At the apex of finance and strategy sits the chief financial officer (CFO), one of the most vital and highly paid executive roles. By unraveling the complex factors influencing CFO pay, we can reveal strategic insights for aspiring finance chiefs.

This article explores the key dimensions shaping CFO compensation, current salary ranges, trends, and real-world job openings. Read on to discover what impacts paychecks in the C-suite today.

Factors influencing CFO salaries

As this position sits at the executive leadership table and steers major strategic decisions, compensation varies greatly depending on several key parameters:

- Industry: since innovative industries require more foresight and flexibility, CFOs in high-growth sectors such as healthcare and technology often earn more than counterparts in stable legacy industries

- Company Size: CFO pay rises with company revenue and market capitalization due to the fact that managing finances for an international conglomerate is more complex compared to a small business

- Location: geographic differences in cost of living and local talent competition also impact CFO salaries

- Experience: seasoned CFOs with decades of experience steering large, complex finance functions earn substantially more than early-career chiefs

- Education: advanced credentials, including CPAs, CFAs, and MBAs, as well as ongoing executive education, demonstrate greater mastery and correlate to higher compensation

- Performance: CFOs that oversee profitable growth and shareholder returns earn higher short- and long-term incentive bonuses, elevating total compensation

Average salary ranges

Although CFO salaries can vary greatly, national surveys do offer a general benchmark for typical compensation ranges. According to salary aggregation website Salary.com, the average CFO salary in the US is $437,711 as of January 2024. Yet most fall within a range of $331,593 to $561,559 when additional variables come into play.

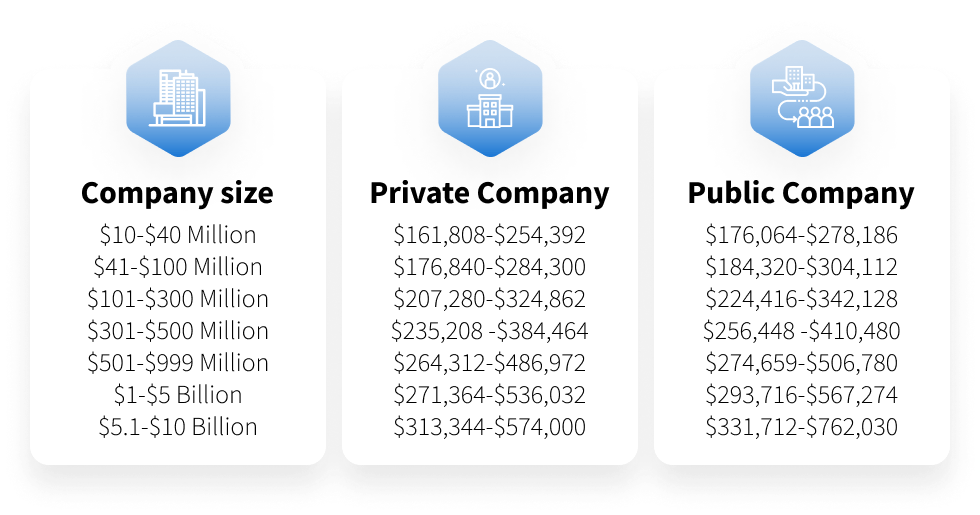

For example, company size: according to CFO Search, an executive search firm, private companies with $10–$40 million in revenue can expect base salaries ranging from $161,000 to $254,000. For public firms of equivalent size, that band rises to $176k–$278k. However, for larger corporations with $5–10 billion in revenue, private industry CFOs make $313k–$574k in base pay, while public company finance chiefs earn $331k–$762k.

Experience: according to compensation data provider PayScale, early-career CFOs with limited time in the role can expect to earn up to $182k. Meanwhile, late-career CFOs with extensive expertise command packages up to $252k.

