Auditing demands attention to detail and accuracy — often under pressure. It can be a complex, nuanced process, with a high risk of error due to the large amount of financial data it typically involves.

Audit software has become an invaluable tool in light of these challenges, helping accountants and organizations maximize efficiency and accuracy at each step of the auditing process.

In this article, we’ll explore the benefits of audit software and the key features to look for, plus five of the best audit software solutions worth considering in 2024.

What is audit software for accounting firms?

Audit software refers to any digital program or application that helps CPA and accounting firms conduct financial audits. As auditing can be complicated and time-consuming, audit software is designed to simplify and speed up the process.

These tools and platforms achieve this through various features that streamline different auditing processes, such as managing and analyzing financial data, assessing risks, complying with laws and regulations, creating reports, and more.

The role of audit software in enhancing accuracy and efficiency

Improving audit accuracy and efficiency are two major advantages of using audit software, due to features that automate tasks, analyze financial data, and generate reports automatically.

This allows accountants to streamline their auditing workflows and save time, as it can significantly reduce the amount of manual work involved.

In addition, audit software can minimize the potential for human error. With tools that organize documents, sync financial data accurately, identify risks, manage compliance, and more, auditing software can take care of some of the technical and organizational aspects of auditing, allowing accountants to feel more confident in their processes and analyses.

Key features of top auditing software

Auditing software platforms typically combine various features to serve different functions and needs. So, before committing to the first audit software you find, it’s worth knowing the essential features to look for when browsing the market.

Automation

Automation can automatically take care of repetitive manual tasks. In audit software, this can include document syncing, data analysis, reporting, and more — providing you with more free time for other auditing responsibilities.

Data analysis

With financial audits often involving lots of data to analyze, audit software that offers fast and accurate analyses of different data sources can not only save you time but eliminate the risks of oversights and inconsistencies.

Document management

Document management can help you store and organize financial documents in one place. This feature can provide you with a clear overview of all documented information that’s easier to review and reconcile as a single source of truth.

Reporting

A powerful reporting feature can automatically generate reports based on financial data across a given period. This can save time, minimize the risk of errors, and streamline your process of creating and reviewing financial reports.

Audit trails

A transparent audit trail can be a lifesaver — especially during the auditing process. Audit software that keeps a monitorable record of all user activity will enable you to keep track of changes and rectify any mistakes that arise.

Team collaboration

For CPA and accounting firms, collaboration is important. Audit software that fosters cloud-based teamwork through task delegation, access control, seamless communication, and more will make it easier for teams to complete audits efficiently.

Risk assessment

Audit software that helps identify audit risks, such as inconsistencies and omissions within financial statements, can save significant time. By highlighting these issues in advance, a risk assessment feature can also ensure your final audit reports are credible and thorough.

Compliance management

Laws and regulations in the finance industry are often complicated — and subject to change. Audit software that stays up to date with these laws, regulations, and accounting standards can ensure your firm’s compliance and also assist you in conducting compliance audits.

Security

Handling sensitive financial information must always be done securely. Security measures, such as encryption, multi-factor authentication, and data backups, are vital in ensuring the protection of your clients’ data.

Integrations

The ability to integrate other software tools into your workflows can increase your overall efficiency and provide a more intuitive user experience for your firm members and clients. It can also help ensure that the auditing software will continue to meet your needs if your operations expand.

Top audit software for CPA firms in 2024

Focusing on the key features, pros and cons, pricing, and more, here’s a round-up of five top audit software options for accounting and CPA firms in 2024.

