Key takeaways:

- Workflow management software helps accounting firms streamline, organize, and automate their workflows. The result is greater efficiency, productivity, and collaboration.

- The right workflow management software will depend on factors such as the size of your business, how many clients you have, your budget, and the type of services you offer.

- Comprehensive practice management platforms such as TaxDome, Canopy, and Karbon combine workflow management capabilities with all the tools you need to run a highly efficient firm.

- Other tools are designed for niche areas within accounting, such as TaxFlow, which focuses specifically on tax-related workflows.

- Workflow management platforms such as Trello are aimed at a more general market and aren’t designed with accountants in mind.

Have you already looked into how workflow management software can boost your firm’s efficiency? If not, now’s the time. Let’s discuss why.

In a report by Sage, 58% of accountants acknowledged technology’s role in boosting their efficiency and productivity. Along with other figures in this report, these statistics showcase the pivotal role software has played in driving positive changes in the accounting industry over recent years. A remarkable achievement in an extremely demanding and stressful profession.

Among these solutions, the ones for managing workflows stand out. As workflows grow in complexity, streamlining day-to-day operations for teams becomes a priority. However, given the highly specialized processes inherent to the industry, finding a tool that seamlessly aligns with these intricate workflows is paramount.

With this in mind, we thoroughly researched and compared the ten best workflow management solutions designed specifically for accounting firms. In this article, we’ll cover their key features, pricing plans, client feedback, and more.

We wrote this article with the help of experienced CPA and cloud accounting expert Marie Greene. The founder of Connected Accounting LLC, Marie helps businesses and startups scale their operations and realize their financial goals through increased efficiency. Read on to hear her thoughts on the importance of workflow management software.

Benefits of accounting workflow management software

Task tracking and automation. Accountants often handle a large volume of documents and complete numerous repetitive tasks manually. Without the right tech, it can be difficult to understand who’s working on what at any given time. This leads to inefficient processes, poor communication, and disjointed collaboration.

Thankfully, it doesn’t have to be that way. “Workflow management software is essential because it provides visibility and control over ongoing tasks, ensuring deadlines are met and resources are used efficiently,” says Marie Greene, CPA.

For accounting firms where multiple team members may collaborate on complex tasks, workflow software helps standardize processes, reduce bottlenecks, and maintain consistency. It not only supports accountability and tracking but also simplifies task delegation and communication across teams.

To enhance consistency and reduce manual workloads, consider implementing systems with robust automation capabilities. “With automation features,” explains Greene, “firms can eliminate repetitive manual tasks, creating smoother, faster, and more reliable operations, ultimately enhancing client satisfaction and productivity.” For more details, check out our guide on how to automate accounting processes.

Time management. Accountants need to stay on top of deadlines and manage their time effectively. Missing a deadline or dropping a client project can have lasting consequences for both client relationships and the firm’s reputation.

Client communication. Chatting with clients is integral. However, it can become disruptive and messy when trying to keep track of information scattered across emails, phone calls, and text messages. Workflow management software can automate a good number of those.

Data security. Accountants deal with sensitive and personal client information — as a result, data security and confidentiality become integral.

Output analytics. Working with many clients and a ton of documents can be cumbersome. For this reason, tracking billable hours solves the issue.

Identifying the accounting workflow software that fits

Your organization’s needs determine which tool suits your practice best. A small firm would be overwhelmed with the pricing structure and functionality of software intended for a larger company, as the scale and complexity of their accounting workflows differ.

Here are some questions to consider before settling on one platform:

- How many firm members will use it?

- Should these users have different levels of access?

- How many clients does the firm handle?

- What sort of clients are those? Are they small businesses? Corporations? High-net-worth individuals?

- How does the firm track time? Billable vs. actual hours?

- What sort of work does the firm do? Accounting, bookkeeping, audit, tax prep, financial advisory, or a combination?

Answer these questions to help you determine which software solution fits your firm best.

Top 10 workflow management software for accountants in 2025

1. TaxDome

TaxDome is a tool that can help you manage all sorts of accounting workflows. It works for accounting practices of all types, including payroll, tax preparation and bookkeeping. In fact, according to CPA PracticeAdvisor's Readers Choice Awards 2024, TaxDome was voted the best comprehensive firm workflow system. This recognition highlights its capabilities in streamlining accounting operations.

Key features

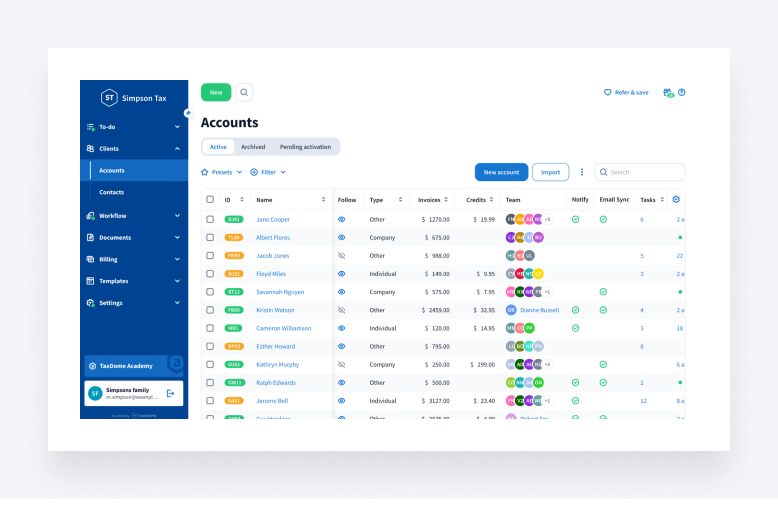

What sets TaxDome apart is that it’s a platform you can use both externally — to manage your clients — and internally — to organize your team, documents and projects. It also offers some of the heavyweight perks right away. These include unlimited cloud storage, adding as many clients to the built-in CRM system as you need, and leveraging e-signatures to go paperless. Let’s look at some of the other core features in more detail.

Project and task management: TaxDome offers ready-made templates for all common accounting scenarios. This means accounting firms don’t have to invent internal processes from scratch, making implementation a breeze. Even better, those templates are fully customizable to fit your specific operations.

Workflow automation: you can automate client communication (e.g. sending emails and text messages, setting reminders) and unburden your team members from having to follow up with multiple clients.

Document management: you can store as many documents as you like using TaxDome’s cloud storage. The built-in client portal and mobile app make it easy to collect documents from clients and share your work with them.

E-invoicing: you won’t have to worry about typing and mailing invoices anymore — nor reminding clients to settle them. Invoices can be sent through the platform, they can be made recurring and even settled automatically*, while reminders can be set without your teammates lifting a finger. You can also lock documents to invoices: clients can view and download the results of your work only after they’ve paid for it.

Integrations: you’ll find the usual suspects — such as QuickBooks Online and Zoho Books — and a lot are also available through Zapier.

Proposals and engagement letters: you can create and customize proposals and engagement letters to pitch your services, secure on-time payments and more.

A full suite of communication tools: you can meet clients at their preferred method of communication with secure chat, email and SMS all on one platform.

In summary, TaxDome is a comprehensive practice management platform for accountants packed with powerful tools to streamline workflows for firms of all sizes.

What kind of businesses use TaxDome?

TaxDome is used by accounting, tax, and bookkeeping firms of all sizes – from solopreneurs to enterprises. TaxDome is popular with firms looking for a comprehensive practice management platform that can transform their accounting workflows, consolidate their accounting tech stack, and provide an outstanding client experience.

TaxDome’s simple and transparent pricing also makes it a great choice for fast-growing accounting practices. With one pricing plan for all users, including access to all TaxDome features, there are no limitations or hidden costs as you scale.

Pricing

TaxDome has designed three plans tailored to meet your specific needs and goals:

- TaxDome Solo: The all-in-one platform to run your entire firm with ease.

- TaxDome Pro: Empower your team and streamline operations with advanced tools for collaboration, visibility, and efficiency.

- TaxDome Business: Deliver premium client experiences and enhance internal efficiency with the most advanced tools in the market.

