These are the two long-awaited features you’ve asked for — to be able to create recurring jobs and to create task dependency. You can now accomplish both with Job Schedules & Automove.

TaxDome now allows you to build fully automated and customizable workflows suitable for whichever service you provide: taxes, accounting, bookkeeping, etc.

What does this mean? In short, you can now ‘Set it and forget it’.

For example, every year on January 5 (this is the schedule part) you have new 1040 jobs created for hundreds (or thousands) of clients. This will trigger emails, organizers, messages, contracts, and other customizable automations to be sent.

Then – once the organizer is complete and the contract signed (this is now the automove part), your employee can be assigned a task to review the information and once done, your preparer can then be notified to prepare a draft of the tax return. This process can happen dozens, hundreds, thousands times — your process becomes foolproof and you can focus on growing your client base and less on administrative tasks.

Bookkeeping? No problem. For example, every month, on the 5th of the month, you can have a new Monthly Bookkeeping job get created for your business clients, triggering a message to request bank statements. Once they’re completed, you or your employees get a task assigned to them.

Now, let us delve into details.

Automove: a quick how-to guide

Automove allows your jobs to move from stage to stage automatically when parameters are met, allowing you to achieve the dependency you require. It removes the need of manually checking whether clients sent you documents, made prepayment, signed their contract, etc.

As soon as the required items are completed, the job moves to the next stage and down your wonderful assembly line of Tax, Bookkeeping, Resolution, etc.

Watch more about how Automove works»

Of course, Automove is not one size fits all that is why you can toggle it on and off at each stage of a Pipeline. In some cases you may want the job to move over automatically, in others you may not.

For example, as soon as clients sign up, you want to send them a welcome email with a new client organizer. (We covered this process in detail in another post.) The email does not require any action from you or your client, so that does not impact automove. An organizer, however, requires your client to submit it. With automove toggled on, once the client submits the organizer, the process will automatically move to the next stage. In the next stage, you may have ‘review documents’ as a task for someone on your team. As soon as they mark that task complete, automove will move the job to the preparer with a task of ‘prepare tax return’.

Let us know how you’re using this to automate your practice even more!

Job schedules: set Jobs to recur at desired intervals here

Most tax and bookkeeping jobs follow a certain schedule and are repeated on a regular timeline.

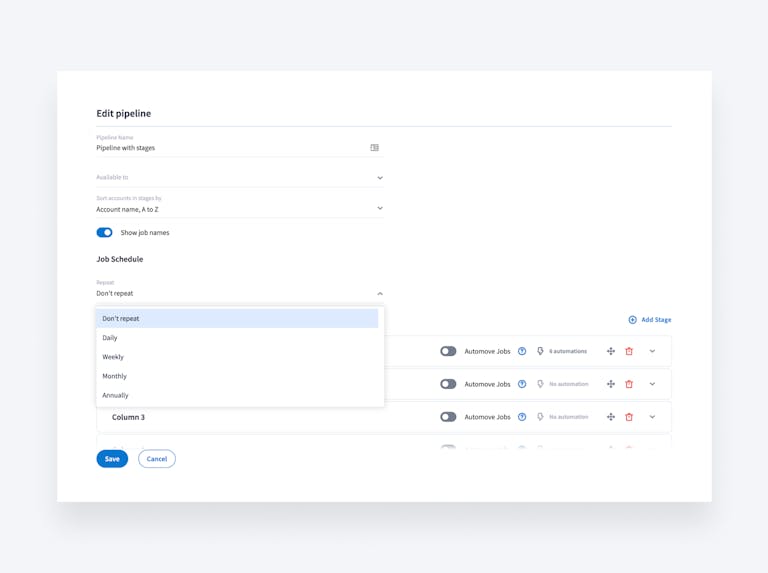

In TaxDome you can now utilize Job Schedules to create Job recurrence on a daily, weekly, bi-weekly, monthly, quarterly, or annual basis. New jobs will be created for each account that is in the schedule. Jobs that are scheduled but not yet created will not appear in your Jobs list to not clutter your interface.