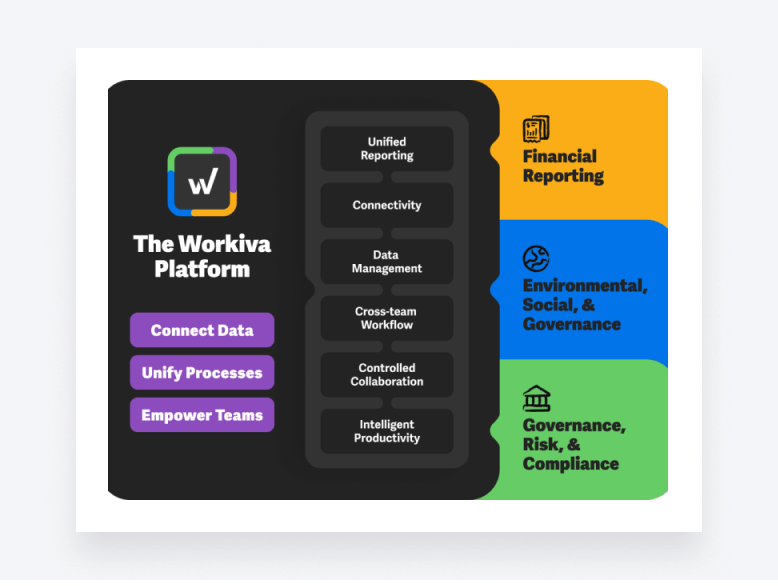

Workiva

Workiva is a platform that combines financial reporting; environmental, social, and governance (ESG) reporting; and governance, risk, and compliance (GRC) reporting. Trusted by more than 6,000 global companies, Workiva can consolidate data from a host of sources and increase efficiency with intelligent automation and collaboration tools, making it a noteworthy all-in-one auditing solution.

Key features

- Financial, ESG, and GRC reporting

- SOX compliance

- Syncing of financial and non-financial data via APIs and a host of supported documents

- Real-time risk assessment and analytics dashboards

- Automation and artificial intelligence (AI) capabilities

- Team productivity and collaboration tools, including automatic audit trails

Pros and cons

| Pros | Cons |

| Provides an all-in-one solution for audit and risk management | May not be ideal for solo firms that won’t use all the features |

| Syncs and organizes data from a host of sources | Due to its many features and tools, users may experience occasional interface lag |

| Designed for team collaboration and productivity | Plans could be costly for large firms and enterprises |

| Boosts efficiency with workflow automations and AI tools | |

| Offers real-time risk assessment and audit analytics |

Pricing

For plans and pricing, interested customers are encouraged to contact Workiva directly or request a demonstration.

Reviews

The current G2 rating for Workiva is 4.5 out of 5 based on more than 780 reviews.

Many user reviews praise Workiva’s data connectivity, compliance management, and AI capabilities. However, negative user comments commonly cite interface lag, costliness, and outdated spreadsheet functionality as drawbacks.

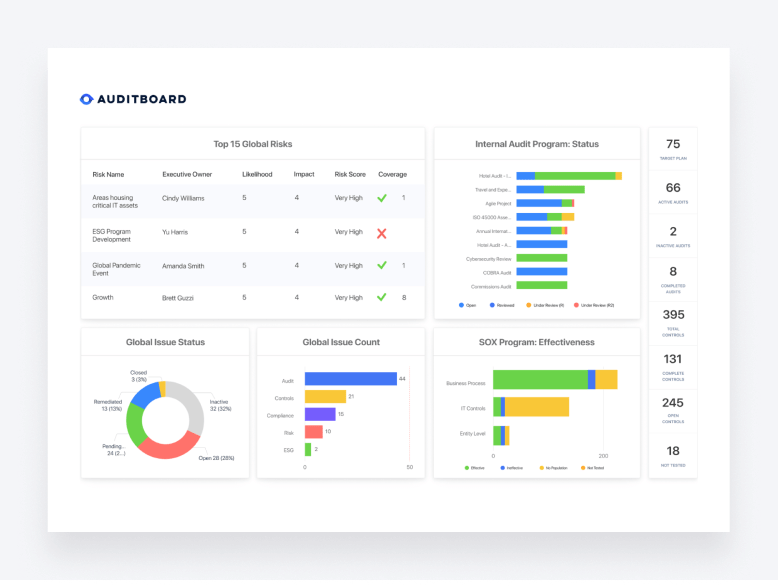

AuditBoard

AuditBoard is a platform that’s designed to streamline audit, compliance, and risk management for teams. Boasting more than 100,000 users and trusted by companies that include Uber and Lenovo, AuditBoard delivers an attractive suite of tools for automating data collection and tasks, analyzing and reporting, managing risk and security, ensuring compliance, and more.