Current Pricing:

TaxDome Solo

- 3-year subscription: $700/year

- 2-year subscription: $750/year

- 1-year subscription: $800/year

TaxDome Pro

- 3-year subscription: $900/year

- 2-year subscription: $950/year

- 1-year subscription: $1,000/year

TaxDome Business

- 3-year subscription: $1,100/year

- 2-year subscription: $1,150/year

- 1-year subscription: $1,200/year

Free trial

TaxDome offers a 14-day free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Ready-made templates for common accounting processes | With the breadth of features, maximizing the platform’s potential may require training |

| Ability to automate client communication, invoicing and admin tasks | |

| Firm and client mobile apps boost efficiency and satisfaction | |

| Unlimited cloud storage and client contacts | |

| Integrations with 2000+ apps via Zapier | |

| Hands-on support and guidance helps drive full adoption |

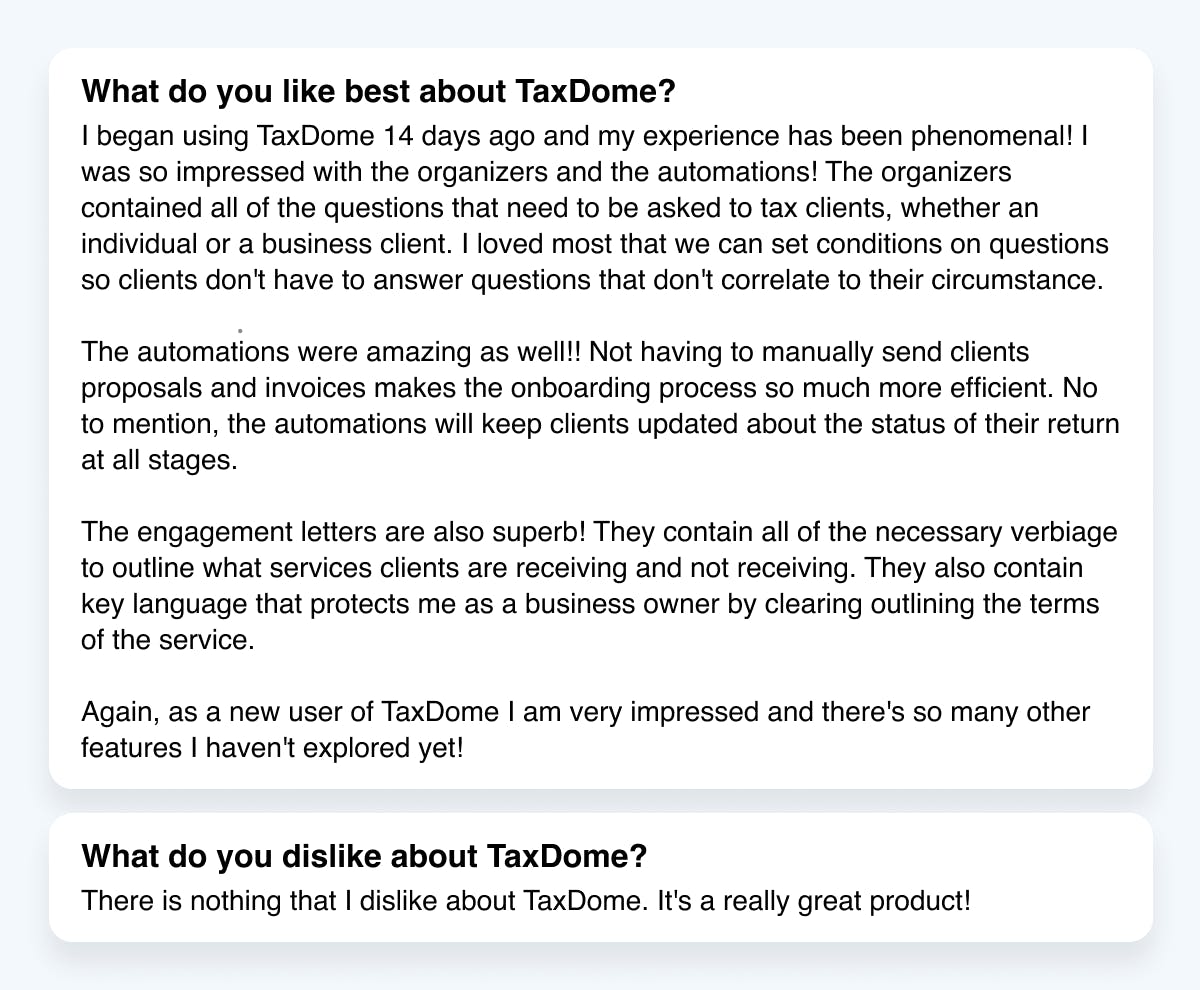

Ratings and reviews

G2 rating: 4.7 out of 5

Capterra rating: 4.8 out of 5

Users say TaxDome is “very powerful” in their businesses and “a fantastic experience.” The fact that everything is in one place is the biggest selling point for users.

Looking for an all-in-one solution to manage documents, clients and track your team’s work? Join our demo and see why you don’t need to look any further.

2. Jetpack Workflow

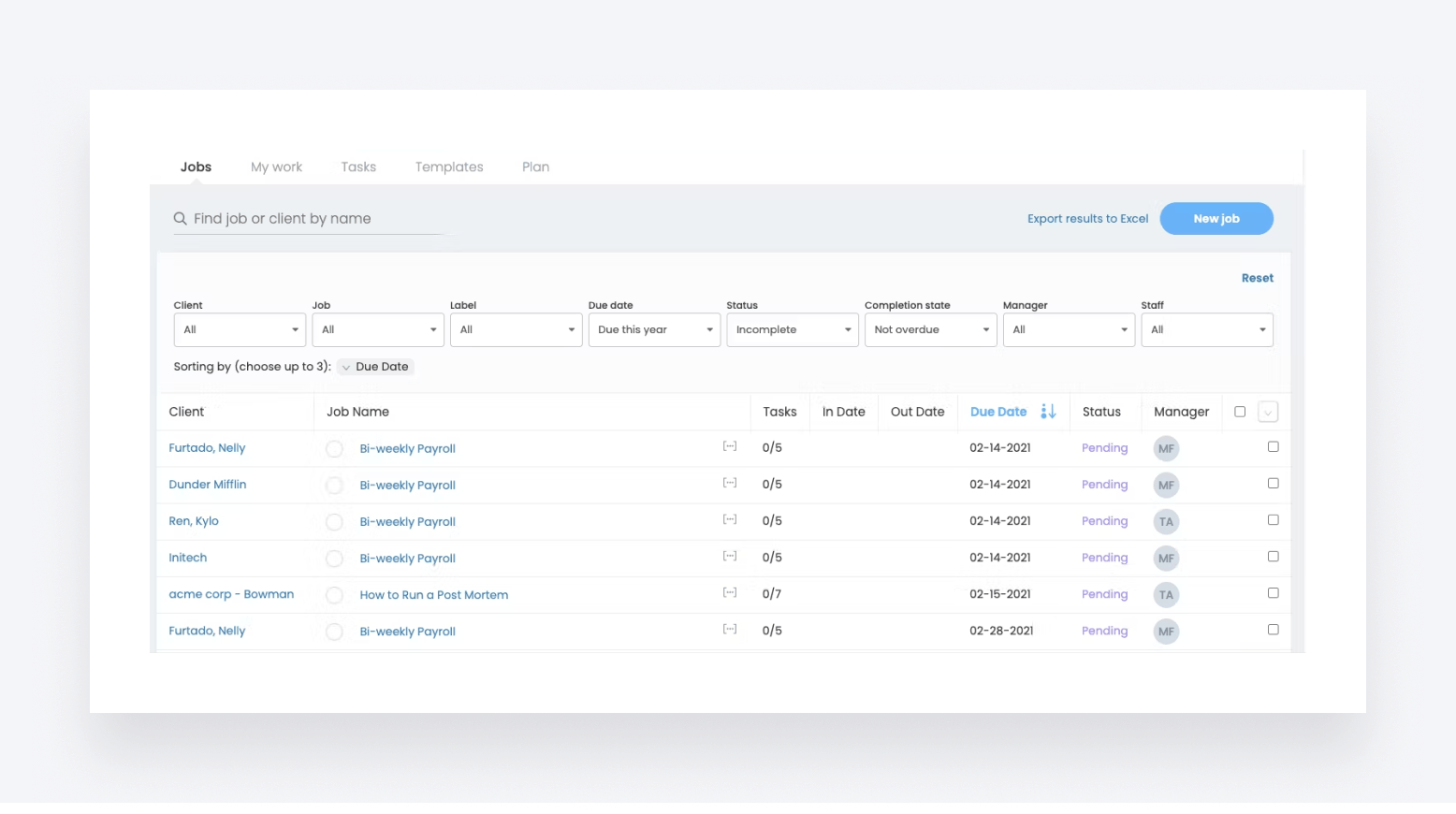

Jetpack Workflow is a way for accountants to juggle multiple clients, coordinate personnel for big projects, and ensure that clients and team members stay on the same page. It includes templates, integrations, and real-time project updates.

Key features

Jetpack has an extensive template library for just about anything you need: emails, to-do lists, project workflows and more.

Jetpack Workflow is a good to-do list: you can have an overview of what your employees are working on or apply filters. Jetpack Workflow integrates with 2000+ apps that accountants might need— but these integrations are not direct: they are only available through Zapier.