Now, how can you utilize schedules in your practice?

Bookkeeping

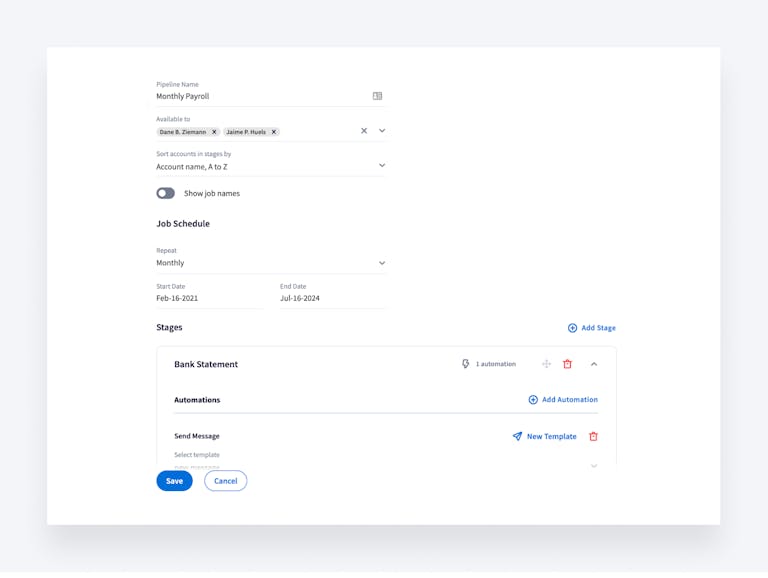

If you have monthly bookkeeping clients – you can now set those jobs on a monthly schedule to be created on the days of your choice.

Once the job is created, the pre-set automations will trigger such as a message and task list to update their bank statements and any other information you need, along with issuing a bill for monthly work.

Personal Tax Return

If you have annual tax clients, you can set those jobs to recur on an annual basis, with a new organizer sent in early January. You can segment your clients by new clients and returning clients – with returning clients receiving a short organizer and different communication.

Business Clients

Business clients bring big business, but also require a great deal of communication. And it is important that you keep your clients aware of upcoming deadlines as penalties may be steep.

Example:

On the first of each month, you can send a secure message with a short task list reminding them to provide you with monthly bank statements and payroll hours.

Or – you can set up quarterly reminders to your business clients to remember to pay estimated payments.

Add the repeat frequency for the Job while editing the Pipeline.

All these functionality works together to help you set up repeatable processes with predefined milestones. Different clients require different automations, so you could filter for your bookkeeping clients (use tags for that) and create a scheduled job for all of them in bulk. And just like that you have set up 100s (or 1000s) of clients on the path to a great user experience and never missing a deadline.

New: Job templates

To make your routine even easier, we went further and created Job Templates. Job Templates help you predefine the description, priority, due dates, or leave comments (@mentions are coming, stay tuned!).

Now, when you create a monthly payroll or bookkeeping job for hundreds of clients, you don’t need to add context to each of them manually. You can have a predefined due date for all of your 1120S (Mar 15, for example).

Or, all of your bookkeeping Jobs can have a pre-determined due date of 14 days after the Job is created, coupled with specific notes and guidelines on how to complete the Job.

Workflow Automation: how to get started

Noone wants to spend hours doing admin work instead of doing what clients actually pay you for. Automations make your life easier, and TaxDome allows you to automate your accounting, bookkeeping, or tax preparation workflow.

However, getting started can feel overwhelming. We feel you. We talked to two new users to TaxDome: Brian Newman of Brian Newman CPA and Jessica Smith of Tax Savvy Jessica. Jessica had more experience with workflow systems, whereas Brian knew he needed to implement automation and optimize processes within his growing practice, but had not yet done so. Admittedly, Brian was overwhelmed. But after talking to Jessica it all started to make sense and Brian was able to see the huge benefits TaxDome would bring to his practice. They shared their workflow examples and things that help them set everything up in the first place.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Download our eBook to get the answers