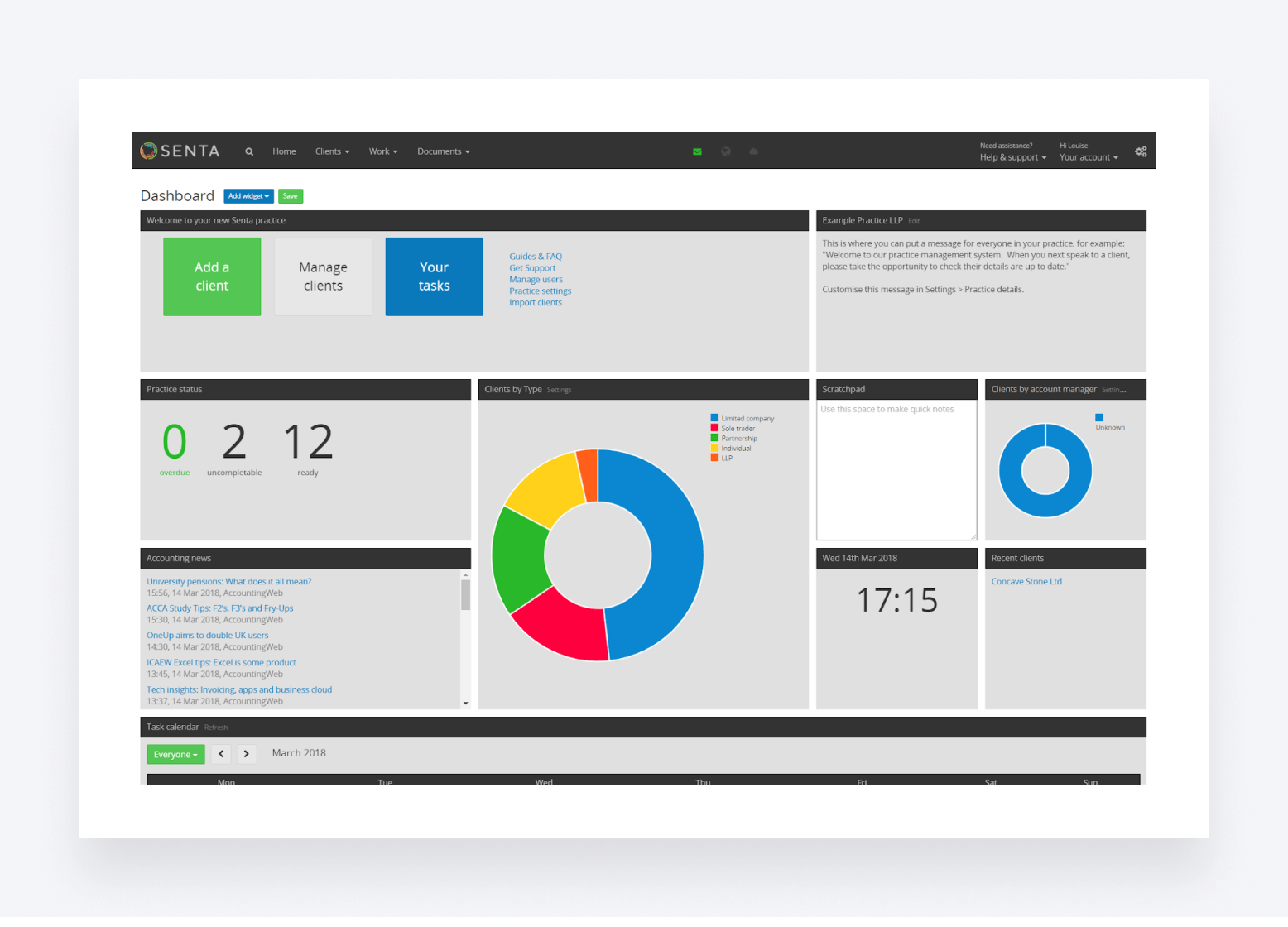

7. Senta

Another cloud-based practice management platform, Senta is built by Iris, a UK-based software provider that covers platforms for accountancy, education, HR, and payroll.

Key features

So what does Senta offer? Here’s a list of its core features:

- Built-in CRM

- Customisable workflows and task management

- Client portal

- Secure document management

- Financial insights and alerts

- Integrations with popular accounting platforms

In terms of UK-specific features, you also get an integration with Companies House for seamless data imports.

Unique selling points

Senta’s task-management capabilities are fairly comprehensive, with handy features that enable you to track overdue tasks and set up workflows for different accounting processes. Having a built-in CRM is also a major plus point, as is the client portal. You also get unlimited file storage.

Potential limitations

When compared with other options, Senta’s user interface isn’t the most attractive or user-friendly. Also, key features are missing, such as firm and client mobile apps, native invoicing, and secure chats.

Pricing

Senta’s pricing changes depending on the number of users, with the per-user price decreasing the more users you have. There’s also a 20% discount for annual subscriptions. See their pricing page for more information.

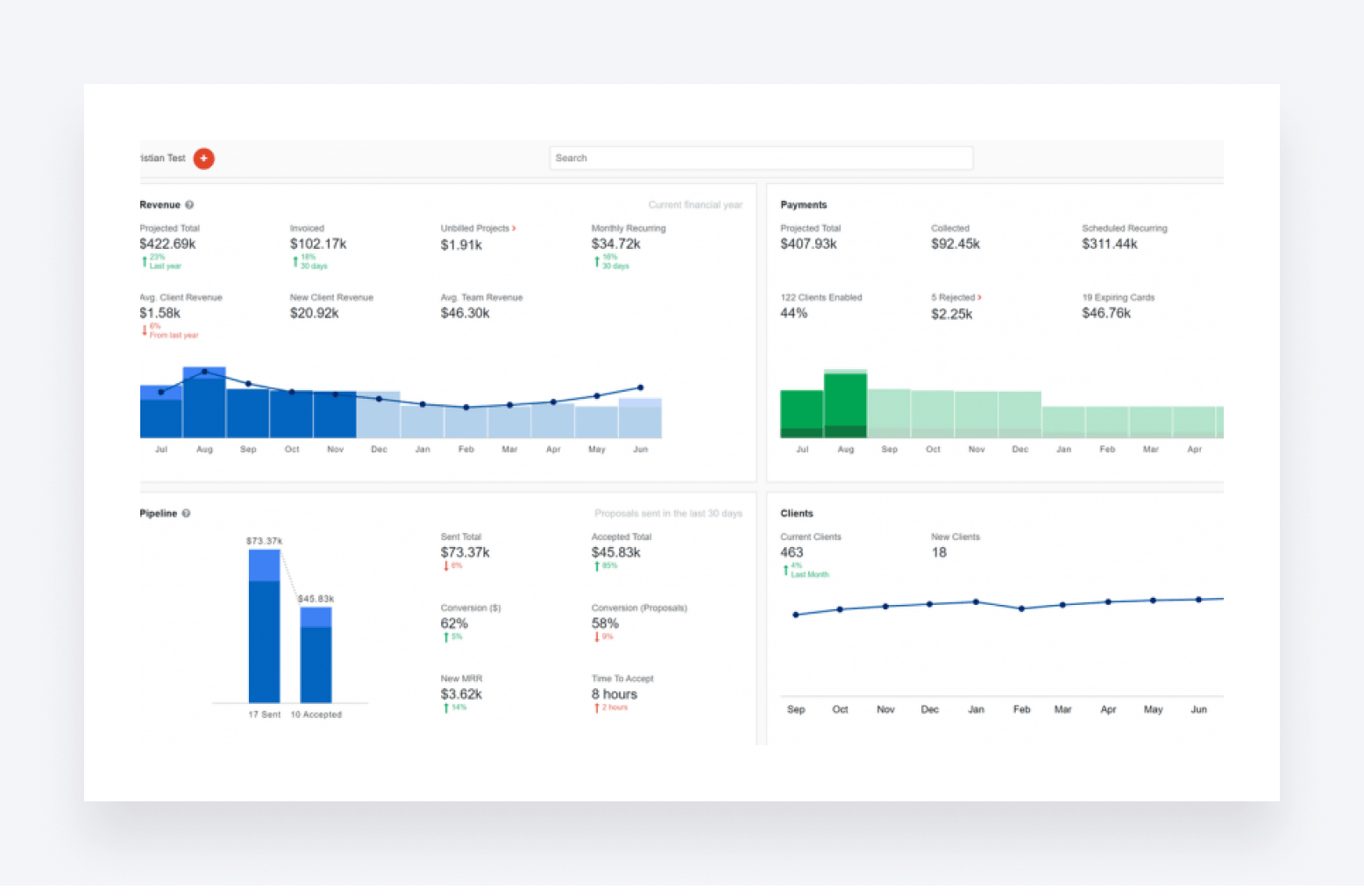

8. Practice Ignition

Practice Ignition is a popular platform that specialises in a particular aspect of practice management: engaging new clients.

Key features

Ignition allows you to manage all aspects of engaging and onboarding new clients, with key features such as:

- Proposals and engagement letters

- Client billing and payments

- Business intelligence dashboard

- Integrations with popular accounting systems

Unique selling points

As a platform that focuses mainly on engaging new clients and securing payment, Ignition offers excellent capabilities for creating professional proposals and engagement letters. With access to customisable templates, you can send proposals in a matter of minutes.

Potential limitations

