During busy season, we do not release new features (see: freeze releases policy) to ensure that you are able to work without distraction. We also delay any interface changes until after the busy season (coming soon: new chat interface & SMS)! Prior to the freeze, we introduced some minor, yet essential updates to streamline your invoicing, workflow and document management. Let’s take a closer look at these updates.

Sneak peek: recurring invoices are already in early access and will be available to everyone soon. With this feature, you can request payment authorization and get paid automatically (by credit card or bank debit). Plus, we will be releasing an updated interface for chats, making tasks more prominent and more space for the chat thread.

💰 Invoicing

New: ACH, SEPA, PADs payments available through Stripe

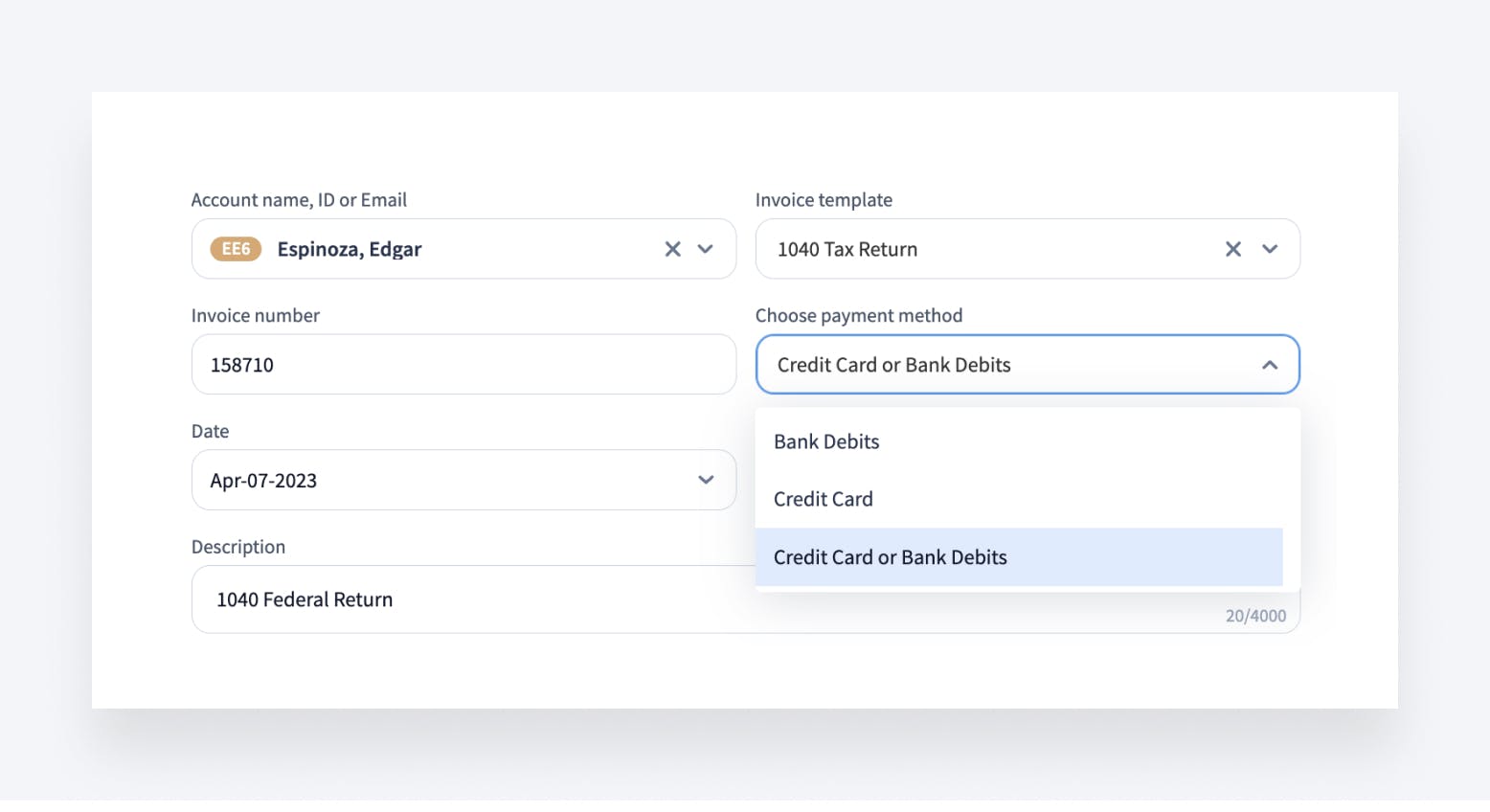

For those who use Stripe as their payment provider, we now support one of the most widely used payment methods — bank debits.

