If you’re running an accounting firm, your clients are at the heart of everything you do. But keeping track of all that data, communication, and workflow can be a real headache. That’s where the right accounting CRM can make all the difference.

Read on to explore how the right CRM can help improve scalability and efficiency for your accounting businesses.

What is an accounting CRM?

CRM stands for “customer relationship management.” As the name suggests, CRM tools help businesses keep track of all their interactions with prospects and customers. Accounting CRMs do all that but with one key difference: they are designed specifically for accounting firms and professionals.

This means you can keep tabs on key accounting data in addition to contacts and communication history and optimize certain workflows specific to the industry. For example, some CRM systems can automate invoicing and billing processes.

Benefits of using a CRM for accountants

Improved teamwork, streamlined processes, and better service are just a few of the many advantages. Let’s take a deeper look at why a CRM is a must-have for a firm of any size.

1. Centralize your client management

An industry-focused CRM brings together your client data and files so you can use them across key business functions, such as:

- Marketing: access lead sources, marketing campaign data, and past communications to personalize outreach

- Account management: keep all client documents and records in one place to see the whole picture of each relationship

- Sales: track client interests and forecasted revenue to manage the customer lifecycle better

By connecting the CRM to your tax, bookkeeping, and other accounting software, you can easily share data across these platforms. This gives you a complete, consolidated view of each client relationship. With the right CRM, the days of endless emails and file versions will be over.

Check out our article on the top 12 CRMs for accountants, bookkeepers, and tax professionals.

2. Automate routine tasks

An accounting CRM streamlines various repetitive processes, freeing up time for higher-value work. For example, some systems have the ability to send out requests and reminders. The most advanced tools can automatically store data and documents submitted via forms and questionnaires.

This eliminates the need for manual data entry and management, resulting in significant time savings.

