Thousands of TaxDome firms leverage our invoicing functionality. It allows practitioners — and their clients — to skip the administrative hassle of printing and sending invoices. Firm employees also don’t need to nudge their clients when it comes to signing or paying: TaxDome’s reminders will do the job for them.

With our latest update we are introducing recurring invoices. They are especially helpful for companies that continually provide repeat services to clients. Recurring invoices automate the billing process, so that employees set invoices up just once. At the same time, you can give clients the option of entering their payment details just once with payment authorization. Instead of having to manually settle invoices each month, the money will automatically be withdrawn at the agreed upon schedule.

We recently hosted a webinar introducing this feature. Check out the recording below and you can also view the Q&A transcript.

What are recurring invoices?

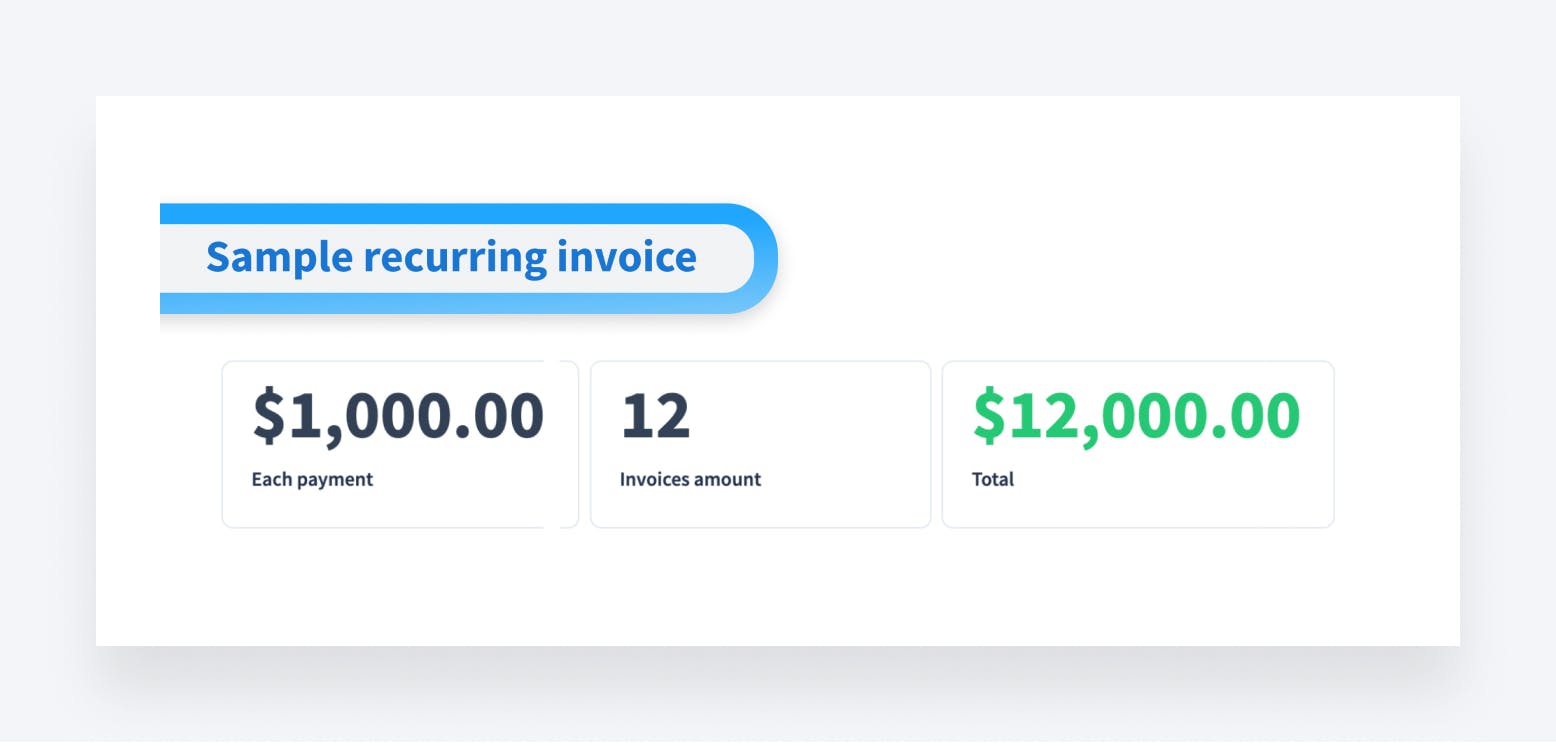

Recurring invoices allow a firm to have invoices sent to clients on a regular predetermined basis (weekly, monthly, etc.) for the services provided during that period. For your clients, it’s simply a periodic payment they make – not unlike Netflix or Spotify, which bill subscribers on a monthly basis.

Payment authorization enables a firm to collect money automatically at the predetermined schedule – whether by credit card or direct debit (ACH, SEPA, BECS…..). We recommend this as a best practice as clients can authorize payment once and all payments will then happen automatically, with neither firm nor client having to spend any time on it. Currently, recurring invoices with payment authorization are enabled for Stripe only.

You do not have to disable CPACharge to enable Stripe, you can have both CPAcharge and Stripe enabled in your portal if you wish.

You can bill clients automatically (if Stripe is your default payment provider)

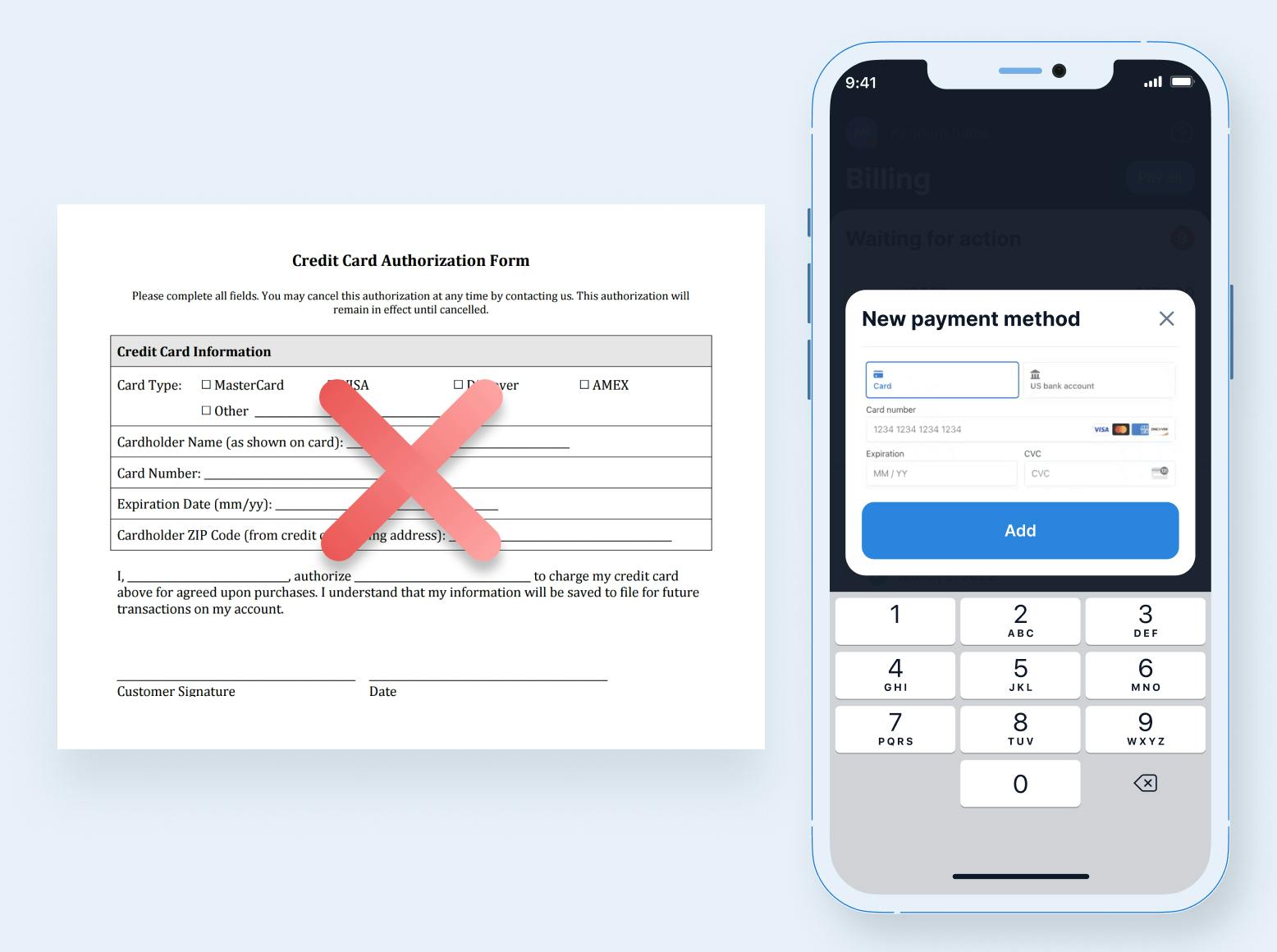

If payment authorization is disabled – invoices still get sent automatically at the chosen intervals, but clients have to enter payment info manually every time. Many firms are utilizing this elsewhere already – the benefit of doing it in TaxDome enables practitioners to provide their clients with an outstanding user experience. Forget manual ‘authorization’ forms which then have to be handled by an administrator – clients are able to enter their account information in your secure, custom-branded portal – from desktop or mobile.

In future releases: for those who already have payment authorization forms on file, we plan to enable you to transition those to TaxDome as a practitioner, without having to ask the client again.

How to create a recurring invoice in TaxDome

For full details on how to create a recurring invoice, please see our help article. For the purposes of this blog, outside of payment authorization described above, here are a few main options we want to highlight:

- Payment method: either credit card, bank debit or both credit card or bank debit

- Acceptance: the invoice can be set to start immediately, or only upon acceptance, or on a certain date, providing flexibility to the firm

- Custom message: You can add a custom message that will be in both the e-mail to the client and on the page where they are able to review it.

How to create a recurring invoice in TaxDome

Recurring invoices, the client experience

When a practitioner creates a recurring invoice, the client will receive notification in their email and/or push notification to their mobile app. The request to review and sign the recurring invoice will also appear in their client portal “To-Do” list.

Once the client clicks on the notification, they’ll be able to review the invoice details. The process is streamlined and simple – no excess information on the screen.

If payment authorization was requested, the client will have to enter their credit card or bank information (remember, the firm can choose how they wish the invoices will be paid!). Until the payment information is provided, the client will not be able to sign.

What the invoice summary and payment authorization looks like for clients

Once the client signs, what happens afterwards on the firm side

Once signed, the recurring invoice becomes active — you can check the status in the Invoice tab, the Recurring Invoices subtab. Keep in mind that you can edit a recurring invoice (apart from the “Account” field) – both before the client accepts the invoice and afterwards. In the latter scenario, you won’t be able to change the following fields:

- Starts on

- First invoice date

- Recurrence (weekly, monthly, etc.)

Once a recurring invoice is set up, if necessary, practitioners can edit them, pause them, and modify them, if need be.

Benefits of using recurring invoices

You don’t need to remember to send an invoice by a certain date each week/month — or remind your clients to pay it. It all happens on an auto-pilot, saving you time and eliminating the administrative effort.

Note: TaxDome’s payment authorization is only available for firms that use Stripe as their default payment provider

2. Schedule your invoices

You can set the invoices to be paid on acceptance, or on a certain date each month. Whichever way you go with your clients, recurring invoices allow you to have different schedules for different clients – and it definitely improves their experience with your firm.

3. Boost revenue by setting up bank debit

TaxDome supports multiple bank debit options globally – ACH in the US, SEPA in Europe, BECS debit in Australia, and pre-authorized debit in Canada. Bank debits carry lower fees than credit card, allowing firms This will allow you to save a considerable amount of money on credit/debit card commissions.

4. Automate sending invoices

Creating recurring invoices will automate a lot of your work, whether you rely on Stripe or CPA Charge as your provider. Currently, recurring invoices with payment authorization are enabled for Stripe only.

You do not have to disable CPACharge to enable Stripe, you can have both CPAcharge and Stripe enabled in your portal if you wish. At this time, payment authorization is available for Stripe. Even if Stripe is disabled, you will still be able to set up invoices to be sent to your clients on a particular schedule, but they will have to manually settle them each month.

Future improvements

In the near future we’ll make recurring invoices even more advanced by:

- Providing payment without logging into the portal: clients will be able to review and sign recurring invoices and settle existing invoices

- Enabling firm members to change payment info and settle invoices on behalf of clients

- Providing firm admins the ability to disable prepayment options in the client portal

If you have any suggestions for improving the Invoicing functionality on TaxDome, let us know on the Feature Request Board!

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.