Key features

- Collaborative audit and risk management

- GRC and ESG reporting, IT security, fraud investigation, and internal controls assessments

- SOX compliance

- More than 200 integrations

- AI-powered analytics and automation

- Audit trails

Pros and cons

| Pros | Cons |

| Designed specifically for team-based audit, compliance, and risk management | May not be ideal for solo firms that won’t utilize all of the features |

| Provides IT risk, fraud, and cybersecurity reporting | Plans could be costly for large firms and enterprises |

| Offers ample integrations for data consolidation, compliance, and more | |

| Increases efficiency with AI-powered analytics and task automation | |

| User-friendly interface that includes dashboards for real-time monitoring of risks, audit statuses, and more |

Pricing

For plans and pricing, interested customers are encouraged to book a live demo or schedule a call with the AuditBoard team.

Reviews

The current G2 rating for AuditBoard is 4.5 out of 5 based on more than 860 reviews.

Based on these reviews, AuditBoard users praise the easy implementation, user-friendliness of the interface, and regular software updates, but mention costliness and occasional software bugs as disadvantages.

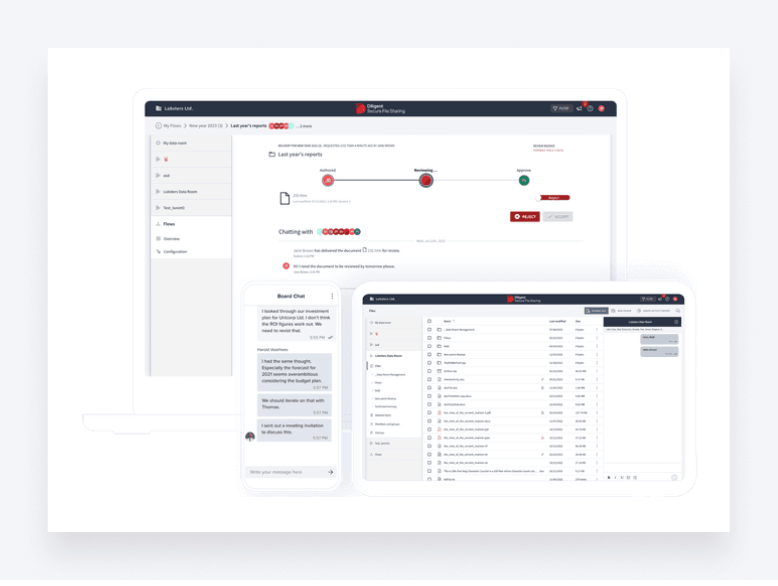

Diligent One Platform

The Diligent One Platform offers GRC and ESG reporting, with features that foster team and investor collaboration, simplify data analysis, and monitor risk and compliance. The Diligent One Platform also has dedicated mobile apps for iOS and Android, enabling users to manage their audits and collaborate on the go.

Key features

- Audit and risk management for teams collaborating with investors

- GRC and ESG reporting, including ACL Analytics

- Customizable workflow automations and AI-powered reporting

- More than 100 integrations

- Audit trails

- Mobile apps for iOS and Android

Pros and cons

| Pros | Cons |

| Designed to enhance collaboration between teams and investors | Some users might find this audit software difficult to learn initially |

| Offers easy customization of workflows | With a focus on collaboration, it may not be the ideal choice for solo firms |

| Provides AI-powered data analytics for real-time reporting | |

| Automatically connects and consolidates data from third-party integrations | |

| Offers mobile apps for managing auditing tasks on the go |

Pricing

For plans and pricing, interested customers are encouraged to contact The Diligent One Platform directly or request a demonstration.

Reviews

The current G2 rating for The Diligent One Platform is 4.5 out of 5 based on more than 120 reviews.

Positive user reviews cite workflow customization and the extensive analytics dashboards as the platform’s strong points, while most of the negative user comments highlight a steep learning curve as the main drawback.