Unlike many other options, Jetpack offers unlimited storage on all plans. Whether you have the basic plan or the premium one, you get unlimited cloud storage for your business needs.

What kind of businesses use Jetpack Workflow?

Jetpack Workflow is another platform designed for accountants and tax professionals. It’s a popular choice for firms looking to streamline their task and workflow management. That said, firms looking for a broader practice management platform with key features such as a client portal will want to look elsewhere.

Pricing

Jetpack offers a simplified pricing structure with just one plan called Starter. If billed annually, it costs $30 per user per month. For monthly billing, it’s $45 per user per month.

Should you need help setting up JetPack Workflow, it won’t be free: the Kickstarter service package costs $299. More advanced plans, Fast Track and Done For You, stand at $749 and $1,499, respectively.

Free trial

Jetpack offers a 14-day free trial, no card required. They do not have a free version you can use.

Pros and cons

| 👍 Pros | 👎 Cons |

| Extensive library of templates | No built-in client portal |

| Unlimited cloud storage | Outdated user interface |

| Seamless integration with other tools |

Ratings and reviews

G2 rating: 4.1 out of 5

Capterra rating: 4.8 out of 5

Positive reviews focus on ease of use and increased firm organization and efficiency. The biggest complaint is that some users had outgrown the software and needed to find an alternative, but most other cons focused on small issues.

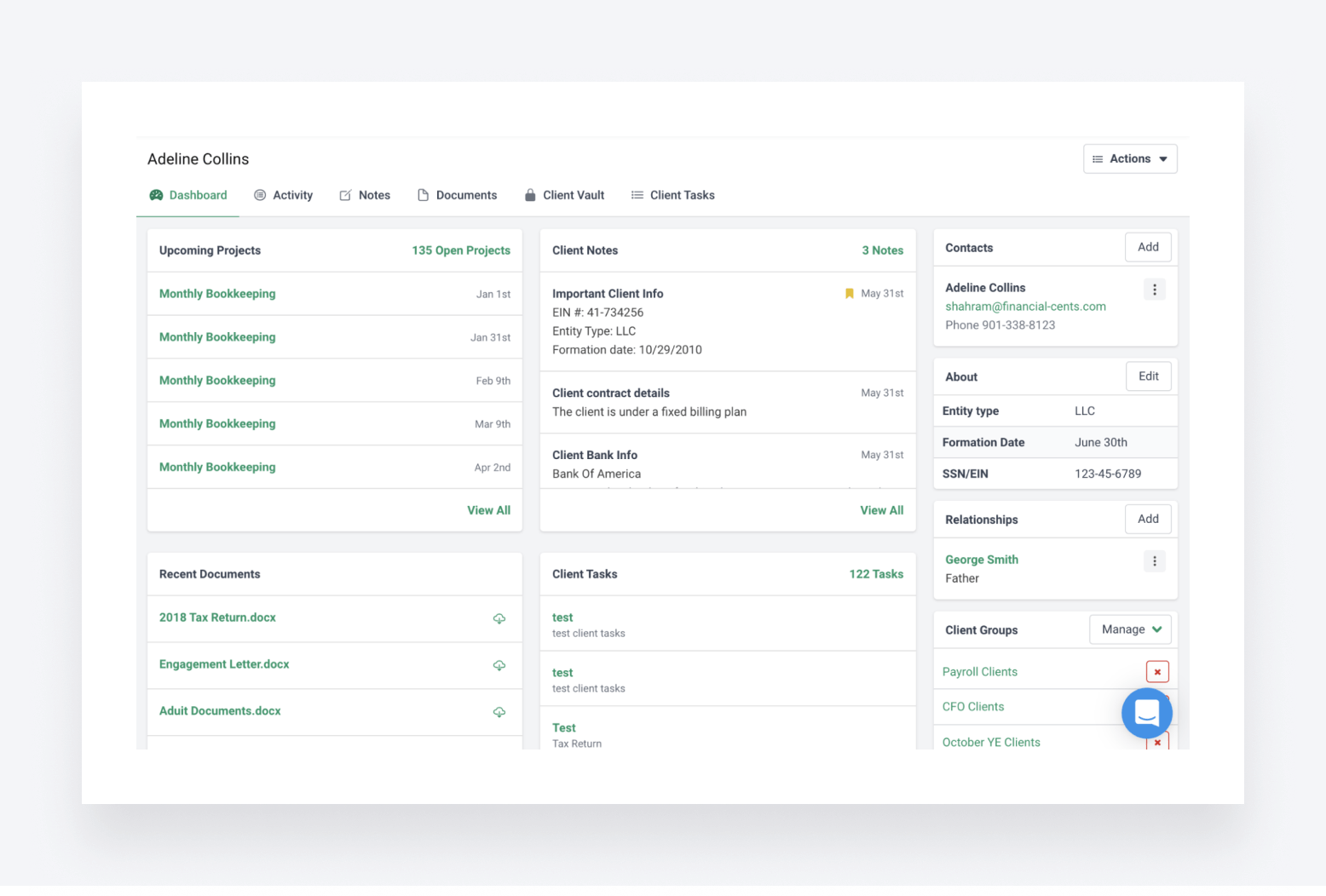

3. Financial Cents

Financial Cents’ sole focus is getting work done. Their subtler promises are cost savings ($19k per employee every year) and time savings (14 hours per employee weekly). There’s also a 30-day money back guarantee.

Key features

You have the run-of-the-mill workflow templates, but there’s a twist: you can upload your own or use AI to create some for you. You can set up recurring tasks, discuss work with your team members inside the workflow and generally track projects’ progress.

What we liked most is the smart way Financial Cents enables you to handle emails from clients. You can create a separate inbox for work-only emails from clients, track communication history within each task, pin important messages to the top and, most impressively, turn emails into projects and track their status.

On the downside, there are no e-signatures available, nor can you rely on a built-in cloud storage to organize documents. QuickBooks also seems to be the only integration Financial Cents offer.

What kind of businesses use Financial Cents?

Financial Cents is popular with small and medium-sized accounting practices looking for a relatively basic practice management platform for improving internal collaboration and organization. The platform lacks mobile apps, however, which will put off accountants looking to manage their work on the go.

Pricing

Financial Cents offers a $39/month (per user) Team Plan and $59/month (per user) Scale Plan.

Free trial

There’s a 14-day free trial available.

Pros and cons

| 👍 Pros | 👎 Cons |

| Custom and AI-generated workflow templates | No mobile apps for firms or clients |

| Useful email management tools | Limited integration options — only QuickBooks Online currently |

Ratings and reviews

G2 rating: 4.8 out of 5

Capterra rating: 4.8 out of 5

Positive reviews mention the lightning-fast speed of customer service and ease of implementation. Some users have complained about the software’s limited template import options and functional issues with workflow triggers.