With this release, we now support the following bank debit payments via Stripe:

- ACH Direct Debit — popular in the US

- SEPA Direct Debit — popular in the EU

- PADs (Pre-authorized debit) — popular in Canada

- BECS Debit – popular in Australia

ACH was previously available for CPACharge but has now been added to Stripe, as well. Bank debits are supported as an option for both one-time and recurring invoices (the latter are currently available for early access users, and will soon be released for everyone 🎉).

To utilize bank debits, set up Stripe as your default payment processor, enable in Stripe settings payment methods you wish e.g. ACH and when creating an invoice, choose how you wish to get paid: by bank debits, credit card, or both.

Note — you can enable both Stripe & CPACharge as payment providers in your firm settings.

Google Pay added as payment method

For Stripe users, Google Pay is also now supported to pay invoices. To activate this method of payment for your clients, simply turn it on in your Stripe account settings. Once credit card payments are enabled for an invoice, your clients will have the option of using Google Pay to make their payment.

To enable Google Pay in your Stripe account, go to Settings -> Payment methods -> Wallets -> Turn on Google Pay.

🤖 Workflow

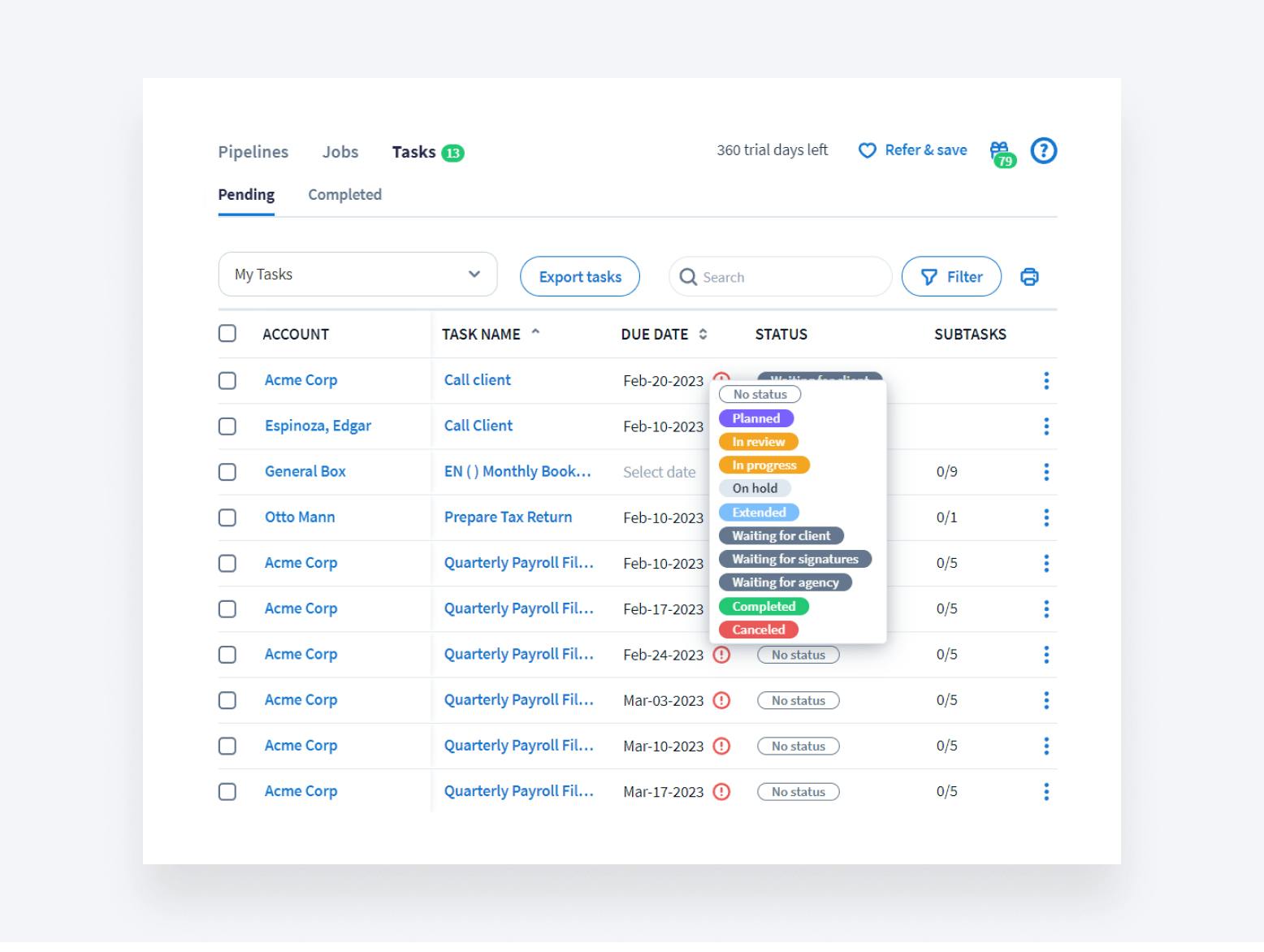

New: 5 additional task statuses to improve tracking and help your firm prioritize work better

We have added the following statuses based on community feedback:

- In review

- On hold

- Extended

- Waiting for agency

- Canceled

These statuses were added to the existing list of statuses: No status, Planned, In Progress, Waiting for Signatures, Waiting for Client and Completed.

Two statuses can trigger the job to move forward in the pipeline: Canceled and Completed. When a task linked to a job is set to Completed or Canceled, it may automove the job. The other statuses are informational and do not trigger automove.

Discover more information on automove>>

Minor workflow improvements

In the previous release, we added the ability to @mention teammates in Job comments for more efficient team collaboration. We’ve continued to enhance collaboration and workflow, and have implemented the following changes:

- The comment interface in the Job sidebar has been improved: the latest comments now appear at the top and the three most recent comments are always visible

- Firm owners and firm admins can now edit and delete comments in Jobs made by firm members, if necessary

- You can now set up which team members can or cannot edit pipeline schedules by using a new permission called “Manage job recurrence” in Employee Access Rights