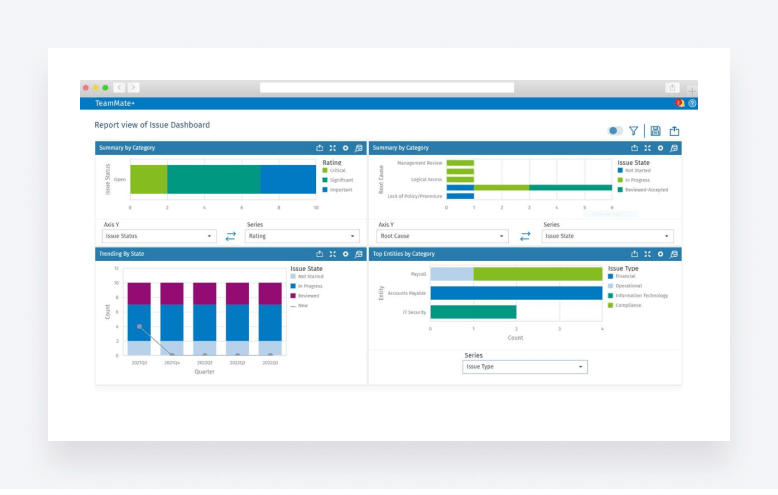

TeamMate

TeamMate by Wolters Kluwer is an award-winning platform specifically built to streamline the auditing process. With automated workflows for risk assessment and audit planning, analytics, report generation, and auditee interaction, TeamMate provides a tailored end-to-end auditing solution with a focus on efficiency and collaboration.

Key features

- Organized workflow stages specifically designed for auditing

- Team collaboration tools, including risk planning, task assignment, and audit trails

- Analytics and reporting tools, including end-of-audit report generation

- Integrations for importing third-party data from Word, Excel, and PDF documents

- Auditee portal for clients and stakeholders

Pros and cons

| Pros | Cons |

| Provides an organized workflow for end-to-end audit management | Some users may not like the limited workflow customization |

| Designed for team-based collaboration and planning | Offers fewer integrations in comparison with other top audit software platforms |

| Generates professional end-of-audit reports | |

| Offers multiple dashboards for data-driven analytics and reporting | |

| Provides an auditee portal for client and stakeholder collaboration |

Pricing

For plans and pricing, interested customers are encouraged to contact a TeamMate Specialist.

Reviews

The current G2 rating for TeamMate is 4 out of 5 based on more than 130 reviews.

Many of these user reviews praise TeamMate’s planning and collaboration features, regular updates, and auditing workflows. However, common drawbacks mentioned by users include a slow user interface, a lack of customization, and limited integrations.

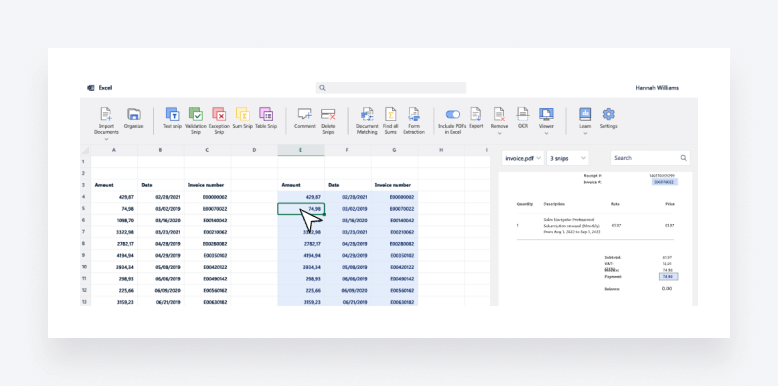

DataSnipper

DataSnipper is an automation platform made for accountants who do most of their auditing in spreadsheets. Used by more than 500,000 audit and finance professionals, DataSnipper is a useful spreadsheet tool for importing and reconciling data — helping to eliminate errors and speed up auditing processes in Excel.

Key features

- Integrates in Excel

- Text recognition and scanning for a range of files: invoices, contracts, financial statements, and more

- Automated syncing and reconciling of data

- Customizable data extraction for creating reports and more

- Co-authoring, enabling real-time collaboration for teams

Pros and cons

| Pros | Cons |

| Simplifies auditing in Excel by syncing and reconciling data automatically | No built-in data analytics, risk assessment, compliance, or reporting features |

| Offers an intuitive and straightforward user experience | Other software cannot be integrated into DataSnipper |

| Reads and imports data from a range of supported documents and files | Can make Excel slower |

| Includes tools for compiling and extracting Excel data | |

| Allows real-time collaboration for teams |

Pricing

DataSnipper offers three plans: Basic, Professional, and Enterprise. The Basic plan, which provides DataSnipper’s core features for small businesses, costs €49 (around $53) per user, per month for annual billing or €59 (around $64) per user, per month for monthly billing.