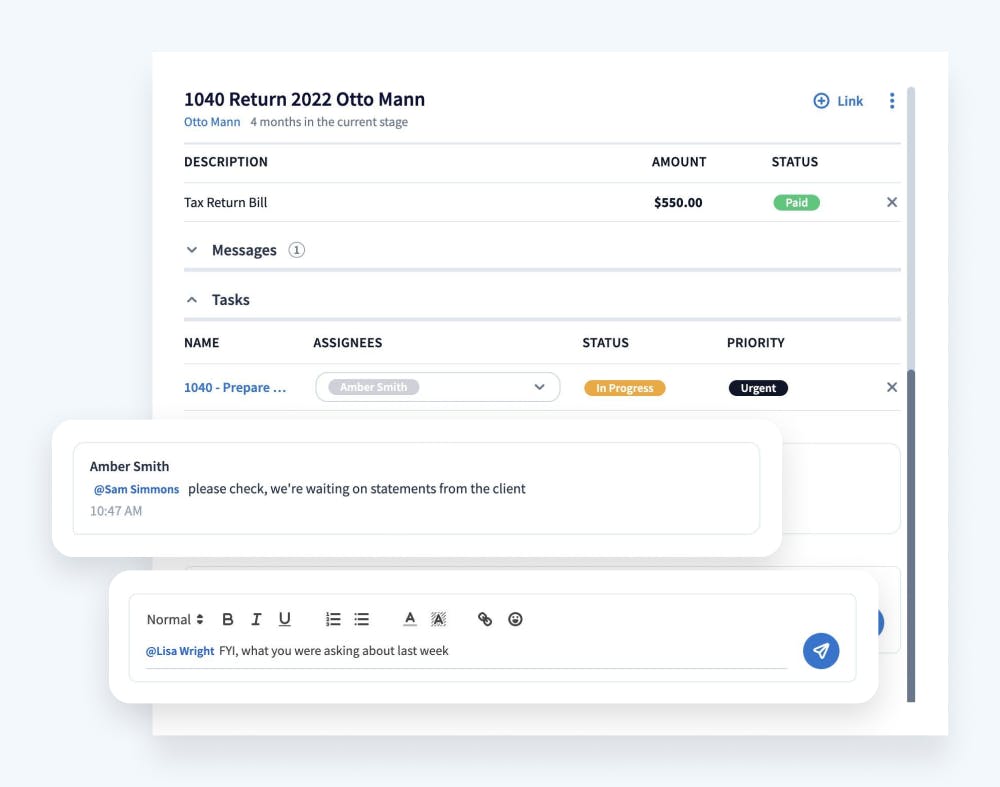

3. Streamline team collaboration

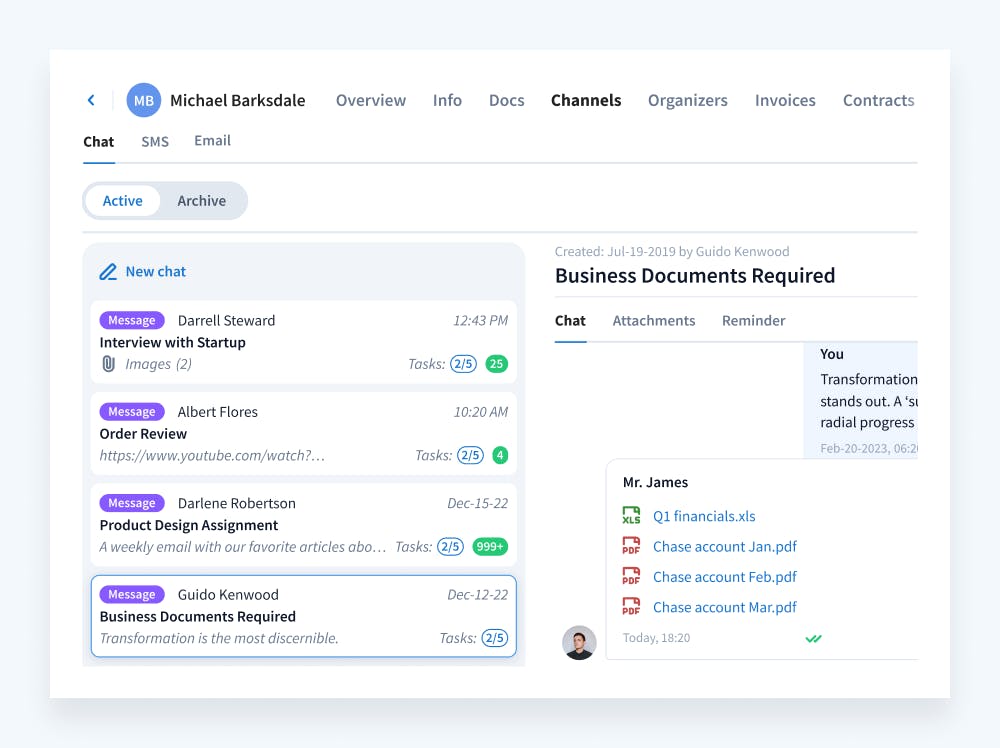

There’s no more hunting through inboxes or shared folders to find the latest client details. All relevant data is available in one place for the whole team to reference. Some CRMs also allow your team to communicate directly within the system and use tags to streamline processes.

This easy access facilitates better communication and coordination within your firm. Your employees can quickly get up to speed on a client’s history and status. In this way, miscommunication or duplicating efforts are less likely to occur.

4. Ensure secure data storage

One of the strongest reasons for using a modern CRM for accounting is the benefits of cloud technology. Such solutions make client relationship management more accessible and secure than ever before.

Today’s cloud-based CRM systems offer:

- Regular updates with the latest efficiencies and security protocols

- Enablement of remote and hybrid work models, savings on costly office space while maintaining productivity

And a major concern— protecting sensitive client data — is addressed through advanced security features such as encryption, access controls, and regular backups. Your information stays safe, even with a distributed, mobile workforce.

5. Gain a competitive advantage

Centralized data, automation, and efficient collaboration enable your team to respond promptly to client requests and deliver a high-quality, consistent experience. This level of professionalism and customer-centric approach yields numerous benefits:

- Increased client satisfaction and retention

- Enhanced reputation

- Positive reviews and referrals from happy clients

- Significant competitive advantage in attracting and retaining clients

Many CRM solutions also offer white-label options, allowing you to add your company’s logo and colors to provide clients with a personalized experience that strengthens your brand identity.

6. Optimize your sales and revenue

The system tracks every interaction and automatically updates statuses as leads or clients move through your pipeline. By understanding the entire customer lifecycle, you can stay on top of your opportunities:

- Get a clear view of promising prospects and prioritize follow-ups accordingly

- Identify cross-selling or upselling opportunities with existing accounts

- Analyze trends and identify areas for improvement in your processes

This optimized sales management ultimately drives revenue growth for your accounting firm by maximizing sales efficiency and effectiveness.