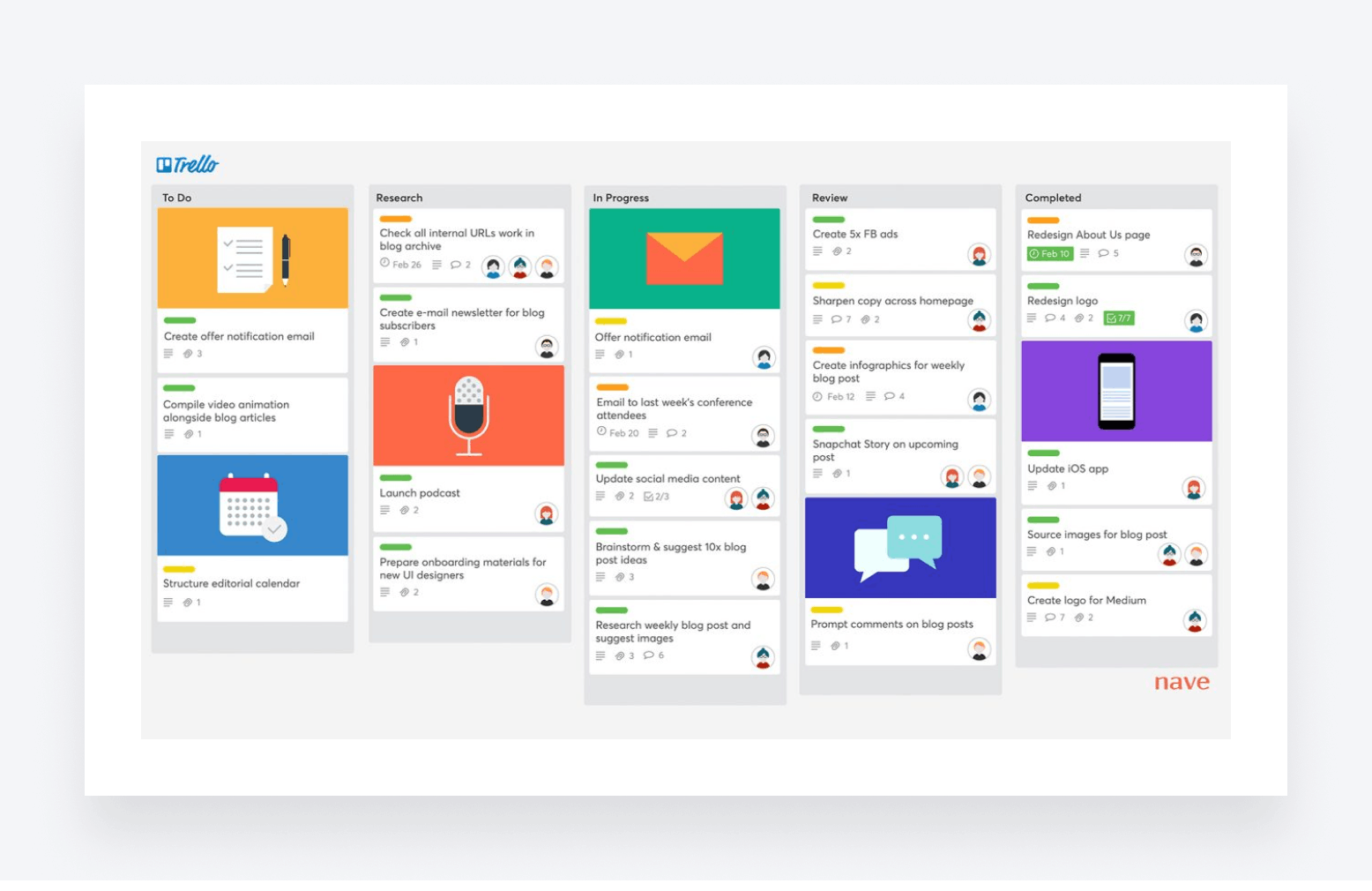

4. Trello

Trello is workflow organization software for solopreneurs and small teams. It is not specifically designed for accountants but could work well for a small accounting firm or a small team within a larger organization.

It allows every team member to see what tasks are in progress, which ones are in the backlog, and – most importantly – when each task is due.

Key features

Trello is a to-do list app that includes team communication capabilities. Your team members are assigned, or can pick, tasks from a Trello board. You can also add custom labels to tasks, to determine urgency, or highlight anything else you might need.

What differs based on the level of your subscription is the way you can visually organize work processes. The Free and Standard plans come only with the bog-standard Kanban view. More advanced options offer Timeline, Table, Calendar, Dashboard, Map and Workspace views.

Trello includes templates from the company and the Trello community. These offer a way out if you don’t want — or simply don’t have the time — to tinker with processes and build them from scratch.

Trello has its own AI assistant — Butler — for workflow automation. However, the number of automations is limited — and dependent — on the plan you use. Trello is also integrated with many apps you’re used to, such as Slack, Zoho, Gmail, and more.

What kind of businesses use Trello?

Unlike most of the tools on this list, Trello isn’t designed specifically for accountants. It’s a highly popular task and project management platform that’s used by a wide range of businesses, although it’s particularly popular with marketing, design, and other online businesses that enjoy its visual approach to task and workflow management.

Pricing

Trello has 4 plans — Free, Standard, Premium and Enterprise — priced at $0, $5, $10 and $17.5 per month, respectively. The paid plans include more advanced functionality, such as unlimited boards for larger teams, higher storage limits, and different views (on top of the usual Kanban).

Free trial

In addition to the free version of the software, Trello also offers a free 14-day trial of its paid subscription.

Pros and cons

| 👍 Pros | 👎 Cons |

| Kanban board interface for task management | Not built specifically for accounting workflows |

| Integrations with popular apps such as Slack, Gmail, etc. | Limited automation capabilities |

| Community templates to quickly setup workflows | No dedicated client portal or accounting-specific features |

| AI assistant for workflow automations | Limited storage capabilities |

Ratings and reviews

G2 rating: 4.4 out of 5

Capterra rating: 4.6 out of 5

Most users rated it as excellent for collaborative projects, especially remote ones. The negative reviews focused on UX issues, pricing and customer support.

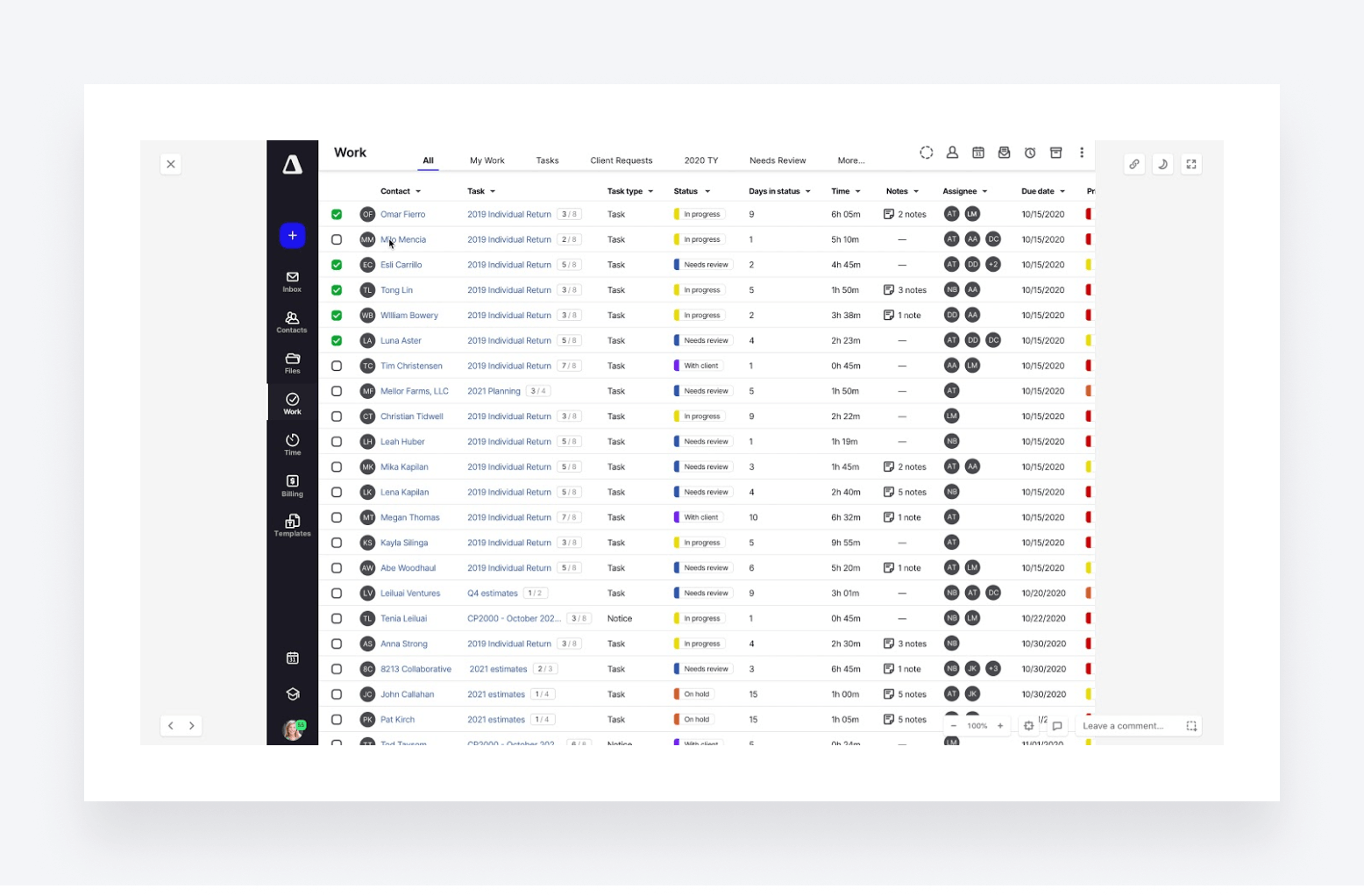

5. Canopy

Canopy is a management software platform designed with accounting firms in mind. Canopy includes tools for client and project management, document organization and sharing, time tracking and billing. As the name suggests, it brings all the tools a firm needs under one canopy.

Key features

Canopy offers impressive functionality for automating your workflow. You have your usual tasks and sub-tasks for team members and a bunch of tools (such as organizers) that help clients — and can be sent automatically

You can also rely on ready-made templates to streamline internal work processes, track billable hours and, perhaps most impressively, leverage in-depth reporting. It helps you get an overview of the status of the tasks, who’s doing what, and how these processes can be made more efficient.

