We are excited to deliver this month’s improvements before tax season starts to help you get through the busy season as smoothly as possible. Here’s what’s new.

Consistent with our vision of having every aspect of your firm organized in one portal, we have introduced a new section: documents. This new, global section contains all documents across all clients across your firm. This global section joins other ‘global’ sections: jobs, tasks, invoices, time entries. In future, we plan to add global sections for other areas (chats, contracts, etc.).

As more business goes digital, the need for chats to become interactive becomes necessary. With this release, you can now embed images and videos, and videos can be viewed directly in the in-app viewer without opening new tabs. On top of that, you can now choose to show the entire message content in email notifications, should you wish to do so.

We’ve also upgraded the ‘Done uploading’ functionality to include a button in the client portal. This feature is optional – but when enabled, your clients will have a prominent ‘Done Uploading’ button in their portal.

Additionally, teams benefit from a new ‘Request access’ button, enabling staff to more easily reach parts of the system unavailable to them.

Sneak peek: We are working on integrating SMS into the suite of communication tools available. Stay tuned!

Let’s dig into these and many other improvements in detail.

📚 Document management

Global Documents: more centralized and efficient document management

The dedicated Documents section enables you to access all documents across all clients in your firm. With a revamped interface and improved navigation, you can now find files you need faster and easier.

Global docs organization

- Recent is a brand-new view created to access the 100 most recently viewed/recently uploaded files, across all clients

- Docs is a new interface created to peruse documents in the context of one client. Similar to Windows Explorer or Mac Finder, this view allows you to switch between client profiles without having to leave the page and go to the Clients section. Additionally, you can easily upload docs and folders, create and apply folder templates, request signatures and all other actions.

- Trash is the recycle bin of your firm – access all deleted documents across all clients for the last 120 days. After 120 days, documents are deleted automatically. More about deleting & restoring files>>

Filtering files by account name, date or based on your preferences allows you to find all signatures, all approvals and recent actions by your firm and clients throughout a specific time period across all accounts. As with other filters, create templates to quickly access your favorite views.

Learn more about how to save time and work smarter with Global Documents on our blog>>

Sneak peek: In the future, we plan to improve the Documents section by adding Signature and Approvals subsections, implementing a new ‘search suggest’ tool in the search bar and more.

✉️ Secure messages

More interactive Chats: embed images and videos

This release brings enhancements to Secure Messages (Chats), to make your communication even more interactive and closer to other messaging tools such as WhatsApp and iMessage.

- Our new in-app media viewer allows your firm and clients to watch all attached media files, images and videos, within the chat thread, enabling you to stay focused and not open a new tab.

- Attach images. You can attach up to 10 images in .png,.jpg, .jpeg, .gif and .svg formats. When attached you and clients can rotate them and zoom in/out depending on the file size (e.g., screenshots of bank statements).

- Embed videos from YouTube, Loom, Vimeo and Google Drive into chats so clients can instantly access them and any time later (e.g., onboarding video guide, tax return overview, walking through the making prepayment process, etc.)

- Rename links. You could always add links to chats, but now you can choose the text the client will see. Instead of long links (https://www.google.com/search?q=yesterday+beatles) – you can say I love this song!

For more details on adding interactive elements to your chats, see our Help Center.

Sneak peek: The above features have been added to chats so far, but image and video support will be implemented universally across TaxDome (in templates, emails, etc.)