📚 Document Management

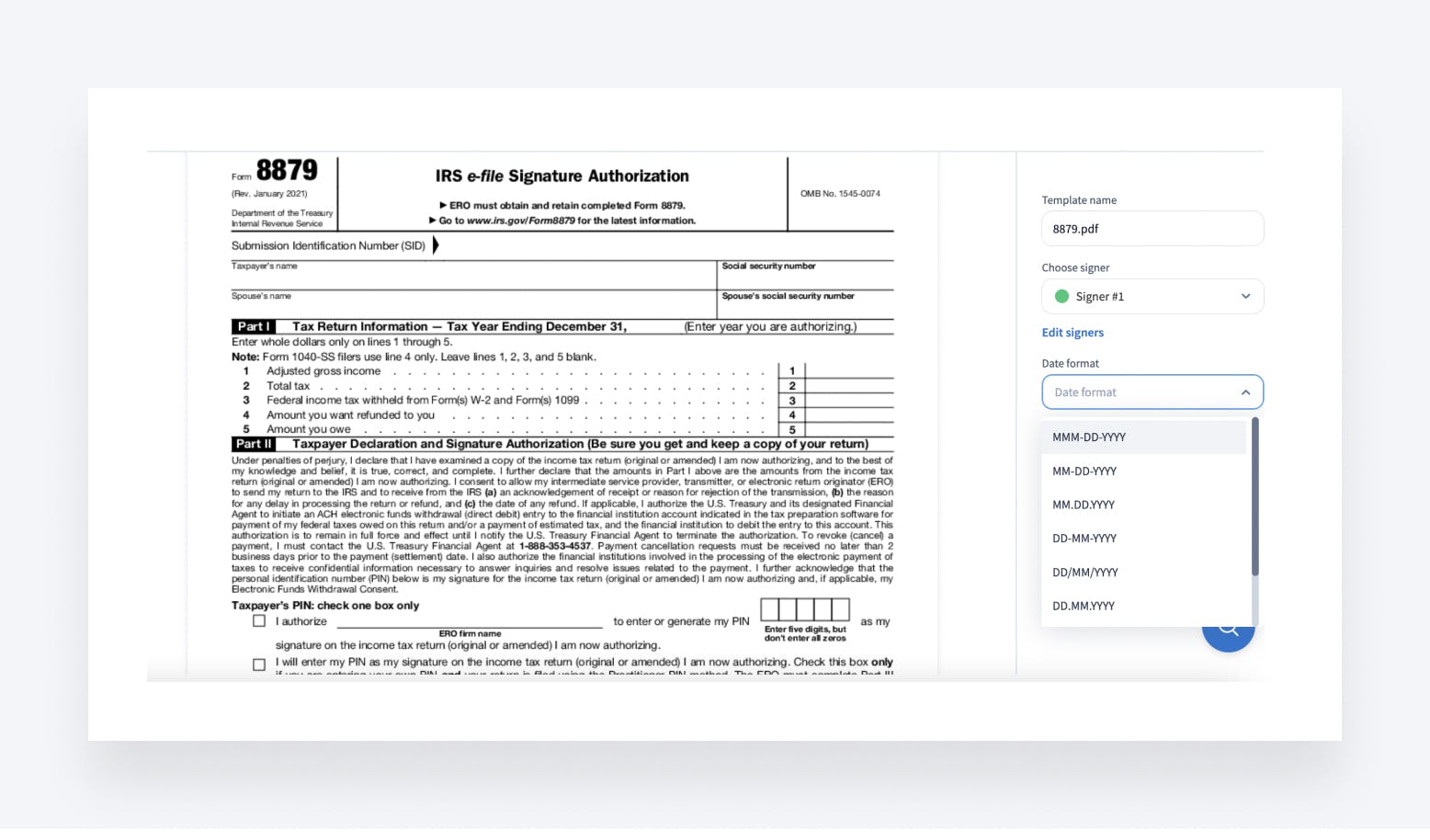

E-signature: select different date formats

When requesting e-signatures, you can now select the most appropriate format to comply with various legal requirements. As an example, for our 🇨🇦 clients, the Government of Canada specifies the ISO 8601 format for all-numeric dates (YYYY-MM-DD; for example, 2023-04-11).

This is possible thanks to our new Date format setting, which you can use not only for requesting e-signatures but also for setting dates in Signature templates.

The default date format is MMM-DD-YYYY, but you can modify it by going to your firm’s International Settings. The selected format will be used when you request a signature, but it won’t affect the way dates look on the signature templates you have previously set up.