What kind of businesses use Canopy?

Canopy is used by accounting and tax professionals across the world. Due to its minimum number of five users, it’s clearly not designed with solopreneurs and small firms in mind. Canopy’s modular pricing is particularly complex, meaning the platform gets increasingly expensive as a firm scales, which may put off fast-growing firms.

Pricing

Canopy’s “base” tool is its client management tool. It is free for up to 250 client contacts.

If you want additional functionality, such as workflow ($45), document management ($40), time & billing ($35), you’ll have to pay more — on a per-user-per-month basis.

Free trial

Canopy includes a 15-day free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Ready-made templates for standardization | Modular pricing can get expensive for full functionality |

| Workflow automation capabilities | Limited client contacts in base plan |

| No custom website capabilities | |

| Limited document storage, according to some reviews |

Ratings and reviews

G2 rating: 4.6 out of 5

Capterra rating: 4.5 out of 5

Most of the negative reviews focus on the pricing model and automation capabilities. On the positive side, the reviews praise the software’s ability to effectively organize files and folders.

6. TaxFlow

TaxFlow, as the name implies, is workflow software specifically made for tax professionals. Instead of being a full-fledged CRM, it is a tool that focuses solely on tracking tax returns through the stages.

While it won’t suit all accountants, tax preparation is such a key piece of the work many accountants perform for their clients that we feel it merits a spot on our list.

Key features

TaxFlow allows accountants and tax preparers to monitor work status, check which tax preparers worked on each return, and make notes inside each return as it moves through stages.

Unlike other tools on the list, you cannot visually assess the work of your employees. The default screen is a list of clients your firm handles. Only when you click on a separate client (i.e. their return), can you create checklists with tasks, attach notes, add labels and more.

What kind of businesses use TaxFlow?

With its somewhat narrow use case, TaxFlow is used exclusively by tax professionals to streamline the tax preparation and filing process. Accounting firms with a broader focus will want to look for a more comprehensive workflow and practice management platform.

Pricing

TaxFlow’s pricing model is straightforward: $20 per user per month if billed annually and $25 per user per month if billed monthly.

Free trial

TaxFlow offers a 14-day free trial. There’s also the lure of a free set-up and free training for your employees.

Pros and cons

| 👍 Pros | 👎 Cons |

| Purpose-built for tax workflow management | Very tax-specific, may not suit broader accounting needs |

| Free setup and training | No visual workflow management views |

Ratings and reviews

Capterra rating: 4.9 out of 5

But there’s a catch: there are only 8 reviews in total.

Most users were upgrading to TaxFlow from Google Sheets, so it’s easy to see how it was an upgrade. Customers also appreciated the price point. However, note that TaxFlow cannot comprehensively automate all firm workflows on its own. Instead, it is best utilized as one component within a firm’s overall tech stack, supplementing other tools.

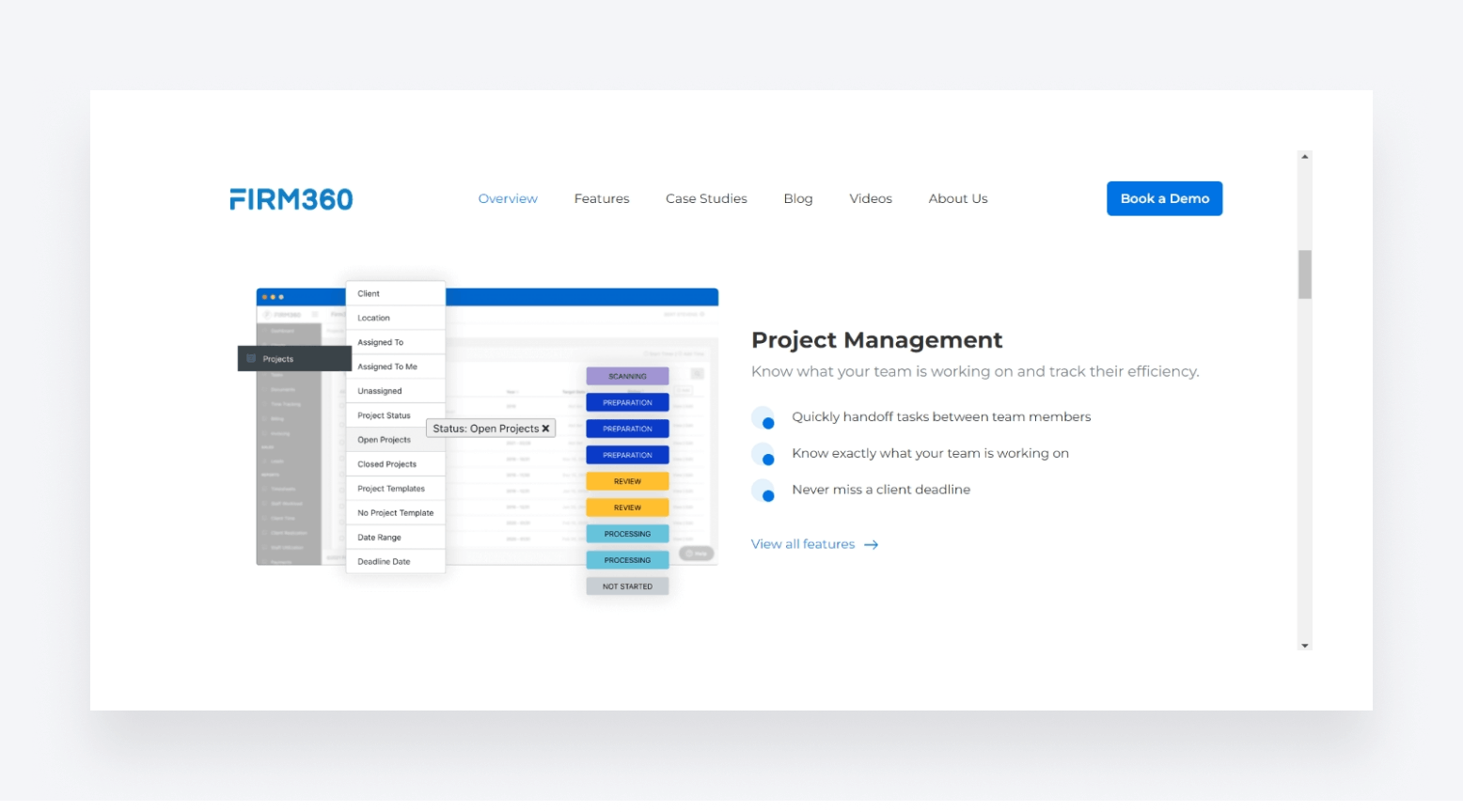

7. Firm360

Firm360 is an accounting firm workflow management software that includes document, project, and client management, as well as time tracking, billing, and productivity management.

Key features

Firm360 positions itself as specialized software for accounting practices. You’ll find the usual package under the hood: client and project management, document management, time & billing and advanced reporting.

However, the pool of integrations is unclear: QuickBooks online, MS Office and Adobe Acrobat are mentioned, with “1,000s more available through a Zapier integration.” Another potential downside is that Firm360 only supports Stripe as a payment provider. It does have the e-signature feature built into Firm360.

What kind of firms use Firm360?

Firm360 is designed to help accountants streamline their day-to-day workflows. There’s no information on its website about pricing or plans, however, so it’s difficult to know what type of accounting firms they are targeting.

Pricing

Firm360’s pricing is not publicly listed on their website. To get details on their different pricing tiers and what is included in each plan, you need to book a demo with their sales team first.

Free trial

Firm360 does not have a free version or a free trial.

Pros and cons

| 👍 Pros | 👎 Cons |

| Designed specifically for accounting practices | Limited payment integration (Stripe only) |

| Integrations with QuickBooks, MS Office, Adobe | No free trial to test out |

| No pricing details provided |

Ratings and reviews

G2 rating: 4.5 out of 5

Capterra rating: 4.7 out of 5

Some users mention that the implementation was confusing, and the workflows are complicated. On the whole, most users were satisfied with the value provided for the asking price.