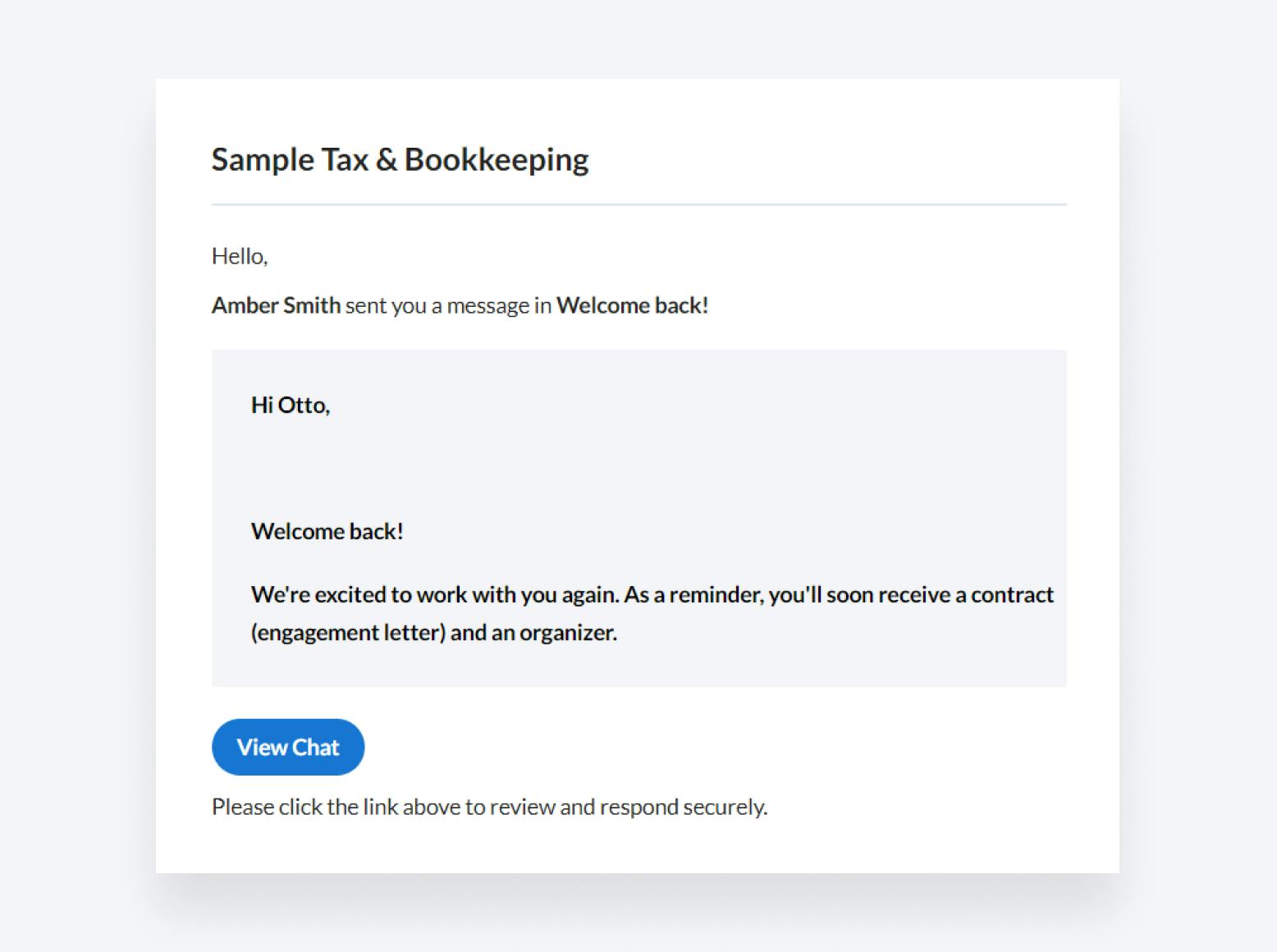

Option to show the message content in email notifications

Previously, we released this ability for controlling the visibility of client tasks in the corresponding client notifications. The practice has proved to be time-saving and productive as your clients don’t have to sign into the client portal to learn what’s needed from them.

Based on this experience, we are introducing the option to control showing content of the message in the body of emails for firms, clients and team members to improve the speed and efficiency of communication. You can enable the functionality in the Firm settings. For firms that wish to maintain a higher level of security, this is an optional feature you can choose to keep toggled off.

Here is how the email notification will appear to your client:

More about the new setting for email notifications on our blog.

Sneak peek: SMS communication is coming before the tax season! You will be able to remind and update clients via SMS and send texts manually and automatically.

👨👩👧👧 Client Portal

Many firms struggle with, “How does my client let me know they’re done uploading documents”? While many firms utilize features that have a clear ‘complete’ status such as organizers (which client can submit) and client tasks (which client can complete), those who do not use these features have more ambiguous workflows. Earlier this year, we introduced features aimed at tackling this problem, namely the ‘Done Uploading’ checkbox which appears after a client uploads a document. Testing and feedback have shown that while this does help, firms were looking for a clearer solution which is visible at all times, not just after an upload.

With this release, a clear ‘Done Uploading’ button can be added to your firm’s client portal home page and Documents section. When pressed, members of your team who follow the account will be notified in Inbox+ and/or email, depending on your notification settings. This feature is optional and can be toggled on/off in your Firm settings.