Find out how to modify your default date format>>

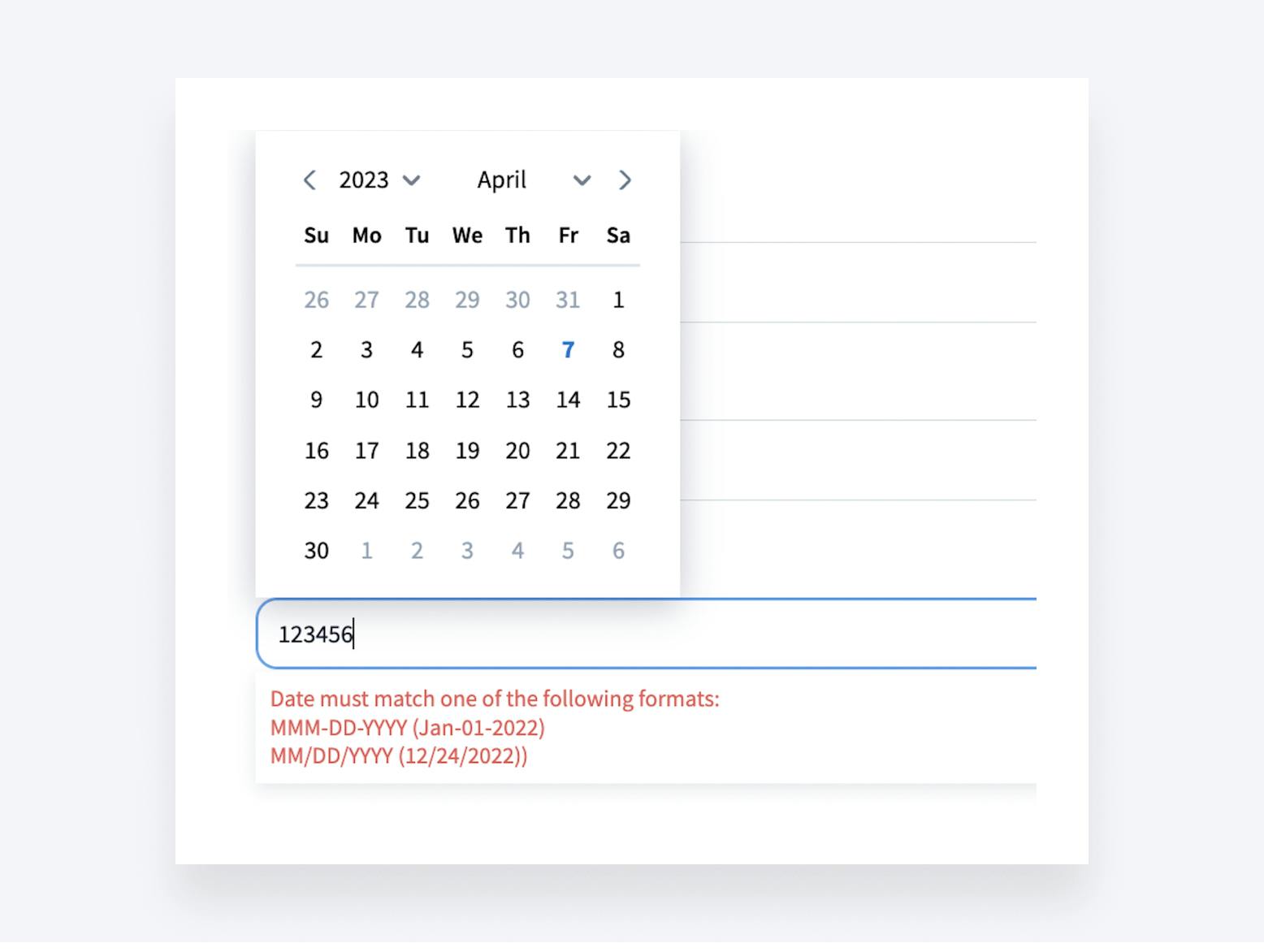

Organizers: validation check for manually entered date formats

We have improved the validation on the date field to ensure that the data is saved in the correct format. If an incorrect date is input into a date field in an organizer, the user will see a suggestion of how to correct it. Learn how to work with organizers>>

💬 Chats

- You can now copy and paste images in messages, comments and wiki pages to send them quickly and easily

- You can now add default reminders to message templates. Learn more how message reminders work>>

📚 Help & Education

- TaxDome Lite: All help articles for our Lite users have been moved to a separate category. We also have a Getting Started article for Lite users with an overview video

- Automation: Several new how-to help articles on automation use cases have been added. You can find out how to move jobs automatically when a document is approved, locked document paid or e-signature is completed. We are going to improve our Workflow section by adding even more useful examples and improving existing articles, so stay tuned!

🔥 Other

- Client portal: we removed the ability for clients to share documents with third parties, firm members can still do so

- Organizer templates: you can now search by typing questions when creating conditions for organizer templates

- You can now download signed contracts with an audit trail as PDF files

- Update in system emails: if your clients have access to multiple accounts, the system will add the account name to all emails to provide more information, ensuring that the client understands which account to log into for access and doesn’t miss your messages. Learn how to set up your TaxDome-generated emails>>

- Have you joined our early access program? Early access members get to use and comment on our new features first. Read about it and join the program>>

All of the above — plus 54 more tweaks and fixes! Join our Facebook Community to ask questions, request features or chat with other TaxDome users.

In case you missed it, here’s a summary of the major features we covered in our previous post.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers