Partial invoice payments is a newly released product update that we’re excited to announce, allowing you to improve your client experience and means to get paid faster.

10,000 firms+ have collected more than $1 billion in client payments with TaxDome — we’re committed to improving both invoicing flexibility for firms and the client experience for their customers. With this release, practitioners are able to reduce accounts receivable and improve revenue operations.

Giving clients flexibility over their invoice payments through installments and payment plans isn’t just helpful for them; it’s also a strategic advantage for your firm.

With partial invoice payments now added to your billing toolbox in TaxDome, here’s how your firm can further exceed client expectations and fast-track growth.

Enrich your client experience, increase client retention and acquisition

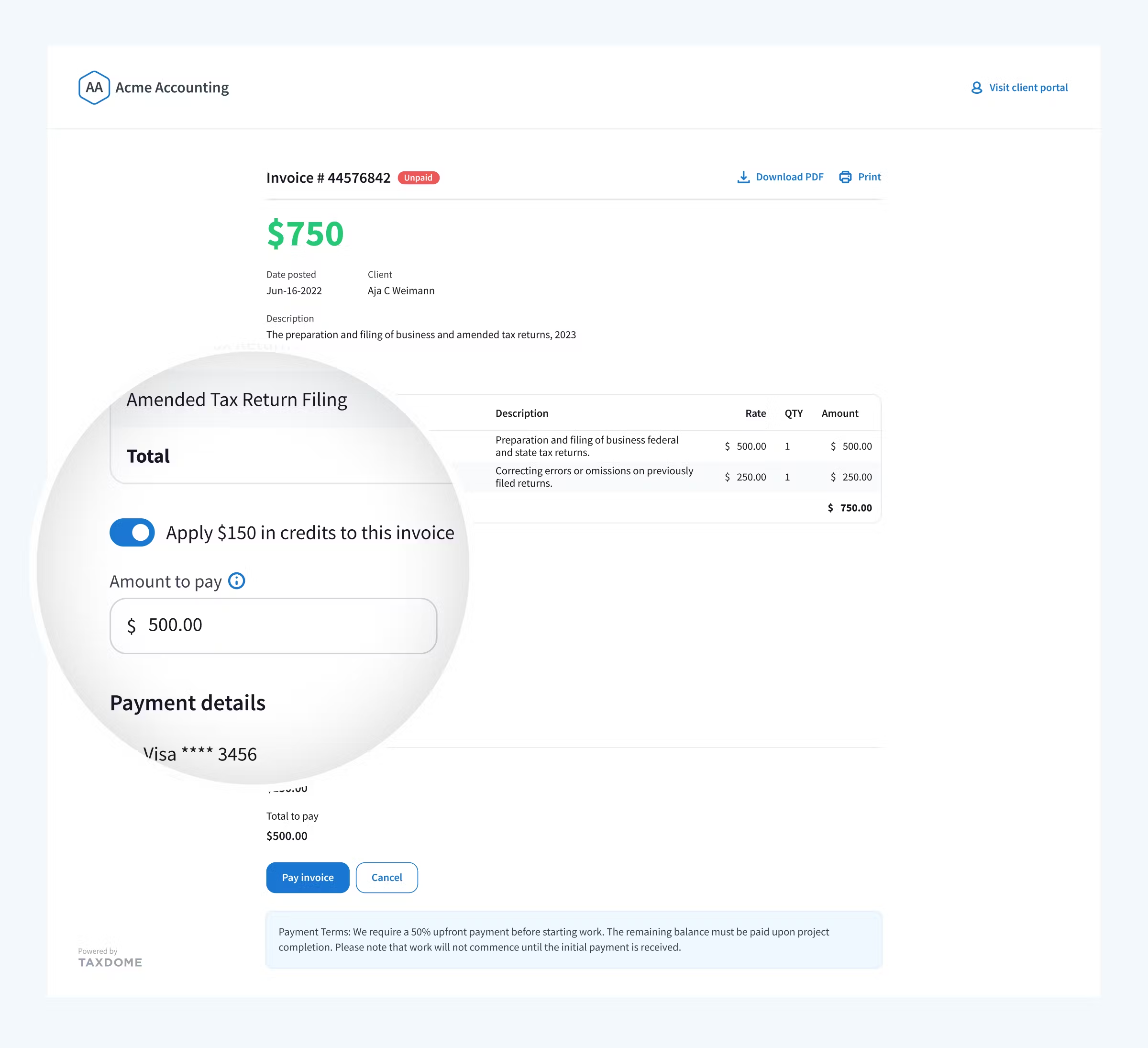

With partially paid invoices, clients can specify the amount to pay and apply credits if available.

Partial invoice payments in TaxDome will allow you to meet your clients’ financial needs and remove the stress associated with lump-sum payments, fostering long-term, valuable relationships through increased satisfaction and loyalty.

Offering partial invoice payments will also help your firm expand its market reach — and improve prospect engagement and acquisition — by providing a level of flexibility that will inspire trust and set your firm apart.

- Clients can specify the amount they want to pay on invoices

- Clients will see clear statuses for partially paid invoices in the client portal, with remaining balances automatically adjusted

Ensure timely payments, minimize risk, and improve cash flow

With partial invoice payments in TaxDome, offer your clients more flexible, convenient payment terms that will help you get paid faster, and more consistently — minimizing risk while giving you greater clarity of all incoming payments so you can better manage your cash flow.