Before subscribing to the Basic plan, however, you can test the water with a 14-day free trial.

The Professional and Enterprise plans provide additional features for medium-sized businesses and enterprises respectively, with custom pricing based on specific needs.

Reviews

The current G2 rating for DataSnipper is 4.8 out of 5 based on more than 150 reviews.

The majority of positive reviews highlight DataSnipper’s ease of use — particularly for scanning documents and syncing data. The common drawbacks users mention include slow document imports and uploads, and how DataSnipper can cause lag within Excel.

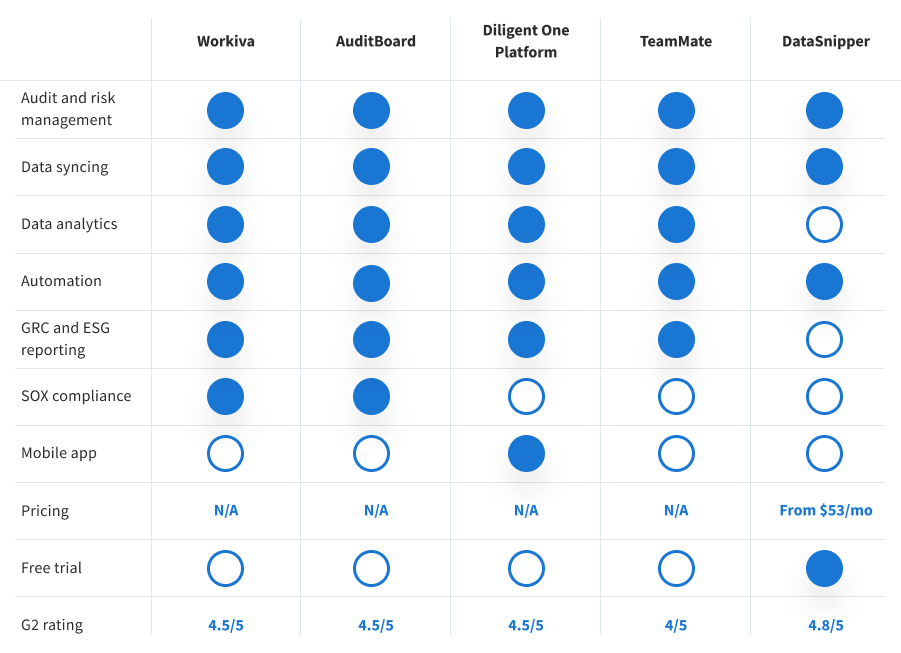

Comparison of the best audit software options

While all of these platforms are designed to simplify audit and risk management, reporting, and compliance, where they greatly differ is in the user experience they provide and the main strengths they bring to the table:

- Workiva is a versatile option for comprehensive reporting and compliance

- AuditBoard is a top choice for team-based auditing and planning

- The Diligent One Platform is ideal for stakeholder collaboration and involvement of investors

- TeamMate is easily implementable thanks to its ready-made auditing workflows

- DataSnipper is best for simplifying the auditing process in Excel

TaxDome: an award-winning solution

Auditors can also benefit from managing their clients, workflows, and reports in one comprehensive tax, bookkeeping, and full-service practice management platform designed to simplify firm operations and improve revenue operations.

TaxDome’s industry-leading solution — the recent winner of the CPA Practice Advisor Readers’s Choice award for ‘Comprehensive Firm Workflow Solutions’ — has helped more than 10,000 firms in 25+ countries achieve new heights of success.

Conclusion

It can be hard to make the right decision for your firm when there are so many audit software options out there, so we hope this article has helped you gain a better understanding of the key features to look for and some of the best solutions the current market has to offer.

Just remember: while it might be tempting to opt for the audit software that rounds up the most features, the best solution is the one that aligns with your specific needs, improves your overall auditing process, and adapts as your firm operations expand.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.