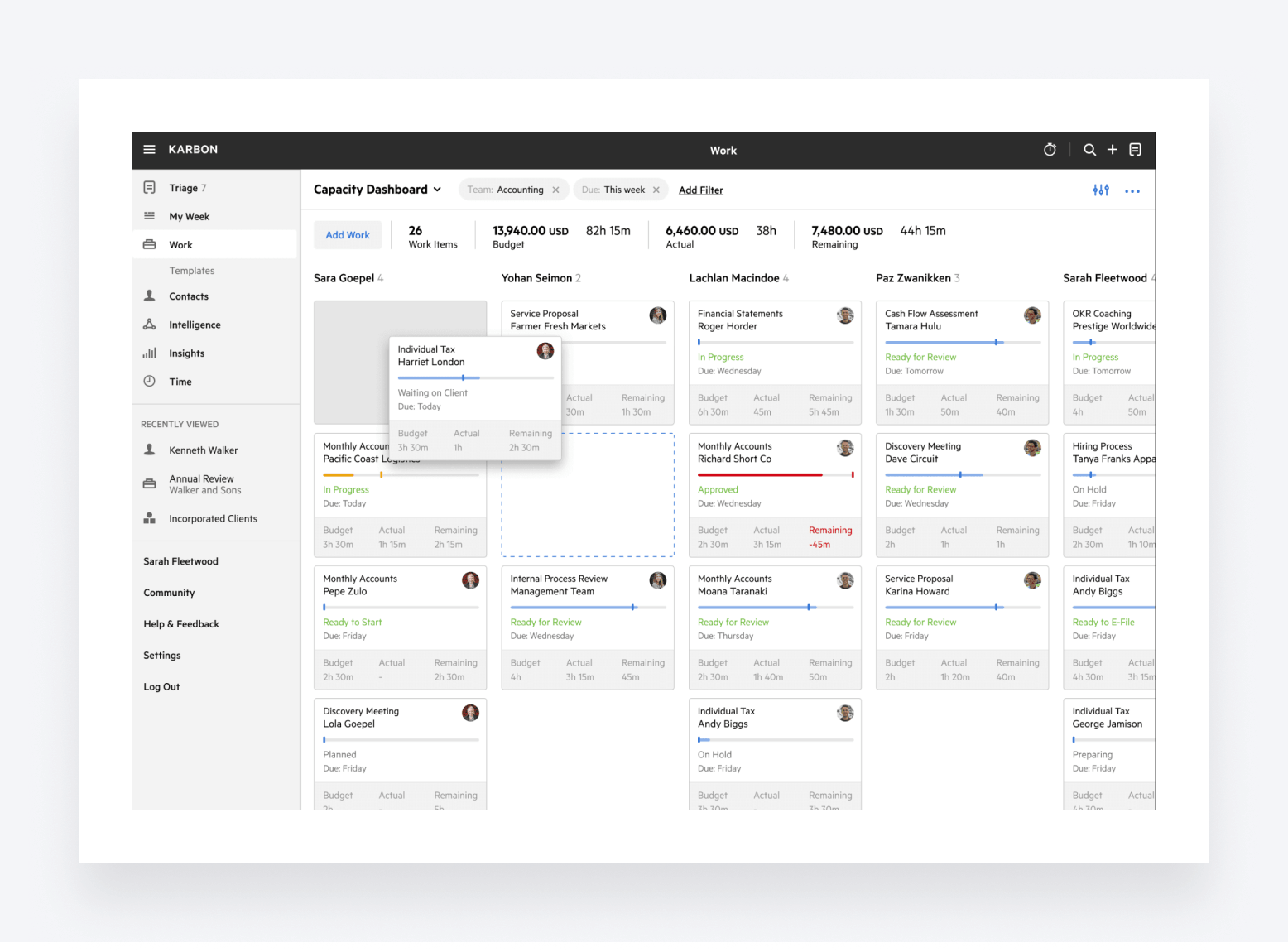

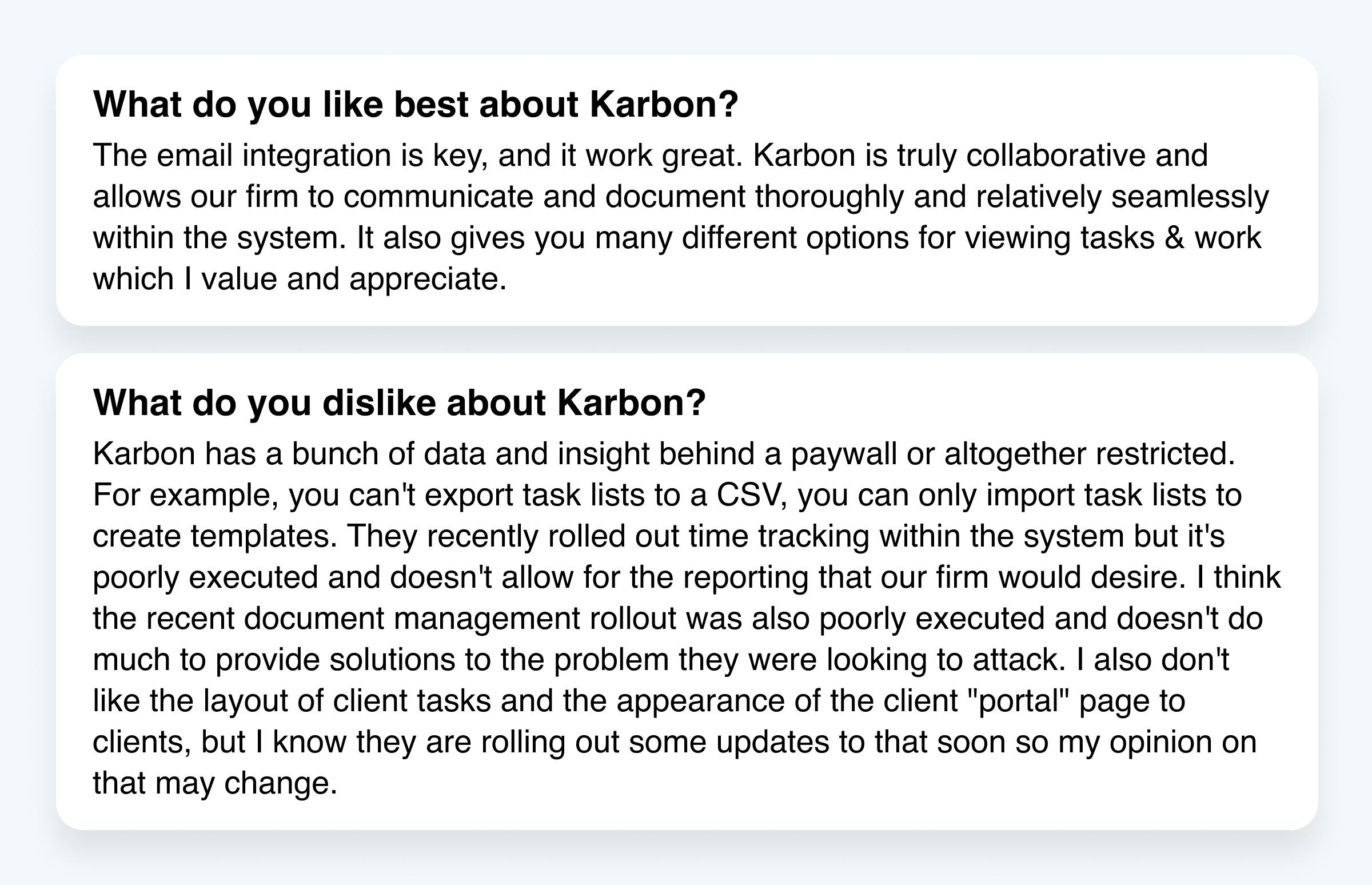

8. Karbon

Karbon is the eighth entry on our list. One of Karbon’s main selling points is its promise to unite an accounting practice wherever its users might be. We won’t name it a unique proposition, though: many similar tools offer that benefit as well. In a more interesting twist, Karbon vows to save every employee at your firm 16.5 hours weekly with its automations.

Key features

Karbon’s workflow automation unites its top features under one roof. You have the usual client portal, built-in document storage, workflow templates, Kanban boards to visualize work, and automatic reminders to save your employees time chasing clients.

What makes Karbon stand out is the “My Week” feature, which promises to organize your team members’ weekly schedule.

What kind of businesses use Karbon?

Another comprehensive practice management platform, Karbon is built for accounting firms of all sizes. That said, its pricing structure means you have to pay more to unlock the full feature set, which may be an issue for smaller firms or those on a tight budget.

Pricing

There are 3 plans: Team, Business and Enterprise. Only the former two have a fixed price: they currently cost $59 and $79 per user per month if billed annually. Enterprise is a custom plan — you’ll have to contact sales to figure out your unique pricing structure.

Free trial

Apparently there is one, but it’s unclear how long it’s for. There is no free version of Karbon.

Pros and cons

| 👍 Pros | 👎 Cons |

| “My Week” feature for team scheduling | Mixed reviews on to-do list usability |

| Client portal and workflow templates | New document management feature has areas for improvement |

Ratings and reviews

G2 rating: 4.8 out of 5

Capterra rating: 4.7 out of 5

The positive ones focus on time-saving, the ability to overview work, and workflow templates you can customize. On the negative side, users point to limitations in exporting tasks, new feature rollouts that fell short, and areas where the client experience could be better designed.