Ignition’s greatest strength is also its biggest weakness. Because of the limited scope of its focus, it doesn’t include many of the features you’d expect from a complete practice management solution, such as a CRM, document management, secure messages, or workflow automation.

To enjoy these features, you need to integrate with third-party applications, which increases the complexity and cost of your accounting tech stack.

Pricing

Ignition is available on three different pricing plans: Core at £79 per month, Pro at £149 per month, and Pro+ at £299 per month. The more expensive the plan, the more features, users, clients, and e-signatures you get.

9. Xero Practice Manager

Chances are you’ve heard of Xero before — alongside QuickBooks Online, it’s one of the most popular accounting software providers in the world. Xero also offers a practice management platform called Xero Practice Manager.

Key features

Here’s what Xero Practice Manager offers:

- Task and resource management

- Time tracking and billing

- Customisable reporting

- Custom-branded documents

Unique selling points

Because of its seamless integration with Xero’s accounting software, it’s a sensible choice for accounting teams that are already part of the Xero software ecosystem. It’s also a powerful platform for organising teams, assigning work, and gaining visibility into progress and deadlines.

Potential limitations

Xero Practice Manager isn’t the best choice if you aren’t already using Xero’s accounting software. There are also limited tools for team collaboration, and no built-in document management or CRM features.

Pricing

Xero Practice Manager is free for accounting and bookkeeping firms that have reached silver, gold, or platinum status on Xero’s partner programme. But it’s not clear from the website how much it costs for everyone else. The website’s pricing page seems to cover Xero’s accounting platform, not its practice management software.

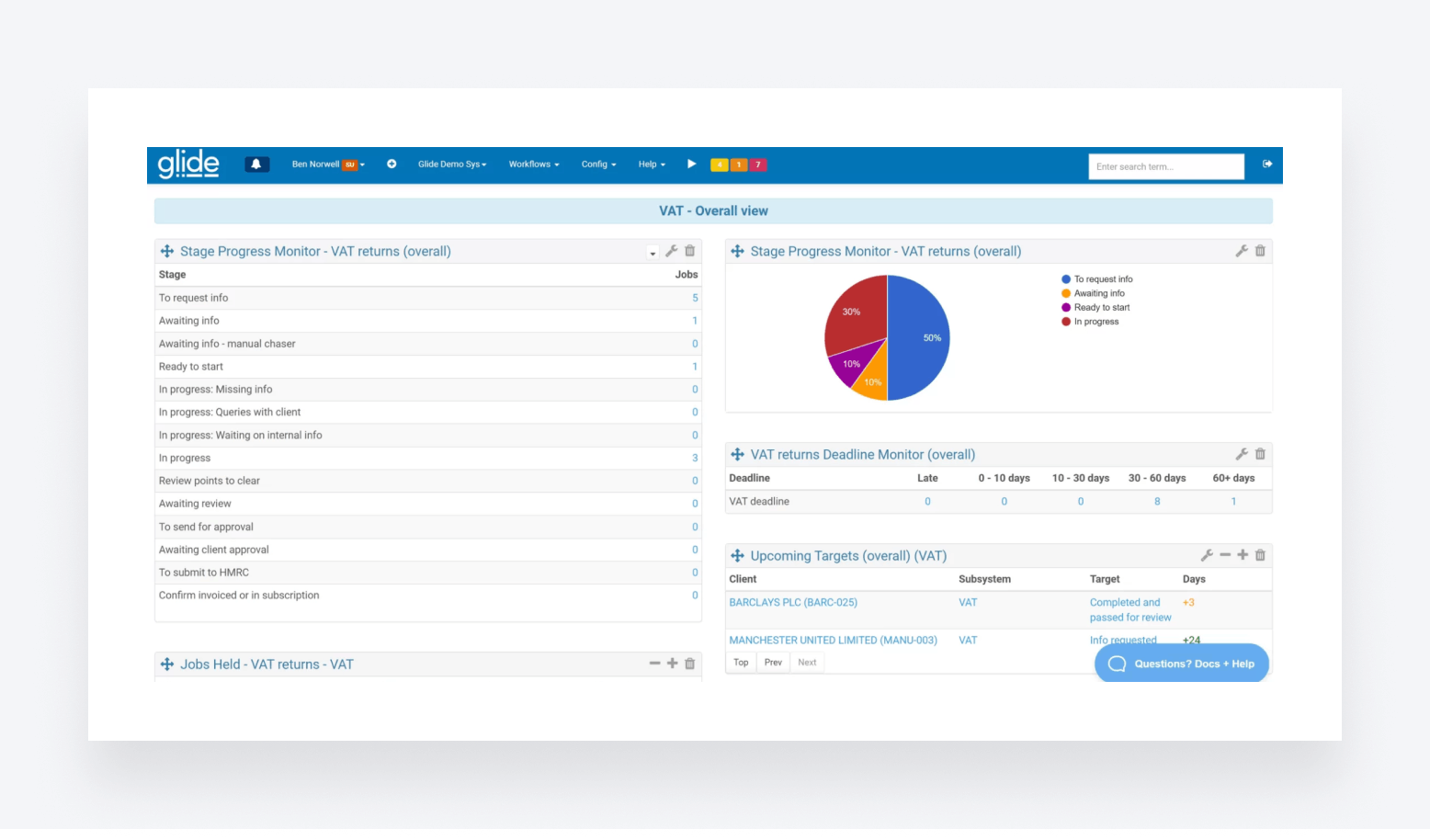

10. Glide

Glide is a practice management platform focused on accounting and professional services firms in the UK. Initially, Glide focused primarily on workflow management and automation, but it has since added additional features to create a more complete offering.

Key features

Here’s what Glide offers:

- Powerful workflow management tools

- Synced email and SMS communication

- Staff scheduler for managing workloads, resources, and bottlenecks

- Time and fees

- A range of integrations, including Companies House

Unique selling points

Glide takes an interesting approach to workflow management, allowing you to build dynamic and customisable flow diagrams that jobs move through. This allows you to visualise your workflows and add as much or as little detail as you want. The staff scheduler tool is also rather unique, featuring a simple drag-and-drop interface.

Potential limitations

Glide is missing several key features, including CRM, document management, e-signatures, invoicing, and more. They do offer integrations to cover these shortfalls, but that means paying for multiple software licences.

Pricing

Glide offers three pricing tiers: Basic, Advanced, and Professional. The amount you pay depends on the number of users you require. Cheaper tiers offer reduced functionality and limits on usage and support. Check out their pricing page for more details.

To sum up

Practice management software has the power to transform the way your accounting firm operates. But despite many similarities, no two products are the same. Some offer limited features, meaning you’ll need to spend extra on additional apps to fill the gaps.

If you’re looking for a central hub for all of your accounting processes, complete with powerful features such as advanced workflow automation, top-rated apps for your firm and clients, a built-in CRM, and much more, look no further than TaxDome. Your clients will thank you, and you’ll thank us!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.