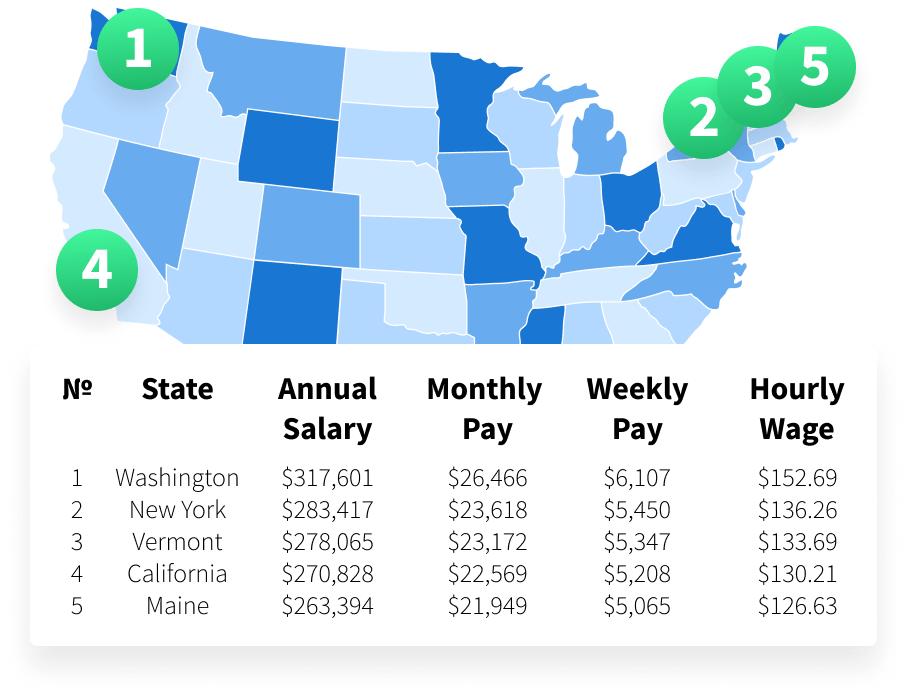

Geographic differences: data from hiring platform ZipRecruiter shows the highest CFO salaries are found in Washington, 21.4% above national averages. New York and Vermont also exceed typical rates by smaller margins.

| States by descending salary | Compensation |

| 1. Washington | $317,601 |

| 2. New York | $283,417 |

| 3. Vermont | $278,065 |

| 4. California | $270,828 |

| 5. Maine | $263,394 |

Benefits and bonuses

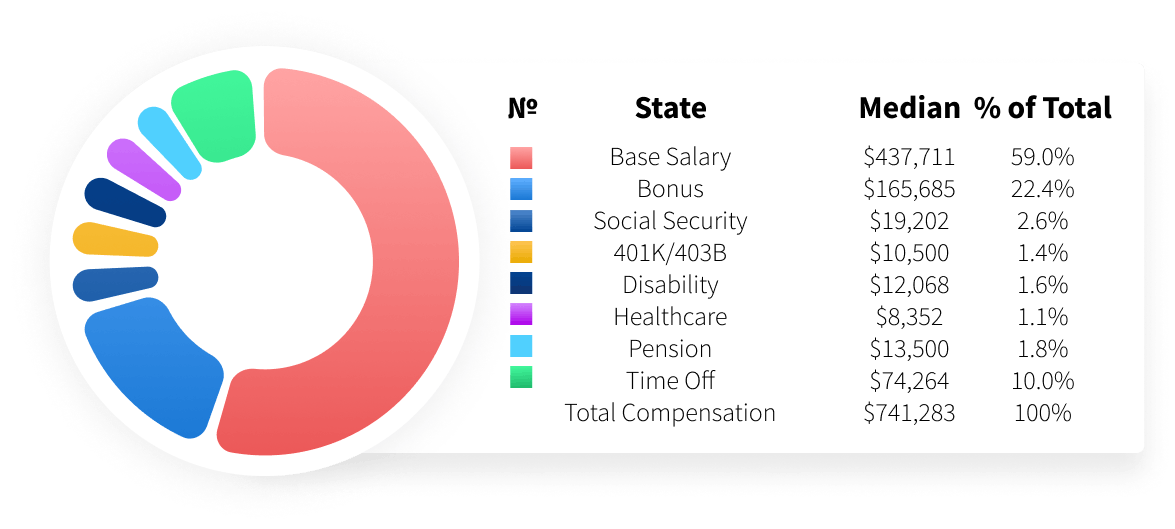

Beyond base salaries, CFOs receive substantial additional compensation through performance incentives, retirement planning, health coverage, paid time off, and professional development. Let’s explore some average numbers across these additional pay components, according to data from Salary.com.

Annual bonuses tied to the company’s financial results make up a significant portion of total pay. Combining salary and bonuses, total CFO pay ranges from $283,179 tцo $1,185,853, with a $603,396 average. On its own, the average bonus is $165,685, comprising 22.4% of overall compensation.

CFO retirement benefits are also very generous, thanks to 401(k) matching, deferred compensation plans, and pension plans. The average annual retirement benefits are $13,500 in pensions (1.8% of total compensation) and $10,500 in 401(k) and 403(b) contributions (1.4%)

Health and insurance coverage also bolster the CFO’s financial security. Companies fully cover medical, dental, and vision expenses for finance chiefs and their families, averaging $8,352 a year (1.1% of total income). The average annual benefit from disability insurance is $12,068 (1.6%), while social security is $19,202 (2.6%).

Significant paid time-off benefits are granted by companies based on the tenure and seniority of the CFO. This facet averages $74,264 annually (10.0% of total compensation).

Lastly, professional development, including continuing education, conference participation, and executive training, allows CFOs continuous advancement.

In sum, factoring in all elements, from bonuses to healthcare, the average CFO total compensation reaches $741,283.