Get to know more about how it works on our blog>>

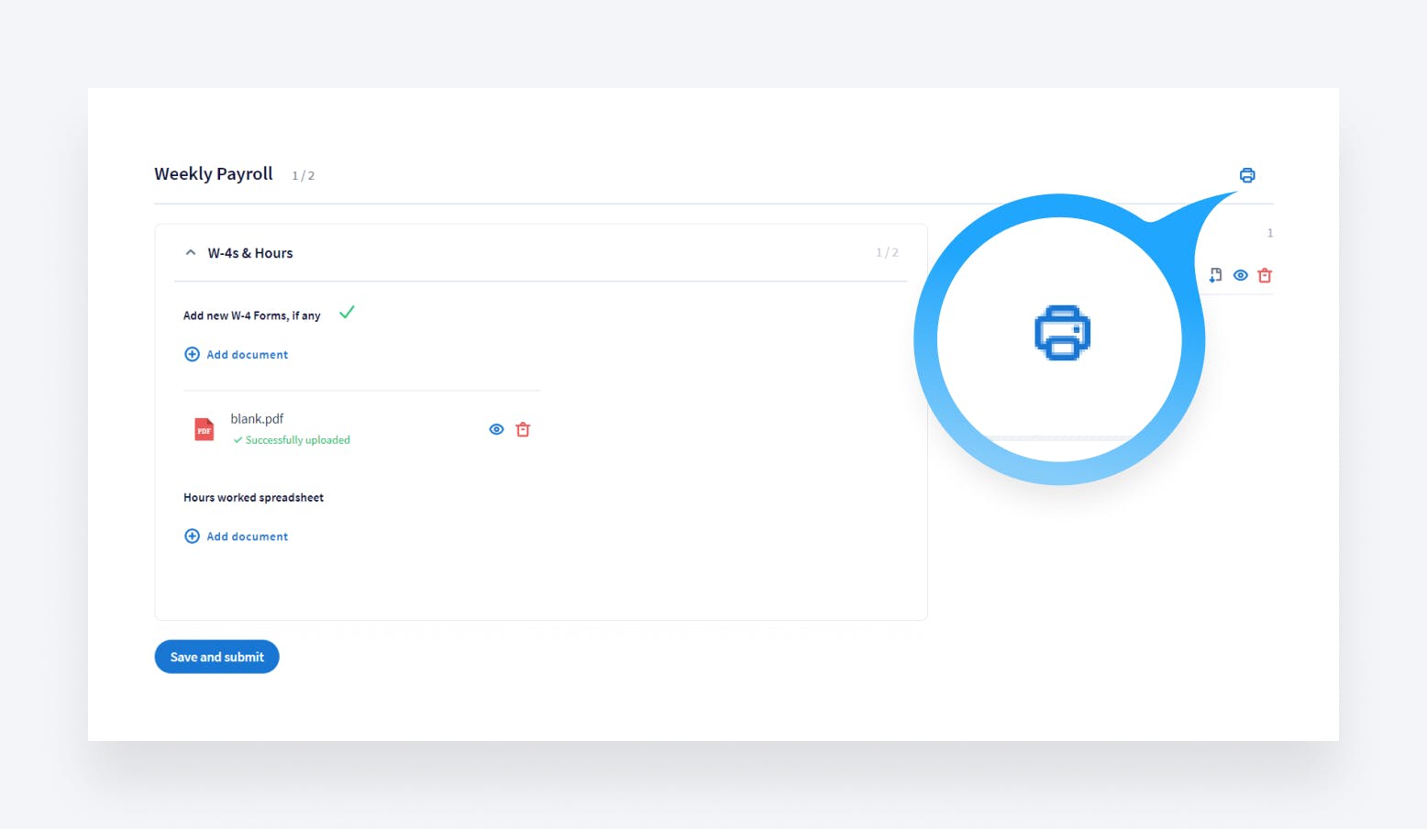

Ability to print organizers

Practitioners have long been able to print organizers or save as PDFs directly from TaxDome. With today’s update, the same functionality is introduced to the client portal: clients can now print organizers to PDFs and save hard copies for future reference.

To learn more about printing organizers, please refer clients to our Help Center>>

🤓 Team management

If you are mentioned in a task or message that you do not have access to, you can now request access with the click of a button. If you’ve ever used Google docs, this functionality is very similar to when you are accessing a document that has not yet been shared with you.

When you request access, a notification will be sent to your teammates to grant access.

Previously, when a firm employee was assigned tasks but did not yet have account access, they received an error message and had to contact someone. This flow has been redesigned and streamlined, the notification to grant access will arrive via email and Inbox+, allowing you to grant access with one click.

More about requesting access>>

Team training & collaboration: Wiki Pages improved

TaxDome’s Wiki Pages boost team productivity and ensure quality output by incorporating SOPs (standard operating procedures). By having everything integrated into one system, save up to 37 hours per employee, per month.

Today’s update streamlines the process of creating a new Wiki Page without opening extra tabs. Additionally, you now have a Trash tab in the Wiki Pages interface where you can find all deleted Pages and relevant information about them: the author (who created the page), title, who and when removed, number of days till the page will be deleted forever. By default, deleted Pages are permanently deleted after 120 days.

More about creating Wiki Pages>>

💰 Billing & Invoicing

UX/UI improvements

It is now easier to add services to invoices with autocomplete; start typing and the dropdown menu will show all options that match your search.

More about payment processing in TaxDome>>

Sneak peek: Recurring invoices are coming before tax season, enabling your firm to receive payments (CC or ACH) at preset schedules!