Accepting partial payments will also help you reduce outstanding invoices, collection time, and follow-ups for overdue payments.

- Easily outline your payment terms in the Notes section when creating an invoice — such as requiring an upfront payment before starting work

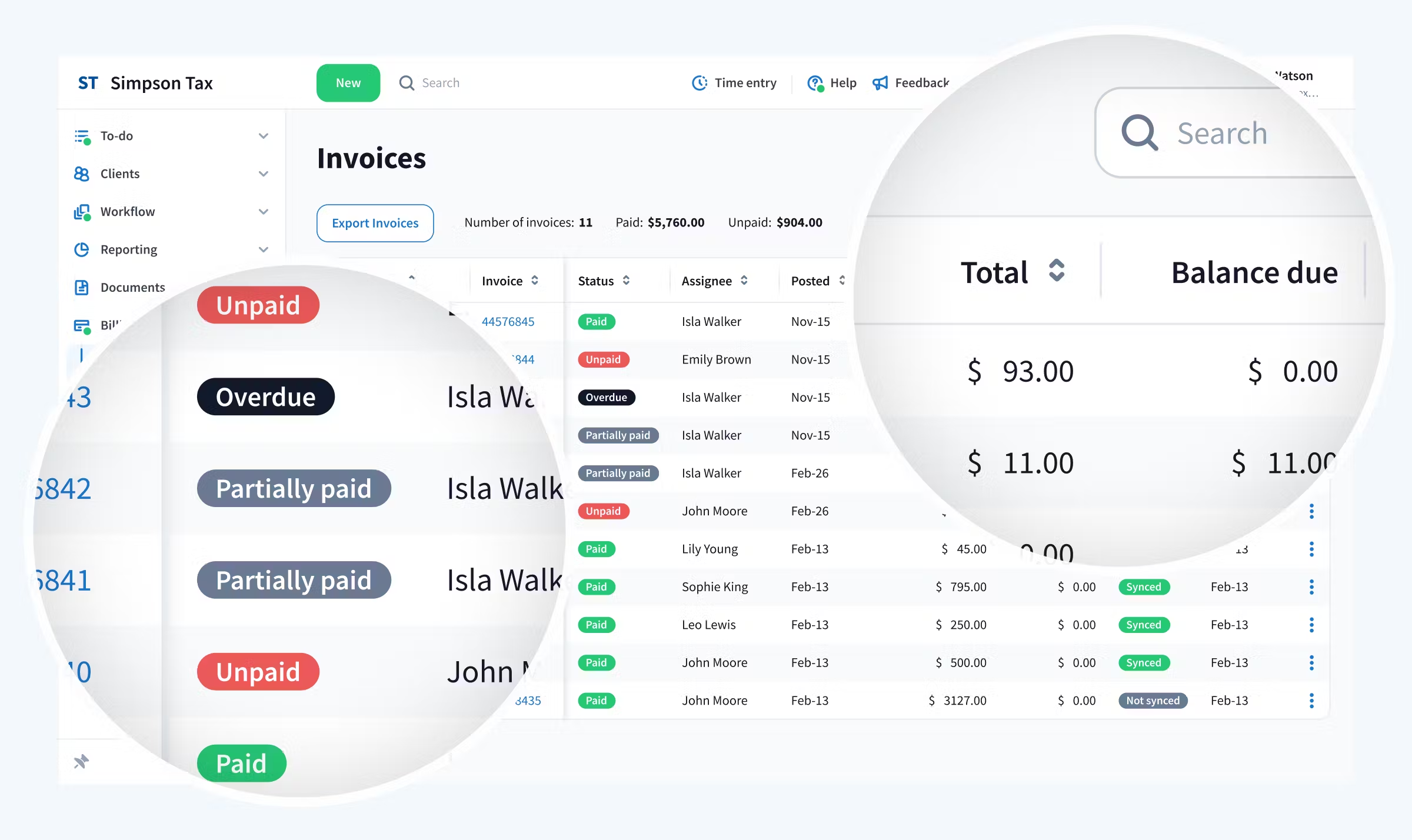

- Track partially paid invoices with convenient new table columns (Amount Paid and Balance Due) and updated search filters

- Instantly view the payment history, amount paid, and remaining balance by opening any invoice

- Automatically sync partially paid invoices to QuickBooks Online via our seamless integration

Instantly view Partially paid invoice status, payment total, balance due, and more via your Invoices page

Also released: redesigned customizable invoices in TaxDome

Our new partial invoice payments feature comes hot on the heels of another new billing release, redesigned customizable invoices, giving you the ability to promote your brand, customize your invoice content, and preview invoices before sending.

With partial invoice payments and customizable invoices bolstering your billing suite in TaxDome, your firm is all set to elevate its professional image, deliver value that will exceed clients’ expectations, and get paid — hassle-free.

TaxDome: an award-winning platform that firms and clients love to use

TaxDome doesn’t just help you simplify billing and get paid. Our comprehensive, award-winning practice management platform is here to help your firm boost operational efficiency, improve team collaboration and organization, and stay one step ahead of client needs with future-ready tools that give your firm a competitive edge.

Ready to take your firm’s success to new heights? Join a community of more than 10,000 firms in 25+ countries dedicated to mutual growth and innovation.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.