CFO salary examples in real companies

From global conglomerates to regional accounting firms, real-world CFO compensation scenarios reveal the tangible impact of company size and industry specialization on base pay and bonuses. While larger organizations offer higher salaries, factors like industry competition and location also have a significant influence. A few examples illustrate the salary ranges:

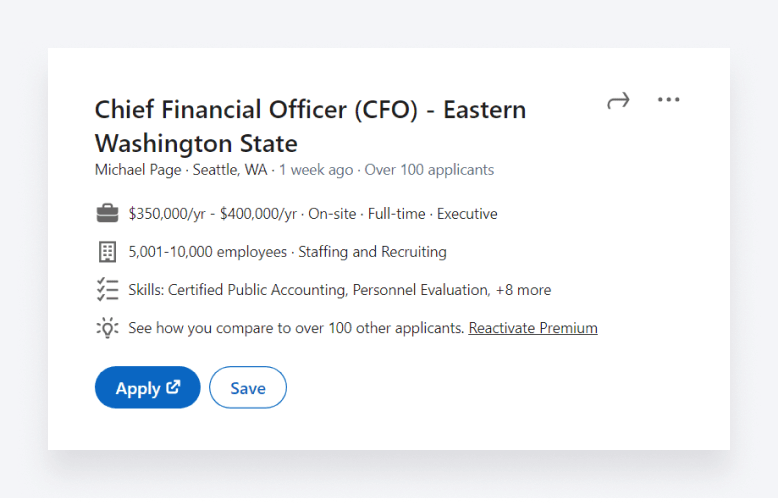

1. This open CFO position in Seattle, WA, for a firm with 5,000–10,000 employees offers $350,000–$400,000 in total annual compensation. A salary at this upper tier demonstrates how pay scales with massive company size and oversight duties for such a large organization.

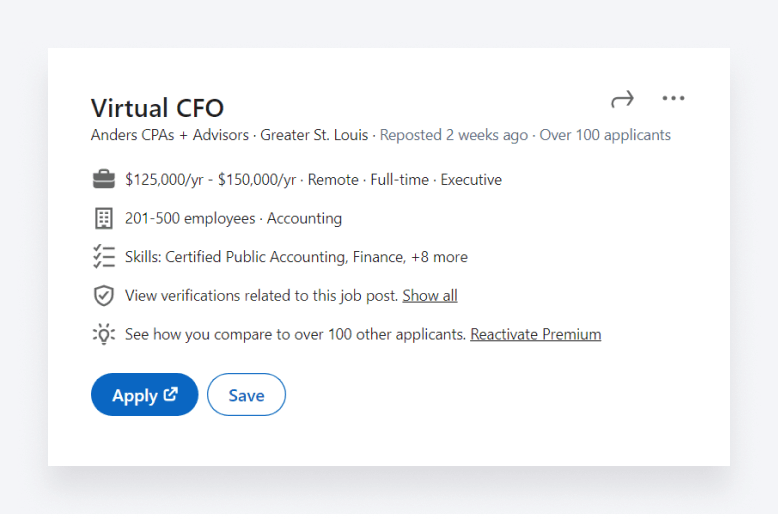

2. An open virtual CFO role at an accounting and advisory firm with just 201–500 people provides $125,000–$150,000 per year. Despite its small size, competitive pressures in the accounting industry and remote work flexibility trends may lift pay rates for these openings.

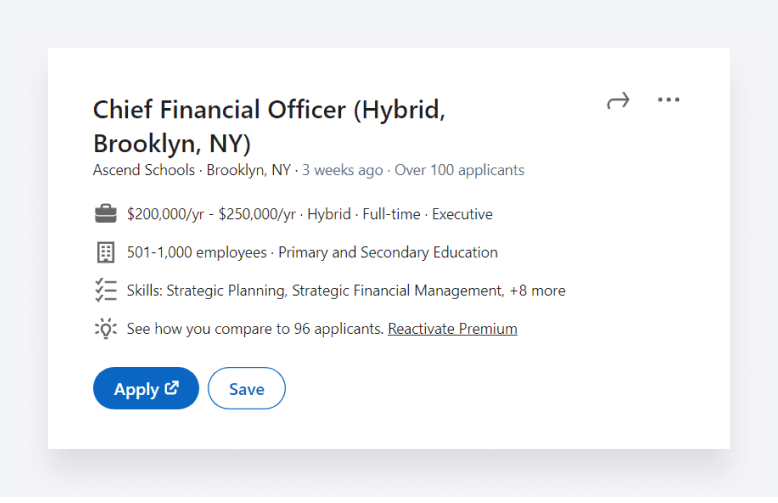

3. A hybrid CFO vacancy for a mid-sized company in Brooklyn with 501–1,000 employees comes with $200,000–$250,000 in total pay. As companies compete for leaders who can direct strategy for targeted markets, factors such as geographic talent demand and specialized industries may have an impact on salary levels.