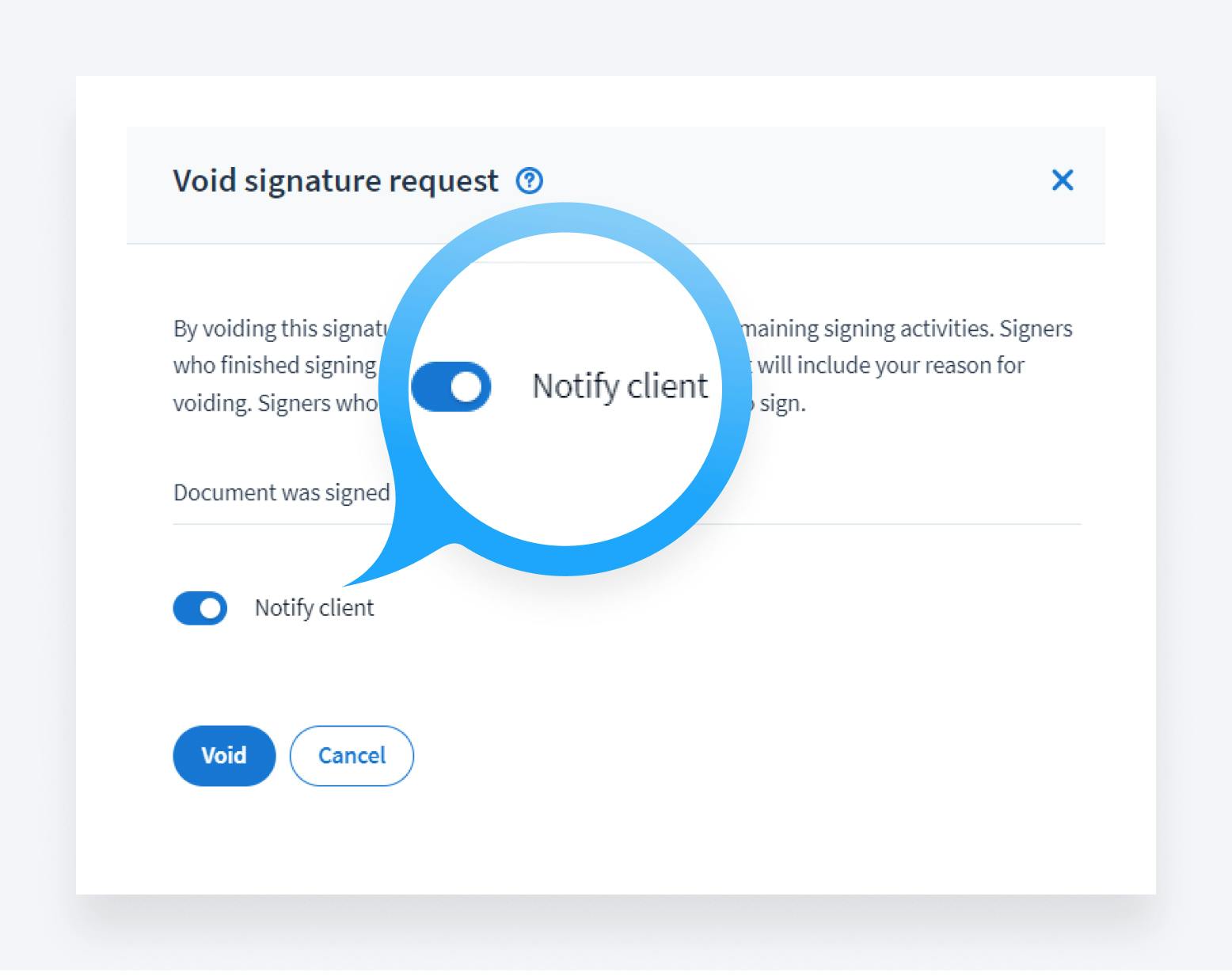

✍️ E-signatures

Voiding e-signatures: client notification made optional

Previously, when voiding pending signature requests, an email notification would be sent to those who previously e-signed the document. User feedback suggested that many users preferred to have this e-mail notification be optional. With this release, you can now toggle the email notification on or off.

Learn more about voiding signature requests on our Help Center>>

🔥 Other

- New: Early access program: be the first to receive new features – see how to enroll

- New TaxDome Academy course: Invoicing Guide, see how firms successfully reduce A/R and always get paid on time

All of the above—plus 56 more tweaks and fixes! Join our Facebook Community to ask any questions, request features or just chat with your peers.

In case you missed it, here’s a summary of the major features that we covered in our previous post.

Thank you! The eBook has been sent to your email. Enjoy your copy.

There was an error processing your request. Please try again later.

Looking to boost your firm's profitability and efficiency?

Download our eBook to get the answers