7. Make informed, data-driven decisions

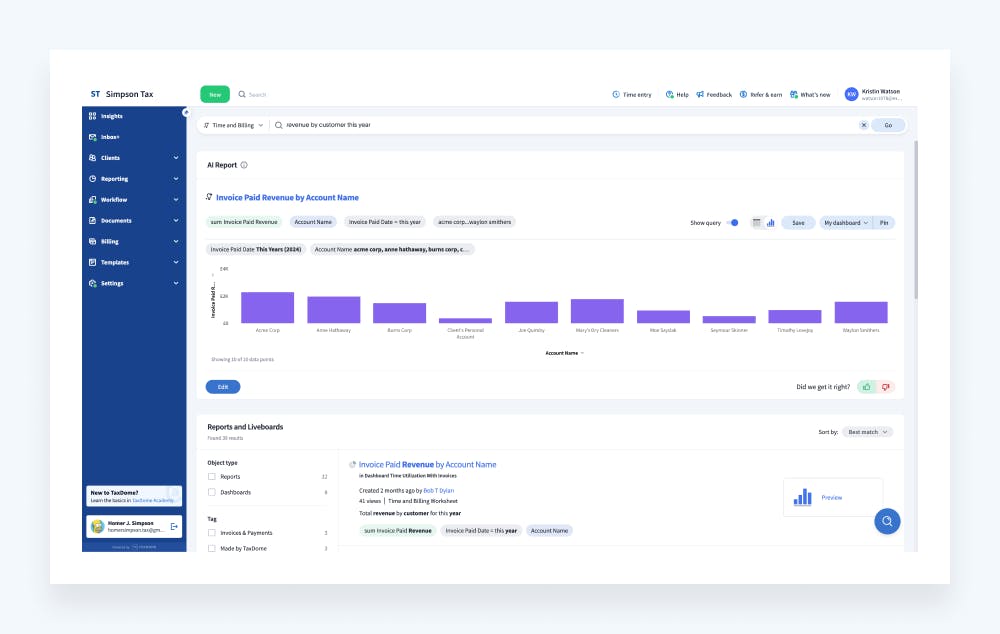

Your CRM collects a wealth of data that you can use to make better-informed decisions. Visual dashboards and reports give you an at-a-glance view of key metrics such as billable hours and project profitability. Many CRMs even use AI to automatically generate insightful reports for you.

With this data at your fingertips, you can identify your firm’s strongest and weakest areas. Certain service offerings may appear to be more profitable than others, or some client engagements may take longer on average. Armed with these insights, you can fine-tune your processes and resource allocation to drive continuous improvement across your operations.

CRM in action: increased efficiency across the board

To see the real-world impact of a CRM system for accountants, let’s examine the success story of Numeralis, a Danish online accounting firm.

Having experienced the pitfalls of disorganized accounting processes in previous roles, Munim Hassouni was determined to avoid such inefficiencies when starting his own firm.

He chose TaxDome, a practice management platform with strong CRM features. TaxDome’s automated workflows, simple onboarding, and legally binding e-signatures gave Numeralis the tools to grow efficiently. The results are remarkable:

- Simplified tech stack using just TaxDome and an accounting program

- Less time spent on admin tasks such as emails and client questions

- Increased efficiency by automating repetitive work

- Scalable processes to easily add more clients

As Munim said: “I’m sticking to TaxDome because it certainly feels like it’s complete. You have everything you need in front of you. It has all the functions you need and is very easy to set up.”

Key takeaways

With the right CRM, you can transform your firm’s operations and client relationships by:

- Centralizing data for a 360-degree view of all client relationships

- Automating repetitive administrative tasks

- Facilitating seamless team collaboration

- Securely storing and managing sensitive client data

- Enabling more informed, data-driven business decisions

Ultimately, the key is to select a CRM designed with the unique needs of accounting professionals in mind. With the right tool, you can position your firm for long-term growth, improve client satisfaction, and gain a significant competitive advantage in the market.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

What makes the best accounting firms thrive while others struggle to keep up? We analyzed our top 20 TaxDome firms, representing over $100M in combined revenue, to uncover the strategies driving their success.