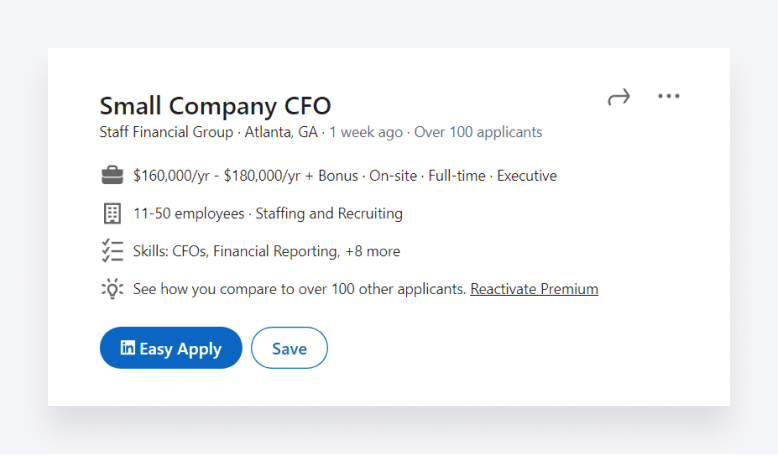

4. A small company CFO at a financial services firm with 11–50 employees makes $160,000–$180,000 in base plus bonuses at Staff Financial Group, Atlanta, GA. Even some smaller firms offer CFO salaries aligned with those of bigger corporations, aiming to attract top finance expertise.

Trends in CFO compensation

Several encouraging trends point towards favorable CFO salary growth in the coming years.

- Digital acceleration: with the majority of finance teams leading tech transformation projects, CFO pay correlates to the level of digitization and analytics adoption achieved

- Remote work flexibility: with more openness to virtual and hybrid CFO roles, compensation may increase due to expanded talent access and geographic pay discrepancies

- Growing employment: per Duke University’s CFO Outlook, median expected employment growth stands at 2.7% for 2024, up from 2.2% in 2023

- Resilient revenues: median 2024 revenue growth projections hold steady at 5% year-over-year, supporting higher variable compensation for CFOs overseeing financial performance

With businesses striving towards resiliency and data-driven decision-making, top CFOs steering companies through fluctuations can expect compensation growth on par with their elevated strategic influence.

FAQ

- What is the starting salary for a CFO?

The average starting salary for a first-time CFO is typically $150k–$175k in base compensation, varying based on company size and industry. With bonuses, total compensation averages $182k.

- Do CFOs in non-profit organizations earn less than those in for-profit companies?

According to ZipRecruiter, nonprofit CFOs do, on average, earn lower salaries, closer to $261,533 annually.

- What impact does company size have on a CFO’s salary?

A significant impact: large corporations offer substantially higher CFO pay due to greater budgets, larger teams to manage, inflated market costs for top talent, and amplified risk factors warranting premiums.

- Can a CFO’s salary be affected by their educational background?

Yes, a CFO’s educational pedigree directly impacts compensation levels. According to Salary.com data, CFOs with bachelor’s degrees average $574,970 in total pay. With a master’s degree or MBA, salaries rise to $589,183. And those holding advanced degrees like JDs, MDs, or PhDs command premium packages of around $603,396.

- How does geographic location influence a CFO’s salary?

Due to a growing corporate presence and extremely high living expenses that justify premiums over the national median pay, states such as Washington and New York City have far higher CFO salaries than the national average.

- What are the career prospects and salary growth for a CFO over time?

The future looks bright for aspiring CFOs over the next 5 years. According to job search platform Zippia, CFO salaries have increased by 3% over the last half decade. Moreover, active job listings for open CFO roles currently tally over 145,000 across the country, signaling ample career advancement opportunities.

- Are there differences in compensation for a CFO in a public company versus a private company?

Yes, public corporation CFOs earn 10–25% higher salaries on average and far larger equity grants and bonuses tied to share performance and quarterly earnings results.

Conclusion

In this article, we explored the multitude of factors influencing CFO compensation, from industry and company size to location, credentials and performance. While base salaries average $437K nationally, total pay varies widely.

Top takeaways:

- Dynamic industries and large corporations pay CFOs top-tier salaries, which can exceed $750k with bonuses

- Location significantly impacts pay, with states such as NYC and Washington offering salaries up to 20% above averages

- Advanced credentials such as MBAs and CPA/CFA certifications can boost CFO pay by 5–15%

- Ongoing positive business trends point to steady CFO salary growth in the 3-5% range annually

Yet with great pay potential comes great responsibility. As organizations navigate volatility, economic uncertainty, digital disruption, and competitive pressures, the need for visionary, disciplined CFO leadership has never been more vital.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.