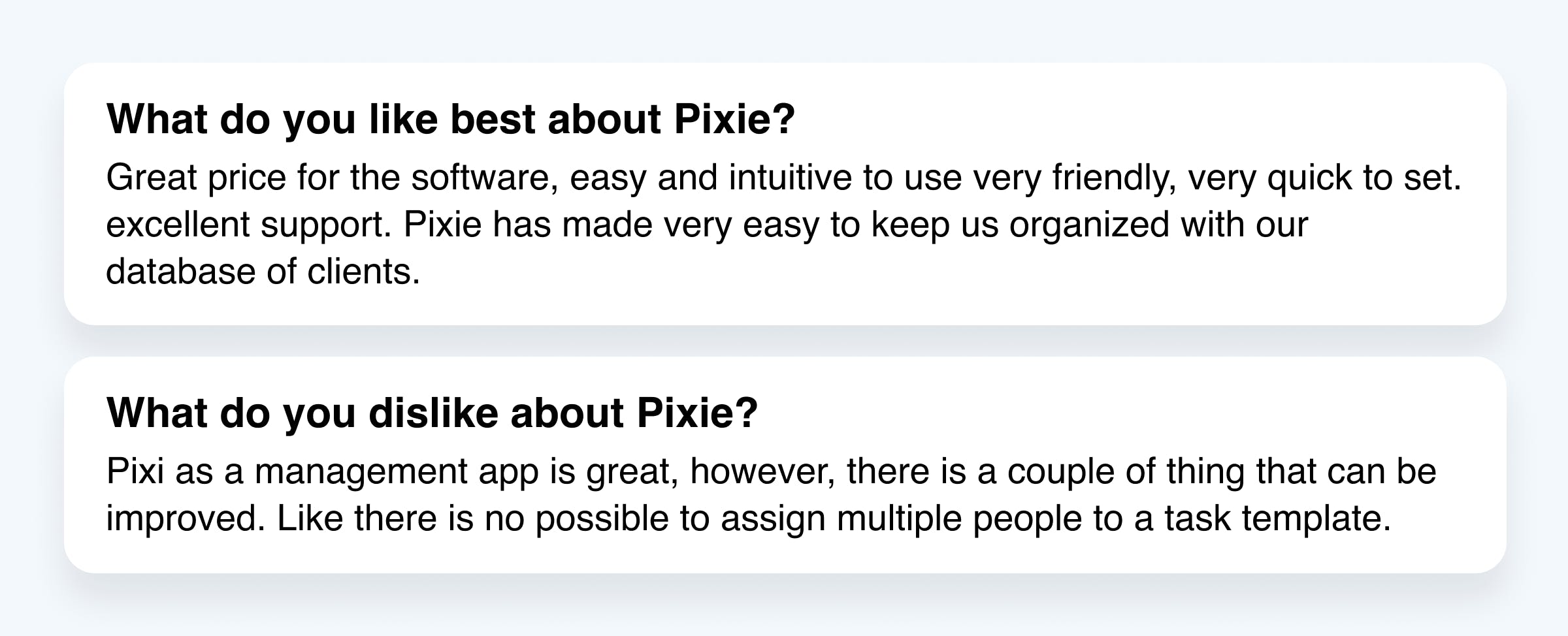

9. Pixie

Pixie is a platform offering various features to help accounting firms streamline their workflows, spend less time on admin, and organize client data – ultimately, to save time and get things done faster. In its own words, Pixie is designed to help firms run operations like clockwork.

Key features

Pixie’s key features include workflow automation — for example, for recurring jobs — custom fields for clients and a document portal, live chat support and community-made templates for applying accounting best practices to your operations right off the bat.

What also stands out about Pixie is that pricing is tailored to scale with businesses. You will pay a monthly subscription fee based on the number of clients you manage.

What kind of businesses use Pixie?

Pixie is a solid choice for accounting practices looking for a relatively simple yet easy to use workflow management system. Its lack of a client portal, however, may be a stalling point for firms looking to offer an enhanced client experience.

Pricing

Pricing for Pixie is based on the number of clients you have. For teams with less than 250 clients, Pixie costs $129 per month. For 251–500 clients, it’s $199 per month, and for 501–1000 clients, it’s $329 per month. For more than 1000 clients, Pixie is priced on application (POA).

Free trial

Pixie’s free trial lasts 30 days. All you have to do is create an account to trial the software.

Pros and cons

| 👍 Pros | 👎 Cons |

| Ready-made templates for best practices | Inability to add internal notes to workflows |

| Live chat support and an active community | No client portal |

Ratings and reviews

G2 rating: 4.8 out of 5

Capterra rating: 4.8 out of 5

Positive user reviews state that Pixie is great for organization and is easy to set up and use, but negative user reviews state that Pixie lacks advanced features for more complex workflows.

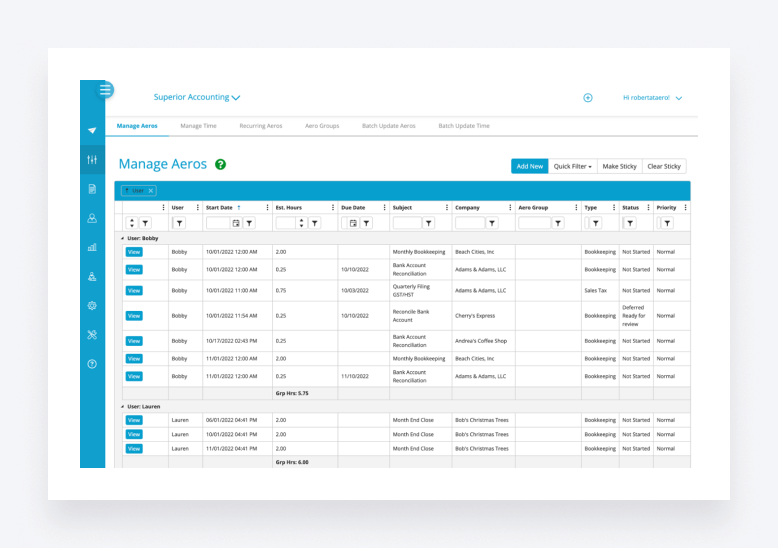

10. Aero Workflow

Aero Workflow calls itself a workflow management tool for accountants, designed by accountants. It lets you create checklists for any accounting or bookkeeping process, set up one-time and recurring tasks, track work and staff, and get insights into your firm with customizable reports. It also offers several integrations – including QuickBooks Online.

Key features

Aero Workflow is a great platform for basic accounting and bookkeeping processes. It offers all the right tools and features that most accountants look for when it comes to streamlining their workflows, from client onboarding to organizing and tracking tasks.

It also offers a template and procedure library to help with best practices, plus useful integrations that include QuickBooks, Office 365, Zapier and more. On top of that, Aero Workflow offers a free White Glove Onboarding service to help firms fully set up new workflows.

What kind of businesses use Aero Workflow?

Aero Workflow is a sensible choice for accounting practices looking for a reliable system for standardizing accounting workflows. It’s not a complete practice management platform, however, and its lack of key features means firms will need to use additional software alongside it.

Pricing

Aero Workflow offers three paid plans: Startup for 1–5 users, Growth for 6–25 users and Scailng for 26–50 users. Per month, these cost $135, $250 and $365 respectively.

There is no real difference between the plans except for the price you’ll pay based on the number of users.

Free trial

Aero Workflow offers a 30-day free trial for each plan.

Pros and cons

| 👍 Pros | 👎 Cons |

| Built specifically for accountants and bookkeepers | Lack of more robust document management capabilities |

| Process template library | No client portal for external collaboration |

| Useful integrations like QBO, Office 365 |

Ratings and reviews

G2 rating: 4.7 out of 5

Capterra rating: 4 out of 5

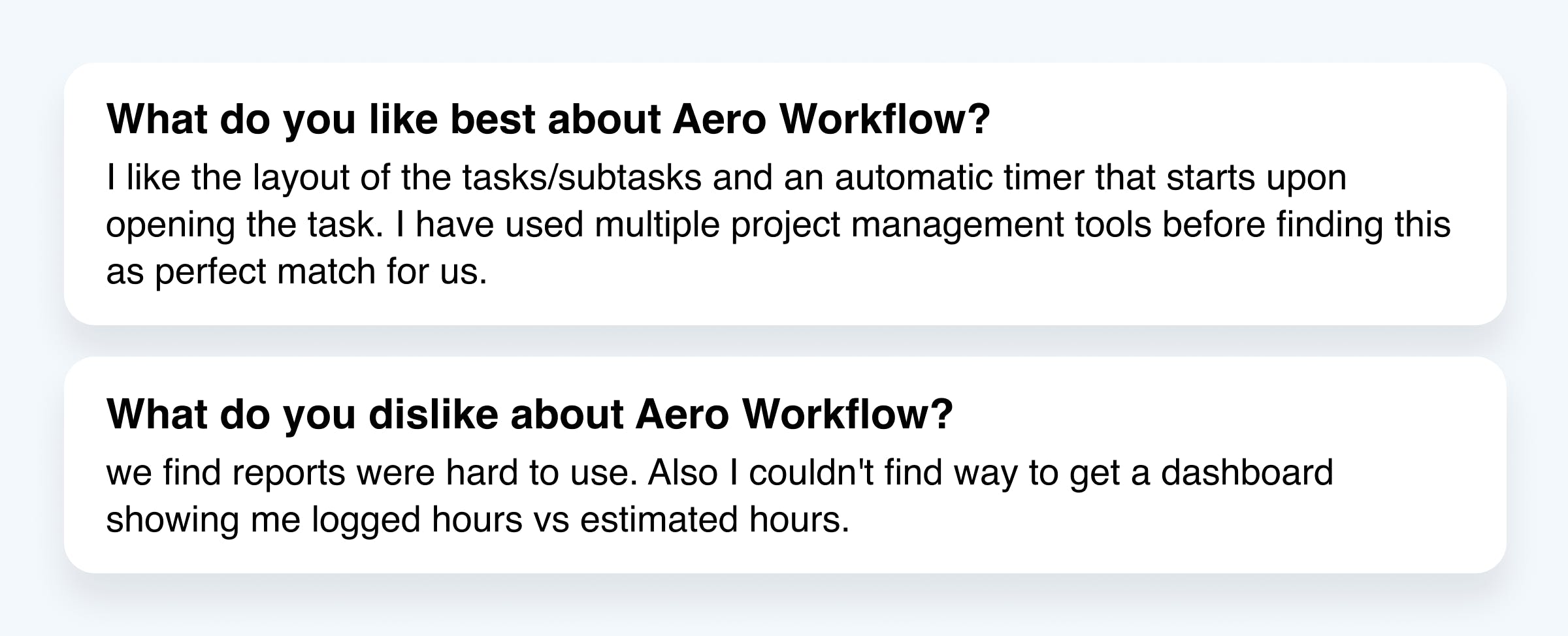

Pros that users mention include the layout of the tasks and subtasks, plus how straightforward it is to organize teams and projects. However, several cons stated difficulty of use, a dated interface and unhelpful customer service.

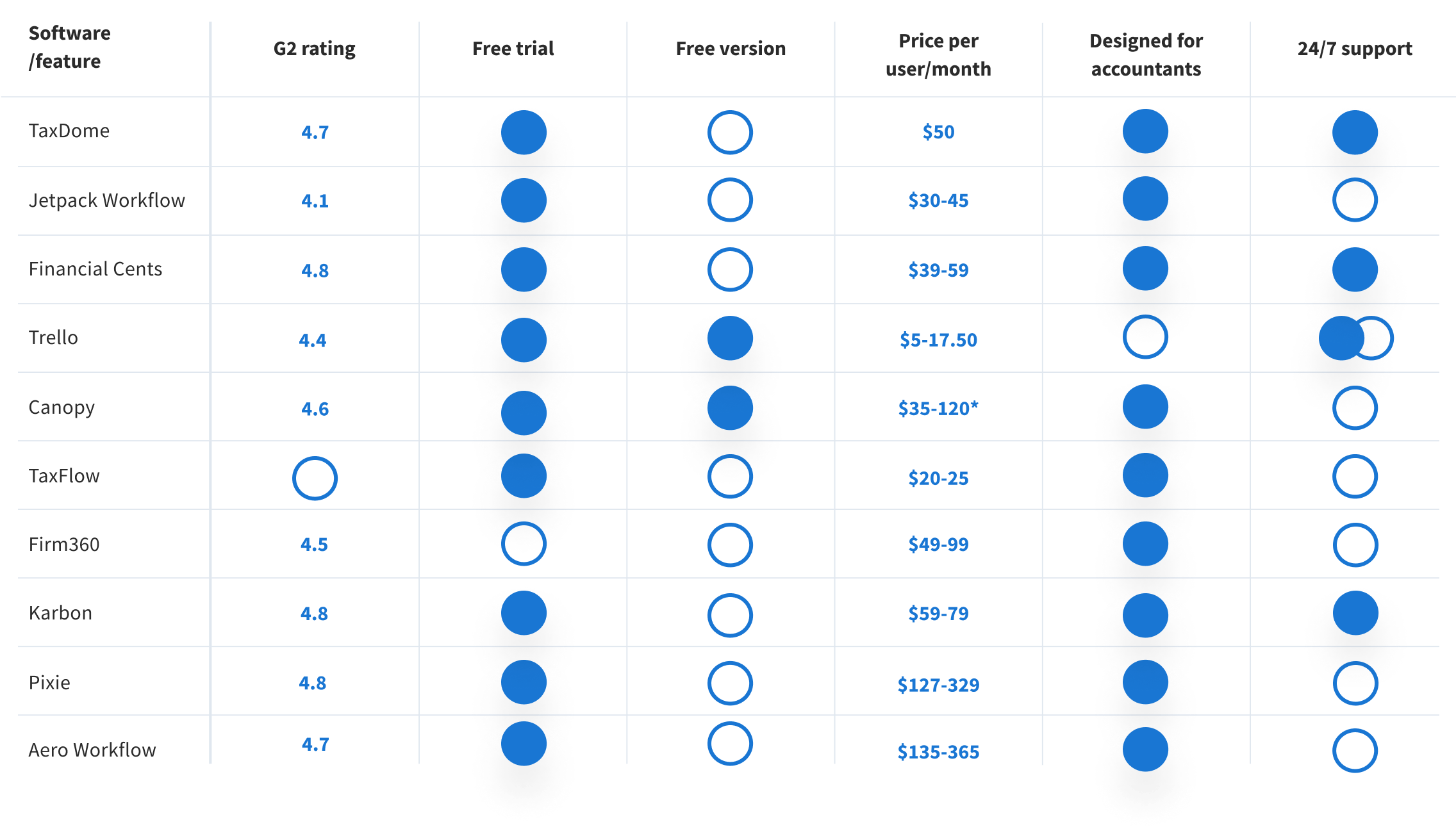

Comparison of workflow management software

We’ve covered a lot of ground in this article, so to help you make the right choice, here’s a simplified chart of how these ten solutions compare in terms of customer satisfaction, pricing, support and more.

After extensively researching and evaluating the available accounting workflow management options, we’ve come to the following conclusions:

- If you need a simple and cost-effective Kanban board and to-do list, go with Trello

- If you need a straightforward upgrade to Google Sheets for your tax returns, TaxFlow is your buddy

- If you need serious analytics of internal processes, Canopy could be your go-to tool

- If you need a powerful, comprehensive solution to streamline the management of clients, employees, documents and more from a single platform tailored for accounting firms, TaxDome stands out as the best option

We encourage you to review our detailed feature comparisons to see how TaxDome differentiates itself and aligns with the needs of your accounting practice.

*Canopy has a modular pricing structure, with each module priced individually.

Case study: a real-life example of accounting workflow management software in action

To help you get a feeling for the transformational effect accounting workflow management software can have on your firm, let’s take a look at a real-life example.

Sydney H. Highly CPA is an accounting and bookkeeping firm based in California. With tax season looming, the firm was looking for a solution to help streamline their tax return workflow, increase efficiency and improve the client experience. They settled on TaxDome.

Implementation

Implementing TaxDome allowed the firm to automate large parts of the tax return workflow, including client communications, document gathering and invoicing.

At the same time, TaxDome’s pipelines simplified team management, providing complete visibility into who’s working on what and where each job is on its journey to completion.

Results

Thanks to TaxDome’s automated workflows, Sydney H. Highly CPA was able to complete more tax returns than ever despite limited staff resources. Not only did the team manage to unlock new levels of efficiency, but they also ensured that clients were kept in the loop throughout the tax return process.

Here’s what Sydney H. Highly had to say about his experience working with TaxDome:

Conclusion

A workflow management tool is a solution that helps optimize your firm’s internal processes. It provides an overview of where things stand and helps identify weak spots. If such a tool comes with automations, they can significantly unburden your team from routine tasks.

When choosing one tool over another, consider the size of your firm, your client base and the specifics of your services. These answers will filter out many options right away.

Want an overview of TaxDome’s capabilities? Join our demo below and discover the many ways it can benefit you in 30 minutes.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.